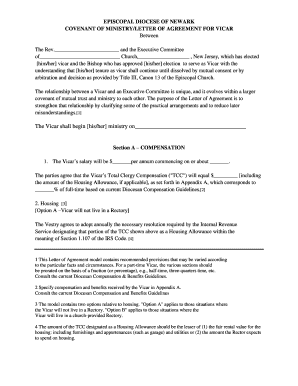

Get the free Individual Income Tax Instructional Pamphlet - state me

Show details

This document provides instructions for nonresidents and part-year residents regarding filing individual income tax in Maine, including details on calculating Maine source income, nonresident credits,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual income tax instructional

Edit your individual income tax instructional form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual income tax instructional form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual income tax instructional online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit individual income tax instructional. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

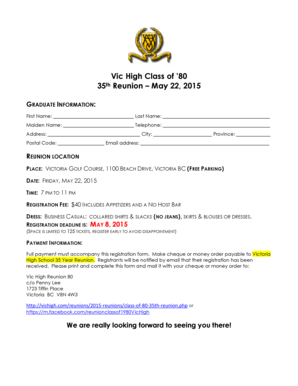

How to fill out individual income tax instructional

How to fill out Individual Income Tax Instructional Pamphlet

01

Obtain the Individual Income Tax Instructional Pamphlet from the relevant tax authority website or office.

02

Review the pamphlet to understand the sections and required information.

03

Gather all necessary documents, such as W-2 forms, 1099s, and other income statements.

04

Fill out personal information at the top of the pamphlet, including name, address, and Social Security number.

05

Follow the instructions carefully for reporting income, making sure to include all sources of income.

06

Complete the deductions and credits sections as applicable, ensuring you have supporting documents.

07

Review the tax calculations and ensure all figures are correct.

08

Sign and date the completed pamphlet, indicating your agreement with the information provided.

09

Submit the pamphlet as instructed, either electronically or through mail, by the tax deadline.

Who needs Individual Income Tax Instructional Pamphlet?

01

Individuals who earn income and are required to file tax returns.

02

Self-employed individuals needing to report business income and expenses.

03

Students receiving scholarship income or part-time earnings.

04

Individuals who have investment income or other taxable income sources.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get tax forms and instruction booklets?

Tax forms and publications Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How do you calculate individual income tax?

How Income Taxes Are Calculated First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

Does the IRS accept A4 paper?

Either a U.S. letter or a European A4 size is acceptable. Why include pages marked "For Your Records?" These worksheets may help the IRS understand how you calculated some of the figures on your return. There's certainly no harm in adding them in. Attach all the U.S. tax forms we prepared.

How do you calculate individual income?

How to calculate annual income. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000.

What is the formula for calculating income tax?

The tax rates are determined by the government and are based on income slabs. The income tax calculation is done based on the following formula: Taxable Income = Gross Salary - Deductions; Income Tax = (Taxable Income x Applicable Tax Rate) - Tax Rebate.

What is the publication 17 tax guide for individuals?

Publication 17 covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet. It explains the tax law to make sure you pay only the tax you owe and no more.

What is the formula for calculating the taxable income?

Taxable income = Gross Income - Exempt Income - Allowable Deductions + Taxable Capital Gains.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Individual Income Tax Instructional Pamphlet?

The Individual Income Tax Instructional Pamphlet is a guide that provides instructions on how to complete individual income tax returns, including the necessary forms and the steps required for accurate filing.

Who is required to file Individual Income Tax Instructional Pamphlet?

Individuals who meet certain income thresholds or who have specific tax situations are required to file the Individual Income Tax Instructional Pamphlet, which typically includes employees, self-employed individuals, and others receiving taxable income.

How to fill out Individual Income Tax Instructional Pamphlet?

To fill out the Individual Income Tax Instructional Pamphlet, taxpayers should collect their income information, follow the step-by-step instructions provided in the pamphlet, fill out the designated forms, and ensure all required documentation is included before submission.

What is the purpose of Individual Income Tax Instructional Pamphlet?

The purpose of the Individual Income Tax Instructional Pamphlet is to assist taxpayers in understanding the requirements for filing their income taxes, ensuring they complete the forms correctly, and comply with tax laws.

What information must be reported on Individual Income Tax Instructional Pamphlet?

Information that must be reported on the Individual Income Tax Instructional Pamphlet typically includes personal identification details, total income, allowable deductions, tax credits, and other relevant financial information needed to determine tax liability.

Fill out your individual income tax instructional online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Income Tax Instructional is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.