Get the free Certificate of Deposit/Deposit Account Assignment - courts state md

Show details

This document is used to assign rights to a certificate of deposit or deposit account as security for a bond in the District Court of Maryland.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of depositdeposit account

Edit your certificate of depositdeposit account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of depositdeposit account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of depositdeposit account online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit certificate of depositdeposit account. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

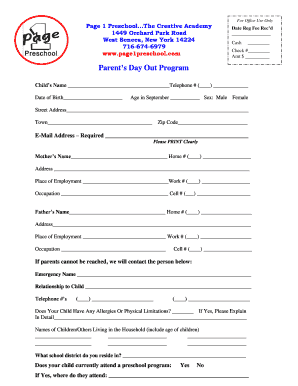

How to fill out certificate of depositdeposit account

How to fill out Certificate of Deposit/Deposit Account Assignment

01

Obtain the Certificate of Deposit/Deposit Account Assignment form from your bank or financial institution.

02

Fill in your personal information, including your full name, address, and contact information.

03

Provide details of the Certificate of Deposit or Deposit Account, including the account number and the financial institution's name.

04

Specify the amount or value of the deposit to be assigned.

05

Identify the assignee by filling in their name and contact information, ensuring they are eligible to receive the assignment.

06

Review the form for accuracy, ensuring all required fields are completed.

07

Sign and date the form to validate the assignment.

08

Submit the completed form to your bank or financial institution for processing.

Who needs Certificate of Deposit/Deposit Account Assignment?

01

Individuals who want to transfer ownership of a Certificate of Deposit or Deposit Account to another party.

02

Estate executors managing the distribution of assets after a person's passing.

03

Trustees managing assets for beneficiaries.

04

Individuals involved in legal matters requiring the assignment of financial accounts.

Fill

form

: Try Risk Free

People Also Ask about

What is the description of a certificate of deposit account?

Your earnings with a $5,000 deposit TermTop APYCD value at maturity 6 months 4.50% $5,092.55 1 year 4.40% $5,220.00 3 years 4.15% $5,648.69 5 years 4.25% $6,156.73 6 days ago

What is a simple definition of a certificate of deposit?

A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and in exchange, the issuing bank pays interest.

What is an assignment of certificate of deposit?

ASSIGNMENT OF CERTIFICATE OF DEPOSIT means the Assignment of Certificate of Deposit from the Borrower to the Authority and the Purchaser assigning a Certificate of Deposit representing the Pledged Funds to the Purchaser; Source 1 Draft Your Clause.

What if I put $20,000 in a CD for 5 years?

How much interest would you earn? If you put $20,000 into a 5-year CD with an interest rate of 4.60%, you'd end the 5-year CD term with $5,043.12 in interest, for a total balance of $25,043.12. Not all CDs offer that interest rate, though.

How much will $1000 make in a CD?

A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and in exchange, the issuing bank pays interest. When you cash in or redeem your CD, you receive the money you originally invested plus any interest.

What is the purpose of a CDs?

A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor. To swap the risk of default, the lender buys a CDS from another investor who agrees to reimburse them if the borrower defaults.

What is an assignment of deposit?

Assignment of Deposit means the Assignment of Deposit dated as of the Fifth Amendment Date, entered into by Borrowers as depositor in favor of Bank.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Deposit/Deposit Account Assignment?

A Certificate of Deposit/Deposit Account Assignment is a financial document that outlines the terms and conditions under which a deposit account, such as a CD, is assigned to another party as collateral or security for a loan or obligation.

Who is required to file Certificate of Deposit/Deposit Account Assignment?

Typically, individuals or entities that have an interest in using a Certificate of Deposit or deposit account as collateral for a loan or financial obligation are required to file a Certificate of Deposit/Deposit Account Assignment.

How to fill out Certificate of Deposit/Deposit Account Assignment?

To fill out a Certificate of Deposit/Deposit Account Assignment, you should provide information such as the names of the parties involved, account details, the amount, and any terms regarding the assignment. It's important to ensure all fields are completed accurately.

What is the purpose of Certificate of Deposit/Deposit Account Assignment?

The purpose of a Certificate of Deposit/Deposit Account Assignment is to formally document the assignment of rights to a deposit account to secure a loan or obligation, ensuring clarity and legal enforceability in financial transactions.

What information must be reported on Certificate of Deposit/Deposit Account Assignment?

The information that must be reported on a Certificate of Deposit/Deposit Account Assignment includes the account holder's name, the financial institution's details, account number, assignment terms, and the signature of the assigning party.

Fill out your certificate of depositdeposit account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Depositdeposit Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.