Get the free Delinquent Real Estate Tax Agreement

Show details

This agreement allows delinquent taxpayers to make installment payments on overdue real estate taxes instead of facing foreclosure. It details the payment terms, obligations, and consequences of default.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign delinquent real estate tax

Edit your delinquent real estate tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delinquent real estate tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

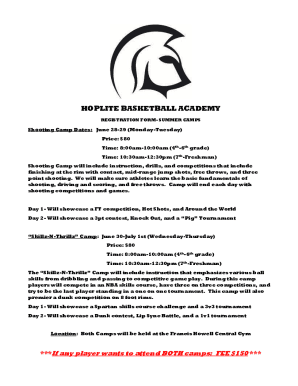

Editing delinquent real estate tax online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit delinquent real estate tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

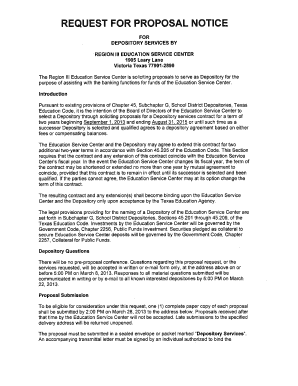

How to fill out delinquent real estate tax

How to fill out Delinquent Real Estate Tax Agreement

01

Obtain the Delinquent Real Estate Tax Agreement form from your local tax authority or website.

02

Fill in your personal information including name, address, and property details.

03

Provide details about the delinquent taxes owed, including the amounts and tax years.

04

Read and understand the terms and conditions of the agreement.

05

Select a payment plan that fits your financial situation, if applicable.

06

Sign and date the agreement to confirm your acceptance of the terms.

07

Submit the completed form to the appropriate tax office by the specified deadline.

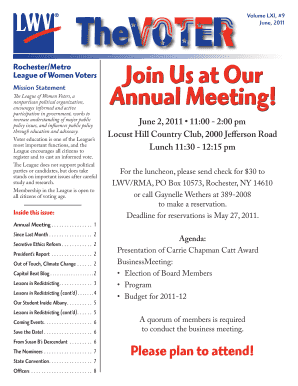

Who needs Delinquent Real Estate Tax Agreement?

01

Property owners who have outstanding real estate taxes.

02

Individuals looking to arrange a payment plan for due taxes.

03

Residents facing financial hardship and need assistance with tax payments.

Fill

form

: Try Risk Free

People Also Ask about

What does delinquent mean in real estate?

Mortgage delinquency is a real estate term that refers to when homeowners are at least 30 days overdue on making at least one mortgage payment. Consequences for mortgage delinquency range from late fees to credit impacts and possibly even foreclosure on a home.

How long can property taxes go unpaid in California?

During this time, the delinquent taxes, interest, and penalties are accumulating until they are all redeemed. At the end of the 5-years for residential properties and 3-years for non-residential commercial properties, if the tax is not redeemed, the TTC has the power to sell the property.

What happens when property taxes are delinquent in California?

If unpaid property taxes are left unaddressed, it could accumulate additional fees and penalties, and the County could ultimately auction the property to recover taxes owed. This process takes some time, but if you act quickly, you have a better chance of saving your home.

How long can property taxes go unpaid in NY?

PER NYS REAL PROPERTY TAX LAW, PROPERTIES WITH TAXES REMAINING UNPAID AFTER TWENTY-ONE (21) MONTHS ARE SUBJECT TO FORECLOSURE.

Can you write off delinquent property taxes?

Delinquent taxes are unpaid taxes that were imposed on the seller for an earlier tax year. If you agree to pay delinquent taxes when you buy your home, you can't deduct them. You treat them as part of the cost of your home. See Real estate taxes, later, under Basis.

What happens if you don't pay your property taxes in California?

Property that remains in tax-defaulted status for five or more years will become subject to the Tax Collector's power to sell. Once subject to power to sell, it will be notated on the Property Tax Statement and the property may be sold at auction or otherwise conveyed to new ownership.

What is the penalty for paying property taxes late California?

The amount needed to redeem tax-defaulted property in full is the sum of the following: The total amount of unpaid taxes for all delinquent years. A 10% penalty on every unpaid installment. A $20 administrative charge for each delinquent year.

What happens if someone pays my delinquent property taxes?

In California, paying someone else's taxes, even if done in good faith, is considered a gesture of goodwill or a means of avoiding a tax lien, but no matter the motive, payment does not transfer legal ownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

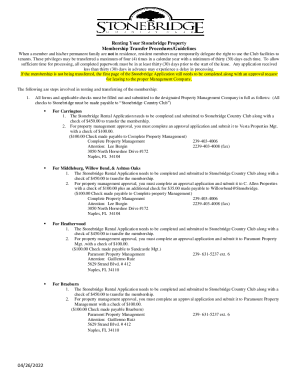

What is Delinquent Real Estate Tax Agreement?

A Delinquent Real Estate Tax Agreement is a legal document that outlines the terms under which a property owner can repay overdue real estate taxes to avoid penalties or tax liens.

Who is required to file Delinquent Real Estate Tax Agreement?

Property owners who have outstanding real estate taxes that are past due are required to file a Delinquent Real Estate Tax Agreement to negotiate a payment plan.

How to fill out Delinquent Real Estate Tax Agreement?

To fill out a Delinquent Real Estate Tax Agreement, a property owner must provide their personal information, property details, the amount of taxes owed, and propose a payment plan, which generally includes the payment amounts and due dates.

What is the purpose of Delinquent Real Estate Tax Agreement?

The purpose of the Delinquent Real Estate Tax Agreement is to provide a legal framework that allows property owners to manage and pay off their overdue taxes while preventing immediate foreclosure actions.

What information must be reported on Delinquent Real Estate Tax Agreement?

The information that must be reported on a Delinquent Real Estate Tax Agreement includes the property owner's name, address, tax identification number, the amount of delinquent taxes owed, and details of the proposed payment arrangement.

Fill out your delinquent real estate tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Delinquent Real Estate Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.