Get the free APPLICATION FOR TAX REGISTRATION - state me

Show details

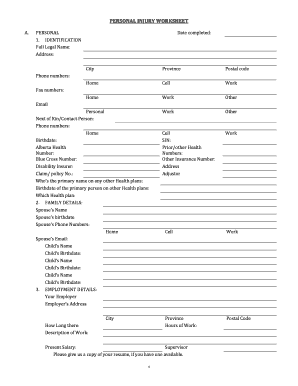

This document serves as an application for registering various tax accounts in the state of Maine, including income tax withholding, unemployment compensation tax, sales and use tax, and more.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for tax registration

Edit your application for tax registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for tax registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for tax registration online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for tax registration. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for tax registration

How to fill out APPLICATION FOR TAX REGISTRATION

01

Obtain the correct APPLICATION FOR TAX REGISTRATION form from your local tax authority's website or office.

02

Read the instructions carefully to understand what information is required.

03

Fill out your personal information including name, address, and contact details.

04

Provide your Social Security Number (SSN) or Employer Identification Number (EIN) as required.

05

Indicate the type of tax registration you are applying for (e.g., individual, business, non-profit).

06

Include any additional information or documentation requested in the form.

07

Review your application for accuracy and completeness.

08

Submit the completed application form to the designated tax authority either in person, by mail, or online if applicable.

Who needs APPLICATION FOR TAX REGISTRATION?

01

Individuals starting a new business that requires tax registration.

02

Freelancers or self-employed individuals who need to report their income.

03

Non-profit organizations that need to register for tax-exempt status.

04

Partnerships or corporations that are forming and require a tax identification number.

05

Foreign entities conducting business in the region and needing tax registration.

Fill

form

: Try Risk Free

People Also Ask about

What is a CR 16 form in Kansas?

The Kansas CR-16 form is a form required to be filed with the court when a corporation has been dissolved and is no longer active. The form can be found on the Kansas Secretary of State website.

How to close a business in Kansas?

What to do when closing a business: Complete the Notice of Business Closure (CR-108) Return the completed form to: Kansas Department of Revenue, 915 SW Harrison Street, Topeka, KS 66625-9000 or FAX to 785-291-3614. Include information on the date the business was closed. Make sure all tax filings are current.

What are tax registration documents?

Tax registration certificate is a required document for businesses and certain entities to have in order to conduct their activities in a jurisdiction . The tax registration certificate is often a part of or issued alongside a business license .

Who qualifies for sales tax exemption in Kansas?

Tax-exempt customers Some customers are exempt from paying sales tax under Kansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

How to get a Kansas sales tax registration number?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

What is a Kansas tax clearance certificate?

What is a Tax Clearance? A Certificate of Tax Clearance is a comprehensive review to determine and ensure that the applicant's account is in current compliance with all applicable: Kansas tax laws administered by the director of taxation within the Kansas Department of Revenue.

How much is Kansas compensating use tax?

Like sales tax, compensating use tax is based on the total cost of the goods purchases, including postage, shipping, handling, or transportation charges. The Compensating Use Tax rate is the same 6.5 percent as the state Sales Tax rate.

Do I need a business tax registration in Wisconsin?

Doing business in Wisconsin may require obtaining licenses and registrations. Although there is no statewide business license, most businesses will need to complete the Business Tax Registration (BTR) with the Wisconsin Department of Revenue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR TAX REGISTRATION?

APPLICATION FOR TAX REGISTRATION is a formal document that individuals or businesses must submit to the relevant government tax authority to obtain a tax identification number and register for tax purposes.

Who is required to file APPLICATION FOR TAX REGISTRATION?

Individuals or businesses that earn income, operate a business, or are otherwise subject to taxation in a particular jurisdiction are required to file APPLICATION FOR TAX REGISTRATION.

How to fill out APPLICATION FOR TAX REGISTRATION?

To fill out APPLICATION FOR TAX REGISTRATION, you need to provide accurate personal or business information, such as name, address, type of business entity, and identification numbers, along with any specific details required by the tax authority.

What is the purpose of APPLICATION FOR TAX REGISTRATION?

The purpose of APPLICATION FOR TAX REGISTRATION is to ensure compliance with tax laws, provide the government with information about taxpayers, and enable the tax authority to assess and collect taxes effectively.

What information must be reported on APPLICATION FOR TAX REGISTRATION?

The information that must be reported typically includes the applicant's name, address, type of business, tax identification numbers, ownership structure, and any other details required by the tax authority.

Fill out your application for tax registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Tax Registration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.