Get the free Howard County Wage Rate Requirements - co ho md

Show details

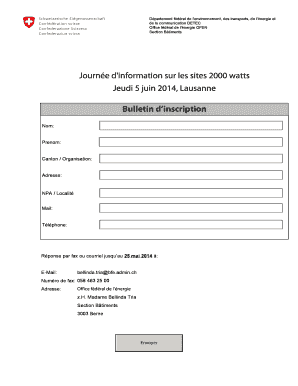

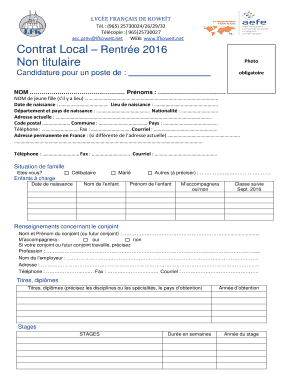

This document outlines the exemption status and certification requirements for contractors and subcontractors in Howard County, Maryland regarding wage rate requirements for service contracts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign howard county wage rate

Edit your howard county wage rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your howard county wage rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing howard county wage rate online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit howard county wage rate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out howard county wage rate

How to fill out Howard County Wage Rate Requirements

01

Obtain the Howard County Wage Rate Requirements document from the appropriate county office or website.

02

Review the eligibility criteria and wage schedule based on the type of project.

03

Fill out the required project information including project name, address, and contractor details.

04

List all subcontractors involved in the project and their respective wage rates.

05

Ensure the wage rates adhere to the specified minimums in the document.

06

Complete any additional sections relevant to the project, including work classifications.

07

Sign and date the form at the bottom, certifying the accuracy of the information provided.

08

Submit the completed form to the designated county office by the stipulated deadline.

Who needs Howard County Wage Rate Requirements?

01

All contractors and subcontractors working on public works projects in Howard County.

02

Employers seeking to comply with local wage laws for their employees.

03

Government agencies overseeing public contracts and funding.

Fill

form

: Try Risk Free

People Also Ask about

What is your minimum hourly rate?

The federal minimum wage for covered nonexempt employees is $7.25 per hour. Many states also have minimum wage laws. In cases where an employee is subject to both the state and federal minimum wage laws, the employee is entitled to the higher of the two minimum wages.

What is a good hourly pay in the US?

American Salary Annual SalaryHourly Wage Top Earners $105,000 $50 75th Percentile $68,500 $33 Average $58,563 $28 25th Percentile $33,000 $16

What is the hourly minimum wage in the USA?

The federal minimum wage is $7.25 per hour. This rate applies to covered nonexempt workers. The minimum wage for employees who receive tips is $2.13 per hour.

How much do Howard County staff get paid?

Average Howard County Government hourly pay ranges from approximately $17.24 per hour for Camp Counselor to $54.05 per hour for Financial Administrator. The average Howard County Government salary ranges from approximately $50,767 per year for Correctional Officer to $140,487 per year for Human Resources Administrator.

What is the hourly rate for the minimum wage?

Current rates £12.21 (aged 21 and over) £10 (aged 18 to 20) £7.55 (aged under 18) £7.55 (apprentice rate)

What are the labor laws for salaried employees in Maryland?

Overtime Pay: Non-exempt salaried employees are entitled to receive overtime pay at a rate of 1.5 times their regular hourly rate for any hours worked beyond 40 hours in a single workweek. Meal and Rest Breaks: Labor laws in Maryland do not require employers to provide meal or rest breaks for adult employees.

What is the hourly rate for minimum wage?

From April 2025, the rates are: £12.21 (aged 21 and over) £10 (aged 18 to 20) £7.55 (aged under 18) £7.55 (apprentice rate)

What's the minimum wage in Howard County, Maryland?

In Howard County, the rates (as of Jan. 1, 2024) are: $15 – standard. $3.63 – tipped employees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Howard County Wage Rate Requirements?

Howard County Wage Rate Requirements refer to the regulations that mandate contractors to pay their employees a minimum wage on county-funded projects, ensuring fair compensation for labor.

Who is required to file Howard County Wage Rate Requirements?

Any contractor or subcontractor involved in a public works contract in Howard County is required to file for Wage Rate Requirements to ensure compliance with local wage laws.

How to fill out Howard County Wage Rate Requirements?

To fill out the Howard County Wage Rate Requirements, contractors must complete the designated forms provided by the county, detailing the wages paid to workers, classifications of labor, and the duration of employment.

What is the purpose of Howard County Wage Rate Requirements?

The purpose of Howard County Wage Rate Requirements is to promote equitable pay for workers, prevent wage theft, and ensure that public funds are used to support fair labor standards.

What information must be reported on Howard County Wage Rate Requirements?

The information that must be reported includes employee names, job classifications, hours worked, wage rates, and any deductions or benefits provided.

Fill out your howard county wage rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Howard County Wage Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.