Get the free APPORTIONED VEHICLE PROPERTY TAX RETURN

Show details

This document outlines the requirements and instructions for Interstate motor carriers in Kentucky to file the Apportioned Vehicle Property Tax Return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign apportioned vehicle property tax

Edit your apportioned vehicle property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apportioned vehicle property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit apportioned vehicle property tax online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit apportioned vehicle property tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

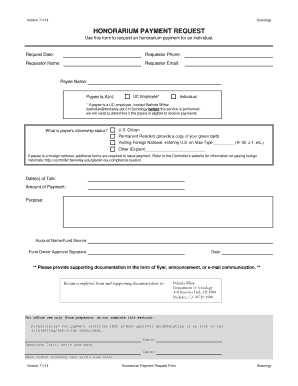

How to fill out apportioned vehicle property tax

How to fill out APPORTIONED VEHICLE PROPERTY TAX RETURN

01

Obtain the APPORTIONED VEHICLE PROPERTY TAX RETURN form from your local tax authority's website or office.

02

Fill in your vehicle information, including make, model, year, and Vehicle Identification Number (VIN).

03

Indicate the state or states where the vehicle is registered.

04

Provide the estimated value of the vehicle based on fair market value.

05

Calculate the apportioned tax based on the percentage of time the vehicle was operated in each state during the tax year.

06

Include any additional information required, such as mileage logs or registration documents.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the appropriate tax authority by the deadline specified.

Who needs APPORTIONED VEHICLE PROPERTY TAX RETURN?

01

Businesses that operate vehicles in multiple states and need to report vehicle value for tax purposes.

02

Fleet operators who manage a fleet of vehicles and need to apportion taxes based on their operations.

03

Individuals or companies that have registered their vehicles in more than one state.

Fill

form

: Try Risk Free

People Also Ask about

What states have no property tax on vehicles?

27 States with No Personal Property Tax on Vehicles Delaware. Georgia. Idaho. Iowa. Maryland. New Jersey. New Mexico. New York.

Can you claim vehicle property tax on your federal return?

If you own a vehicle or boat, you may pay annual fees to register it with the state. A portion of this registration fee, based on the value of your vehicle, may be claimed as a deduction on your tax return. Personal property tax is deductible if it is a state or local tax that is: Charged on personal property.

Can you pay NC vehicle tax online?

You will pay both the registration fee and property taxes to the NC DMV using one of these three payment options: Online – Visit DMV's online registration system to pay with your credit or check card. By Mail – Send a check or money order to the address listed on your renewal notice.

Does North Carolina have vehicle personal property tax?

Yes, North Carolina Statutes require that all vehicles be taxed as either a registered motor vehicle or personal property (unregistered vehicle). Regardless of the condition or function of the vehicle it must be taxed. The tax value could be adjusted for the condition, but it must be taxed.

What are the three types of property taxes?

The four broad types of property taxes are land, improvements to land (immovable man-made objects, such as buildings), personal property (movable man-made objects) and intangible property. Real property (also called real estate or realty) is the combination of land and improvements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPORTIONED VEHICLE PROPERTY TAX RETURN?

APPORTIONED VEHICLE PROPERTY TAX RETURN is a form used to report the property tax on vehicles that are apportioned based on their use across multiple jurisdictions.

Who is required to file APPORTIONED VEHICLE PROPERTY TAX RETURN?

Businesses that operate commercial vehicles registered in multiple states and allocate vehicle usage across those states are required to file the APPORTIONED VEHICLE PROPERTY TAX RETURN.

How to fill out APPORTIONED VEHICLE PROPERTY TAX RETURN?

To fill out the APPORTIONED VEHICLE PROPERTY TAX RETURN, you need to provide information about the vehicles, their registration details, usage data across jurisdictions, and any applicable tax credits or deductions.

What is the purpose of APPORTIONED VEHICLE PROPERTY TAX RETURN?

The purpose of the APPORTIONED VEHICLE PROPERTY TAX RETURN is to ensure that property taxes for vehicles are fairly allocated among the states based on the proportion of usage in each state.

What information must be reported on APPORTIONED VEHICLE PROPERTY TAX RETURN?

The information that must be reported includes vehicle identification details, the number of miles driven in each jurisdiction, registration information, and any previous tax payment details.

Fill out your apportioned vehicle property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Apportioned Vehicle Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.