Get the free MOTION FOR STAY OF SERVICE OF EARNINGS WITHHOLDING ORDER - courts state md

Show details

A motion to request a stay on the service of an Earnings Withholding Order for reasons such as lack of arrearage or erroneous amount.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motion for stay of

Edit your motion for stay of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motion for stay of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing motion for stay of online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit motion for stay of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motion for stay of

How to fill out MOTION FOR STAY OF SERVICE OF EARNINGS WITHHOLDING ORDER

01

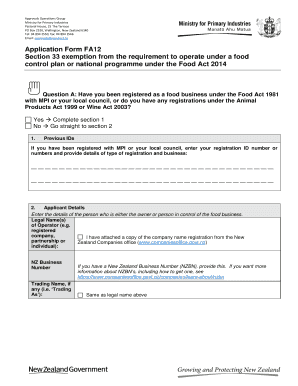

Obtain the Motion for Stay of Service of Earnings Withholding Order form from the appropriate court or legal resource.

02

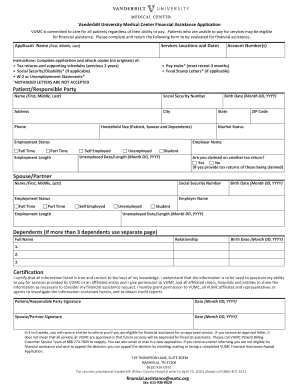

Fill out your personal information in the designated sections, including your name, address, and contact details.

03

Provide the case number and relevant details regarding the earnings withholding order you wish to stay.

04

Clearly state the reasons for requesting a stay of service, including any supporting evidence or documentation.

05

Review the form to ensure all information is accurate and complete.

06

Sign and date the motion in the appropriate section.

07

File the completed motion with the court, and ensure a copy is served to the opposing party.

08

Prepare for any hearing, if required, by gathering additional evidence or documentation that supports your request.

Who needs MOTION FOR STAY OF SERVICE OF EARNINGS WITHHOLDING ORDER?

01

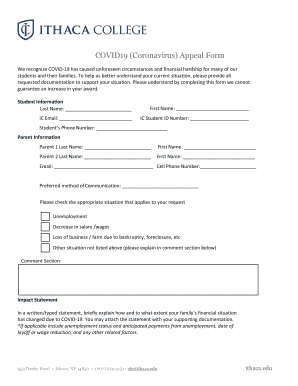

Individuals who are facing an earnings withholding order and believe they have valid reasons to temporarily halt the enforcement of such an order.

02

People who are experiencing financial hardships and need to request a suspension of withholding to manage their earnings.

03

Anyone who has had an earnings withholding order wrongly issued or requires clarification on its enforcement.

Fill

form

: Try Risk Free

People Also Ask about

What is an income withholding order in Massachusetts?

An income withholding order is an order for a specific amount of money to be withheld from an employee's paycheck to pay child support. When a judge issues a child support order in Massachusetts, the order must include a provision for immediate income withholding (unless the judge suspends the withholding).

What is the meaning of income withholding?

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W–4.

What is a notice of earnings withholding order termination?

Notice of Termination or Modification of Earnings Withholding Order (WG-012) Tells an employer to stop or change an earning withholding order. This form is completed by the sheriff, marshal, or constable acting as the levying officer.

How long does an income withholding order take?

Withholding order is effective "as soon as possible" but no later than 10 days after it is received. Employer delivers papers to the employee -- a copy of the IWO, the attached statement of rights, and blank Request for Hearing within 7 days of receiving the IWO.

What does an earnings withholding order for court-ordered debt mean?

An earnings withholding order is a court-ordered legal document. It requires an employer to withhold up to 25 percent of an employee's wages. This money is paid to a creditor until the employee pays off their debt. A creditor is a person or business that is owed money.

Why did I get an earnings withholding order?

An earnings withholding order is a court-ordered legal document. It requires an employer to withhold up to 25 percent of an employee's wages. This money is paid to a creditor until the employee pays off their debt. A creditor is a person or business that is owed money.

Is Massachusetts a mandatory withholding state?

As an employer, you must withhold state income taxes from salaries or payments made to employees who live in or are employed in Massachusetts and you must send them in, along with the appropriate form or electronic return, on time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MOTION FOR STAY OF SERVICE OF EARNINGS WITHHOLDING ORDER?

A Motion for Stay of Service of Earnings Withholding Order is a legal request to temporarily halt or postpone the enforcement of an earnings withholding order, which is an order to deduct a portion of a person's wages for debt repayment or child support.

Who is required to file MOTION FOR STAY OF SERVICE OF EARNINGS WITHHOLDING ORDER?

Typically, the person whose earnings are being withheld (the debtor or obligor) must file a Motion for Stay of Service of Earnings Withholding Order to contest or seek relief from the withholding.

How to fill out MOTION FOR STAY OF SERVICE OF EARNINGS WITHHOLDING ORDER?

To fill out the Motion, one must provide personal information, details of the original court order, the reasons for the motion, and any supporting documentation. It may be helpful to consult legal guidelines specific to the jurisdiction.

What is the purpose of MOTION FOR STAY OF SERVICE OF EARNINGS WITHHOLDING ORDER?

The purpose of this motion is to provide the individual an opportunity to contest the withholding order or to request a temporary pause in the enforcement of the order while further proceedings are considered.

What information must be reported on MOTION FOR STAY OF SERVICE OF EARNINGS WITHHOLDING ORDER?

The motion should typically include the name and contact information of the filer, details of the original court order, reasons for requesting the stay, any relevant financial information, and the specific relief being sought.

Fill out your motion for stay of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motion For Stay Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.