Get the free Form 740-X

Show details

This document is used for filing amended Kentucky Individual Income Tax Returns for the tax years 2005 or 2006, allowing taxpayers to correct previously filed returns.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 740-x

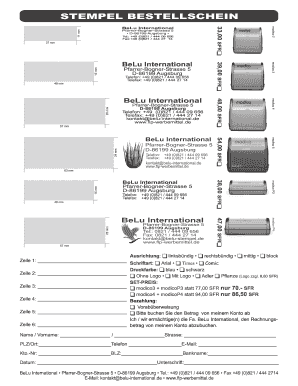

Edit your form 740-x form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 740-x form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 740-x online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 740-x. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 740-x

How to fill out Form 740-X

01

Obtain a copy of Form 740-X from the official tax website.

02

Read the instructions carefully to understand what changes need to be reported.

03

Complete the identification section with your name, address, and Social Security number.

04

Fill out the section for the tax year you are amending.

05

Provide the original amounts as per your original Form 740 and the corrected amounts for the changes.

06

Explain the reasons for the amendments in the provided section.

07

Attach any supporting documents that back up the changes you are reporting.

08

Review the form for accuracy and completeness before submission.

09

Sign and date the form, and then send it to the appropriate tax authority address listed in the instructions.

Who needs Form 740-X?

01

Individuals who filed a Kentucky income tax return and need to make amendments.

02

Taxpayers who find errors in their previously filed Form 740 that affect their tax liability.

03

Persons who realize they may have overlooked deductions or credits on their original return.

Fill

form

: Try Risk Free

People Also Ask about

What income is not taxed in KY?

Kentucky fully exempts all Social Security income from taxation while providing a significant deduction for seniors receiving other types of retirement income. The state has relatively low sales and property taxes, but also has an inheritance tax.

Who qualifies for family size tax credit in Kentucky?

Nonrefundable Family Size Tax Credit The family size tax credit is based on modified gross income and the size of the family. If total modified gross income is $41,496 or less for 2024, you may qualify for the Kentucky family size tax credit.

What is not taxed in Kentucky?

Tax-exempt goods Some goods are exempt from sales tax under Kentucky law. Examples include groceries, prescription drugs, and some manufacturing equipment.

What is income that is not taxed?

Inheritances, gifts, cash rebates, alimony payments (for divorce decrees finalized after 2018), child support payments, most healthcare benefits, welfare payments, and money that is reimbursed from qualifying adoptions are deemed nontaxable by the IRS.

What is the minimum income to file taxes in Kentucky?

What are Kentucky's Filing Requirements? Family size is One and MGI is greater than $15,060. Family size is Two and MGI is greater than $20,440. Family size is Three and MGI is greater than $25,820. Family size is Four or more and MGI is greater than $31,200.

What is a form 740 in Kentucky?

Form 740 (2023): Kentucky Individual Income Tax Return Full-Year Residents. Tax Forms Tax Codes. Form 740 is the Kentucky Individual Income Tax Return used by residents of the state of Kentucky to report their income and calculate any taxes owed or due for the tax year 2023.

Is KY getting rid of state income tax?

A 2022 Kentucky law reduced the state's income tax rate and set a series of revenue-based triggers that could gradually lower the tax to zero. But unlike in Mississippi, the triggers aren't automatic. Rather, the Kentucky General Assembly must approve each additional decrease in the tax rate.

What income is taxable in Kentucky?

Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 740-X?

Form 740-X is an amended individual income tax return form used in Kentucky to correct errors or make adjustments to a previously filed Form 740.

Who is required to file Form 740-X?

Any individual who needs to amend their Kentucky individual income tax return (Form 740) due to errors or changes in income, deductions, credits, or other tax-related information is required to file Form 740-X.

How to fill out Form 740-X?

To fill out Form 740-X, you must provide your personal information, indicate the tax year being amended, explain the reasons for the amendment, and enter revised amounts for income, deductions, and credits. Follow the instructions provided with the form carefully.

What is the purpose of Form 740-X?

The purpose of Form 740-X is to allow taxpayers to officially make amendments to their previously filed Kentucky individual income tax returns to ensure accurate reporting and compliance with tax laws.

What information must be reported on Form 740-X?

Form 740-X requires reporting of the taxpayer's name, social security number, tax year being amended, the amounts from the original return, the corrected amounts, and an explanation of the reasons for the amendment.

Fill out your form 740-x online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 740-X is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.