Get the free Economic Recovery Loan Program

Show details

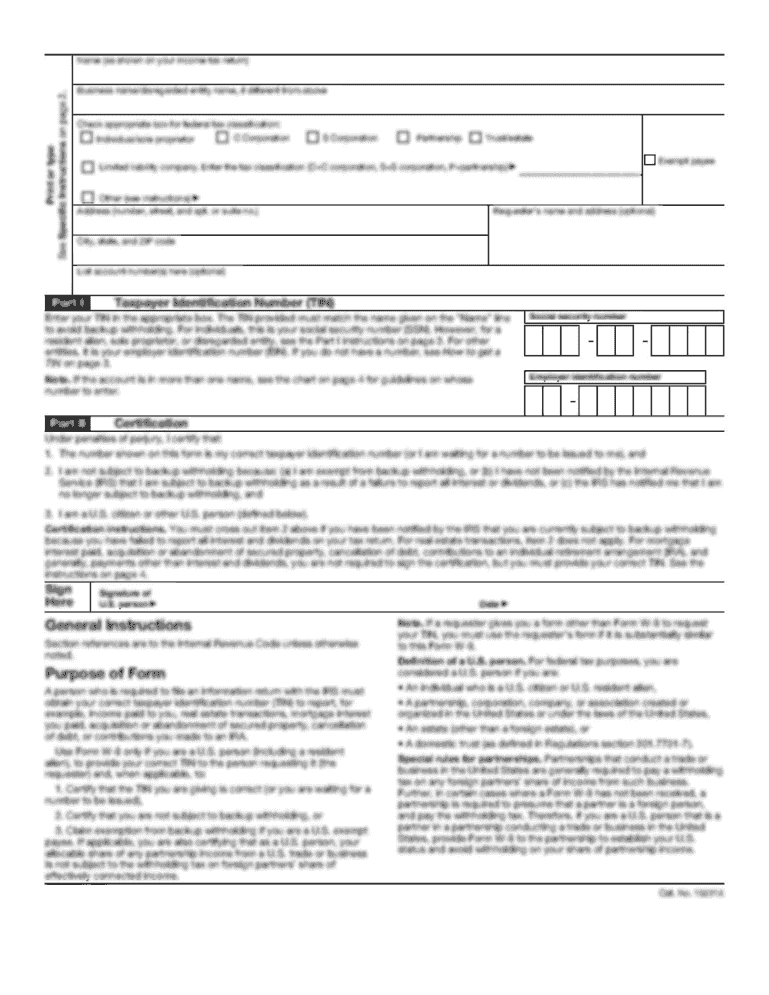

This document outlines the application process for the Economic Recovery Loan Program, providing a detailed checklist of required information and documentation to be submitted by businesses seeking

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign economic recovery loan program

Edit your economic recovery loan program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your economic recovery loan program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit economic recovery loan program online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit economic recovery loan program. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out economic recovery loan program

How to fill out Economic Recovery Loan Program

01

Visit the official website of the Economic Recovery Loan Program.

02

Gather necessary documents including financial statements, proof of income, and business plans.

03

Complete the online application form accurately.

04

Upload all required supporting documents.

05

Review the application for any errors or missing information.

06

Submit the application before the deadline.

07

Wait for a confirmation email acknowledging receipt of your application.

08

Monitor your application status through the website or contact support for updates.

Who needs Economic Recovery Loan Program?

01

Small business owners seeking financial assistance due to economic downturns.

02

Entrepreneurs looking for capital to start or expand their business.

03

Individuals whose income has been affected by recent economic challenges.

04

Non-profit organizations in need of funds to maintain operations during recovery.

Fill

form

: Try Risk Free

People Also Ask about

What is an economic injury disaster?

EIDL provides the necessary working capital to help small businesses impacted by a disaster survive until normal operations resume. EIDL assistance is available only to small businesses when SBA determines they are unable to obtain credit elsewhere.

What is the SBA disaster loan for Florida?

Homeowners may be eligible for a disaster loan up to $500,000 for primary residence repairs or rebuilding. SBA may also be able to help homeowners and renters with up to $100,000 to replace personal property, including automobiles damaged or destroyed in the disaster.

Why is my SBA loan only paying interest?

The SBA 7(a) loan program can include an interest-only period to provide a financial cushion to support your business during this process. In this transitional period, rather than making full principal-and-interest payments, you'll make interest-only payments. The only interest paid is on the amounts already dispersed.

Does everyone get approved for an SBA disaster loan?

If you have bad credit, or your small business credit score isn't stellar, the SBA will still consider other factors, such as recent income and your history of rent, utilities, insurance, and other payments, to determine whether you qualify for an SBA disaster loan.

Who is eligible for the Economic Injury disaster loan?

Any business with up to 500 employees is eligible for an Economic Injury Disaster Loan (“EIDL”). Similar eligibility criteria as applicable to PPP Loans apply, e.g., businesses with up to 500 employees, independent contractors and sole proprietors are also eligible.

Will Eidl be forgiven?

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

What is the default rate for the EIDL loan?

The SBA disbursed more than 4.1 million EIDL loans totaling approximately $400 billion. The SBA has reported that 1.3 million EIDL loans are in default, in liquidation, or have been charged off. This is actually not much different from the federal government's originally projected default rate of 37%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Economic Recovery Loan Program?

The Economic Recovery Loan Program is a financial initiative designed to provide loans to businesses and individuals affected by economic downturns, helping them to stabilize and recover.

Who is required to file Economic Recovery Loan Program?

Businesses and individuals who seek financial assistance under the program are required to file, typically those who have experienced economic hardship due to specific qualifying events.

How to fill out Economic Recovery Loan Program?

To fill out the Economic Recovery Loan Program application, applicants should gather necessary financial documents, complete the required forms with accurate information, and submit the application as directed by the administering agency.

What is the purpose of Economic Recovery Loan Program?

The purpose of the Economic Recovery Loan Program is to provide financial support to help businesses and individuals recover from economic crises, ensuring stability and continued operation.

What information must be reported on Economic Recovery Loan Program?

Applicants must report their financial status, including income, expenses, and any relevant economic impact data, along with other necessary personal or business information as required by the program.

Fill out your economic recovery loan program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Economic Recovery Loan Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.