Get the free Property Tax Forms and Instructions for Public Service Companies

Show details

This document provides property tax returns, schedules, and instructions for public service companies in Kentucky, detailing filing requirements and related classifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax forms and

Edit your property tax forms and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax forms and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax forms and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit property tax forms and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

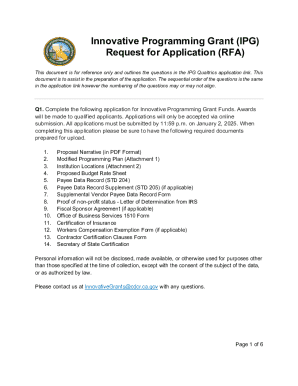

How to fill out property tax forms and

How to fill out Property Tax Forms and Instructions for Public Service Companies

01

Gather all necessary documentation, including property details and ownership information.

02

Obtain the specific Property Tax Form relevant to Public Service Companies from the local tax authority's website or office.

03

Carefully read the instructions provided with the form to understand all required sections.

04

Fill out the property identification section with accurate details about the property.

05

Complete the valuation section, ensuring that all assessments and valuations are accurate and supported by documentation.

06

Review any exemptions or credits that may apply and fill those sections out appropriately.

07

Provide any additional information requested in the specific form, such as financial statements or operational details.

08

Double-check all entries for accuracy before signing the form.

09

Submit the completed form by the specified deadline, either online or by mailing it to the appropriate tax authority.

Who needs Property Tax Forms and Instructions for Public Service Companies?

01

Public Service Companies that own property subject to taxation.

02

Businesses involved in utilities, telecommunications, transportation, and similar industries.

03

Any entity required to report property holdings to local tax authorities for assessment.

Fill

form

: Try Risk Free

People Also Ask about

What tax form do companies use?

Depending on whether you want to be treated as a C corporation or an S corporation, you can choose to file Form 1120 or 1120-S, respectively. Alternatively, you can file as a partnership, using Form 1065.

Does staples have IRS tax forms?

Tax Forms; W2, 1099, 1040, Envelopes and More Staples.

Where can I get tax forms and instruction booklets?

Tax forms and publications Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is the new 1040 form for seniors?

Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

Does the post office have local tax forms?

0:22 2:11 This service is convenient for those who prefer physical copies. Yet not all post offices may carryMoreThis service is convenient for those who prefer physical copies. Yet not all post offices may carry every type of tax form n the IRS is the primary distributor of tax forms.

Where can I pick up tax forms?

Tax forms and publications Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What tax document do you need for property tax?

Your lender will send you Form 1098, detailing the mortgage interest you paid during the tax year. This form is crucial for claiming the mortgage interest deduction. Keep receipts or statements showing the amount of property tax you paid. These records will help you claim the property tax deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Property Tax Forms and Instructions for Public Service Companies?

Property Tax Forms and Instructions for Public Service Companies are official documents that outline the requirements and processes for public service companies to report and pay property taxes on their assets.

Who is required to file Property Tax Forms and Instructions for Public Service Companies?

Public service companies, which may include utilities and transportation companies, are required to file these forms as they own tangible property subject to property taxation.

How to fill out Property Tax Forms and Instructions for Public Service Companies?

To fill out the forms, companies must gather necessary financial information regarding their assets, follow the instructions provided on the forms, and ensure that all required fields are completed accurately before submission.

What is the purpose of Property Tax Forms and Instructions for Public Service Companies?

The purpose is to ensure that public service companies provide accurate information about their taxable property, enabling government entities to assess and collect property taxes appropriately.

What information must be reported on Property Tax Forms and Instructions for Public Service Companies?

Companies must report details such as the type of property owned, its location, valuation, and any other data required to compute the property tax obligations.

Fill out your property tax forms and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Forms And is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.