Get the free Kentucky Net Operating Loss Application for Income Tax Refund

Show details

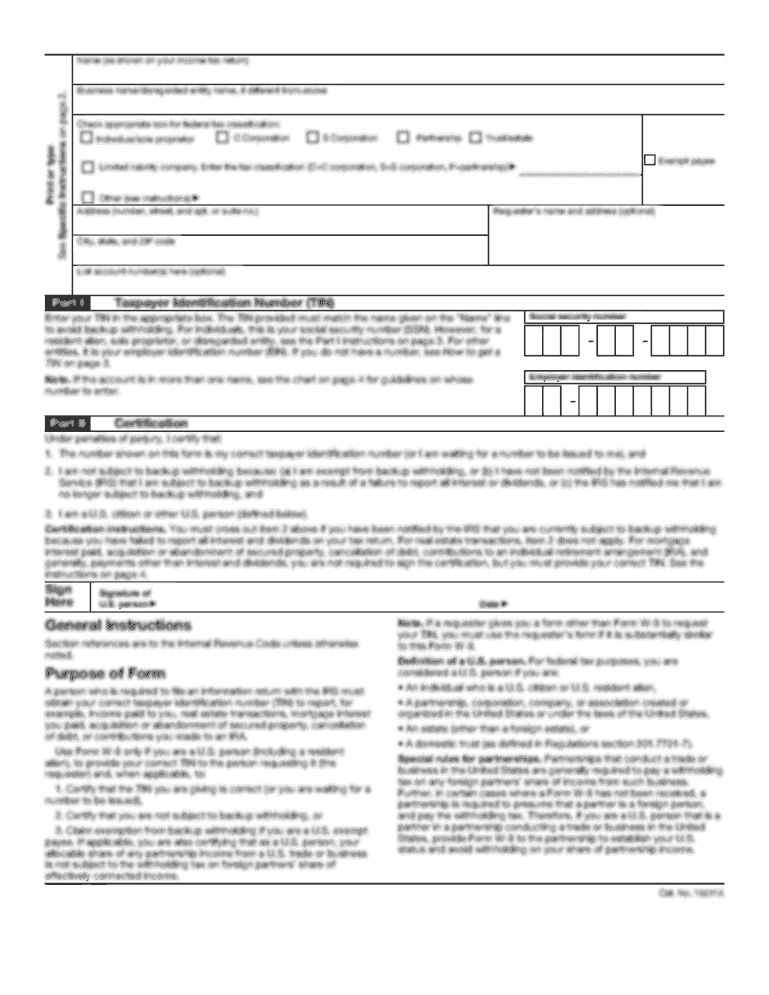

This form is used by taxpayers other than corporations to apply for a carryback of net operating losses for income tax refunds.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kentucky net operating loss

Edit your kentucky net operating loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kentucky net operating loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kentucky net operating loss online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit kentucky net operating loss. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kentucky net operating loss

How to fill out Kentucky Net Operating Loss Application for Income Tax Refund

01

Begin by obtaining the Kentucky Net Operating Loss Application form from the Kentucky Department of Revenue's website.

02

Fill in your personal identification information, including your name, address, and Social Security number or Federal Employer Identification Number.

03

Indicate the tax year for which you are claiming the net operating loss.

04

Provide detailed information about your business’s income and expenses to establish the net operating loss.

05

Complete the section that calculates the net operating loss amount based on your financial data.

06

Attach any necessary supporting documents, such as tax returns and financial statements, to validate your application.

07

Review the form for accuracy and completeness before submission.

08

Submit the completed application to the appropriate Kentucky Department of Revenue address as specified in the application instructions.

Who needs Kentucky Net Operating Loss Application for Income Tax Refund?

01

Businesses operating in Kentucky that have incurred a net operating loss and are seeking a refund on income tax paid in prior years.

02

Taxpayers who have experienced financial setbacks that impact their taxable income.

Fill

form

: Try Risk Free

People Also Ask about

What is a 740 NP form in Kentucky?

Form 740-NP is a tax return used by individuals who were not residents of Kentucky for the entire 2023 tax year. This includes those who: Lived in Kentucky for less than 183 days (nonresidents) Moved in or out of Kentucky during the year (part-year residents)

Are NOLs tax deductible?

Prior to this legislation, NOLs could be deducted against 100% of annual income under federal law. Excess NOL amounts could be carried back two years and carried forward 20 years. As amended by the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, NOL deductions may only offset up to 80% of taxable income.

Do states follow federal NOL rules?

Taxpayers will generally have a state net operating loss if deductions exceed income for the year in question. But most states do not allow exactly the same net operating loss deduction for corporate taxpayers as was Treatment of Federal Deduction, IRC §172taken on the federal return.

Is there a NOL deduction in Kentucky?

Does Kentucky allow a net operating loss (NOL) deduction? Yes, Kentucky allows a deduction based on IRC Sec. 172, ( Sec. 141.011(1), KRS) except it limits the deduction to 80% of taxable income for NOLs arising after 2017.

Does Kentucky conform to section 174?

Expenses — The update to the IRC conformity date means that, for taxable years beginning on or after January 1, 2023, Kentucky conforms to the IRC Section 174 changes requiring taxpayers to capitalize and amortize R&E expenses rather than deduct them.

Can I get refund from a net operating loss?

Generally, a taxpayer may claim an NOL carryforward on its income tax return and must attach a statement showing how the NOL deduction was computed. In order to file an NOL carryback claim, a taxpayer can file an amended income tax return for the carryback year or a tentative refund claim.

What is the 179 rule in Kentucky?

Section 179 Expense Deduction IRC §179 expense deduction increased to $100,000 for Kentucky for property placed in service on or after January 1, 2020: Property placed into service 9/10/01 - 12/31/19. Use December 31, 2001 IRC ($25,000 § 179 maximum)

How much is the Llet fee in Kentucky?

CORPORATION NET INCOME TAX The LLET may be calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. A minimum tax of $175 applies regardless of the method used.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Kentucky Net Operating Loss Application for Income Tax Refund?

The Kentucky Net Operating Loss Application for Income Tax Refund is a tax form that allows businesses to apply for a refund of income taxes paid in prior years by utilizing net operating losses incurred in the current fiscal period.

Who is required to file Kentucky Net Operating Loss Application for Income Tax Refund?

Businesses that have incurred a net operating loss in Kentucky and wish to claim a refund for income taxes paid in previous years are required to file this application.

How to fill out Kentucky Net Operating Loss Application for Income Tax Refund?

To fill out the application, taxpayers must provide details about their net operating loss, including the tax years being carried back, relevant financial data, and any supporting documentation as required by the state.

What is the purpose of Kentucky Net Operating Loss Application for Income Tax Refund?

The purpose of this application is to provide a mechanism for businesses to recover some of their tax liabilities by applying net operating losses from one tax year to offset taxes owed in prior years.

What information must be reported on Kentucky Net Operating Loss Application for Income Tax Refund?

Information that must be reported includes the amount of net operating loss, the tax years affected, supporting financial calculations, and any relevant taxpayer identification details.

Fill out your kentucky net operating loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kentucky Net Operating Loss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.