Get the free 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ

Show details

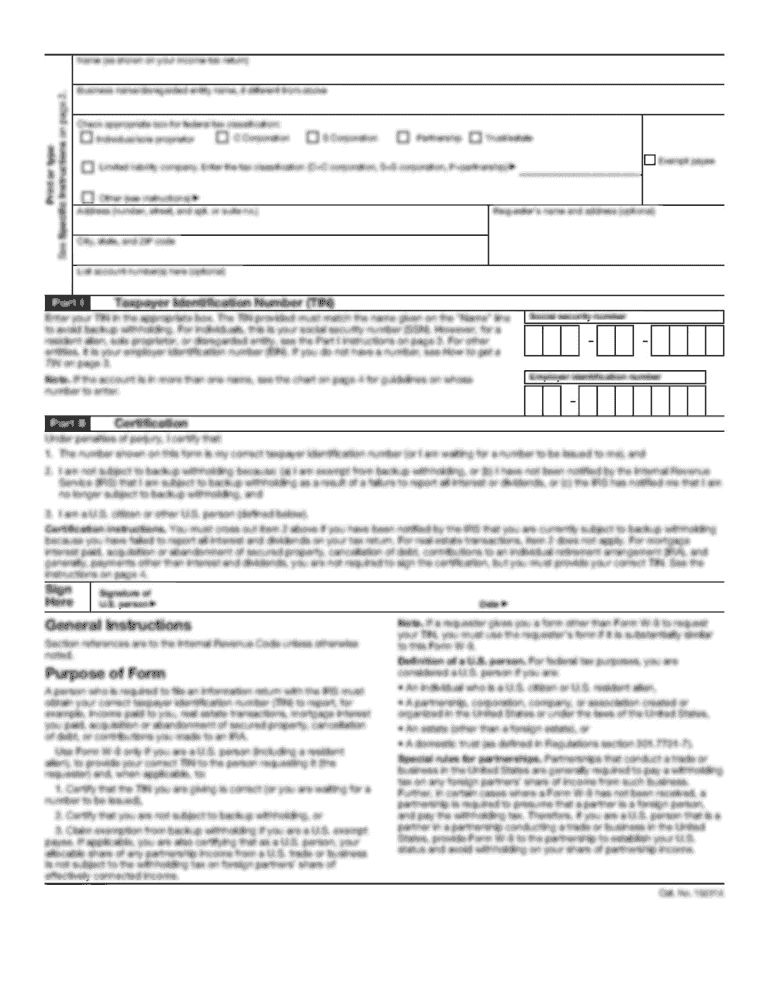

This document provides guidance on filing the Kentucky individual income tax returns (Forms 740 and 740-EZ) for the year 2009, including details on residency status, filing requirements, tax credits,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009 kentucky individual income

Edit your 2009 kentucky individual income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 kentucky individual income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 kentucky individual income online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2009 kentucky individual income. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009 kentucky individual income

How to fill out 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ

01

Obtain the 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ from the Kentucky Department of Revenue website or a local tax office.

02

Read through the instructions to familiarize yourself with the requirements and forms.

03

Gather all necessary documentation, such as W-2 forms, 1099 forms, and any other income statements.

04

Determine which form to use: Form 740 is for more complex tax situations, while Form 740-EZ is for simpler cases.

05

Fill out personal information, including name, address, Social Security Number, and filing status.

06

Report all income sources as outlined in the instructions.

07

Claim any deductions and credits that apply to your situation according to the guidelines provided.

08

Calculate your tax liability using the tax tables or formulas in the instructions.

09

Review your completed forms for accuracy and completeness.

10

Submit your completed tax forms by the deadline either electronically or by mail.

Who needs 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ?

01

Residents of Kentucky who have earned income during the 2009 tax year.

02

Individuals who are required to file individual income tax returns in Kentucky.

03

Taxpayers who are claiming deductions or credits specific to Kentucky state taxes.

04

Anyone seeking to understand their tax obligations and how to properly report income in Kentucky for the year 2009.

Fill

form

: Try Risk Free

People Also Ask about

Is Kentucky doing away with state income tax?

What has Kentucky done? A 2022 Kentucky law reduced the state's income tax rate and set a series of revenue-based triggers that could gradually lower the tax to zero. But unlike in Mississippi, the triggers aren't automatic.

Are Mississippi and Kentucky on track to eliminate income taxes on wages?

Associated Press: Mississippi and Kentucky Aim to End Personal Income Taxes. About 45 years have passed since a U.S. state last eliminated its income tax on wages and salaries. But with recent actions in Mississippi and Kentucky, two states now are on a path to do so, if their economies keep growing.

What are the tax changes for Kentucky in 2025?

On February 6, 2025, Governor Beshear signed House Bill 1, which reduces the Kentucky individual income tax rate from 4% to 3.5%, effective for tax years beginning on or after January 1, 2026. The individual income tax rate may be reduced in subsequent years if fiscal conditions are met.

What states are considering eliminating income tax?

Economic uncertainty and the prospect of reduced federal aid also have made many lawmakers more cautious this legislative season, he said. But lawmakers in several states — including Oklahoma, South Carolina and West Virginia — have continued their march to eliminate state income taxes.

Can you deduct gambling losses in Kentucky?

Yes! Gambling winnings are classed as ordinary income and are therefore taxable in Kentucky. When calculating Kentucky gambling tax, you are allowed to deduct losses, although they cannot exceed the amount of the winnings.

Is KY getting rid of state income tax?

A 2022 Kentucky law reduced the state's income tax rate and set a series of revenue-based triggers that could gradually lower the tax to zero. But unlike in Mississippi, the triggers aren't automatic. Rather, the Kentucky General Assembly must approve each additional decrease in the tax rate.

What is a form 740 in Kentucky?

Form 740 (2023): Kentucky Individual Income Tax Return Full-Year Residents. Tax Forms Tax Codes. Form 740 is the Kentucky Individual Income Tax Return used by residents of the state of Kentucky to report their income and calculate any taxes owed or due for the tax year 2023.

How to fill out EZ tax form?

How to fill out the 1040EZ Tax Form Instructions for Simplified Filing? Gather your financial documents such as W-2s and 1099s. Complete your personal information including name, address, and SSN. Fill in your income and tax credits on the designated lines. Double-check your entries for accuracy and completeness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ?

The 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ provide detailed guidance on how to complete the tax forms required for filing individual income tax returns in the state of Kentucky for the year 2009.

Who is required to file 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ?

Individuals who are residents of Kentucky, who have income that meets or exceeds the state's filing thresholds, or who owe tax are required to file the 2009 Kentucky Individual Income Tax returns using Forms 740 or 740-EZ.

How to fill out 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ?

To fill out the 2009 Kentucky Individual Income Tax forms, taxpayers must follow the instructions provided in the tax guide, which explains how to report income, claim deductions, and calculate tax liability. The forms require personal information, income details, and any applicable credits and deductions.

What is the purpose of 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ?

The purpose of the 2009 Kentucky Individual Income Tax Instructions is to assist taxpayers in accurately completing their tax returns, ensuring compliance with state tax laws, and providing information on available deductions, credits, and filing procedures.

What information must be reported on 2009 Kentucky Individual Income Tax Instructions for Forms 740 and 740-EZ?

Taxpayers must report personal information including their name, Social Security number, income details from various sources, adjustments to income, deductions, credits, and any tax payments made during the year.

Fill out your 2009 kentucky individual income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 Kentucky Individual Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.