Get the free MARKET CONDUCT EXAMINATION REPORT - mdinsurance state md

Show details

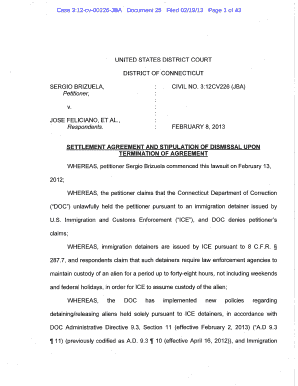

This document reports the findings of the Maryland Insurance Administration's examination of the market conduct of Fidelity Insurance Company, focusing on its compliance with health insurance regulations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign market conduct examination report

Edit your market conduct examination report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your market conduct examination report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit market conduct examination report online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit market conduct examination report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out market conduct examination report

How to fill out MARKET CONDUCT EXAMINATION REPORT

01

Gather necessary information about the market conduct examination.

02

Identify the specific reporting requirements as per regulatory guidelines.

03

Fill out each section of the report, including company information, exam dates, and purposes.

04

Provide a detailed analysis of the market conduct practices reviewed.

05

Document any findings or discrepancies noted during the examination.

06

Ensure all data is accurate and supported by evidence.

07

Include signatures and dates where required.

08

Review the report for completeness and compliance before submission.

Who needs MARKET CONDUCT EXAMINATION REPORT?

01

Insurance companies undergoing regulatory assessments.

02

State insurance regulators assessing market practices.

03

Compliance officers in financial institutions.

04

Legal teams involved in regulatory reporting.

05

Market analysts and researchers studying industry practices.

Fill

form

: Try Risk Free

People Also Ask about

What is the most common trigger for a market conduct exam?

Complaints: The most frequent trigger for a market conduct exam.

What triggers a market conduct exam?

Complaints: The most frequent trigger for a market conduct exam. Regulatory action or activity in other states: State departments of insurance (DOI) compile data in their jurisdictions and share it with other DOIs. A red flag in one state can trigger investigations in others.

What is a market conduct examiner?

The Market Conduct Examiner will be responsible for performing reviews of major insurance companies' operations, marketing, underwriting, rating, policyholder service, producer licensing, complaint handling and claims handling processes to verify compliance with states' insurance statutes and regulations.

What is a market conduct report?

The California Department of Insurance conducts examinations of licensed insurance companies to evaluate insurers' compliance with the California Insurance Code (CIC) and the California Code of Regulations (CCR) with respect to rating, underwriting, and claim practices. These are called market conduct examinations.

What is the market conduct exam process?

A comprehensive or full scope examination generally involves a review of all of a company's business practices, which would include: (1) company operations/management; (2) complaint handling; (3) marketing and sales; (4) producer licensing; (5) policyholder service; (6) underwriting; and (7) claims.

What is a market conduct report?

The California Department of Insurance conducts examinations of licensed insurance companies to evaluate insurers' compliance with the California Insurance Code (CIC) and the California Code of Regulations (CCR) with respect to rating, underwriting, and claim practices. These are called market conduct examinations.

What does market conduct regulation assess?

Market regulation complements financial solvency regulation. Problems spotted during a market conduct review can be a precursor to financial solvency concerns. Market regulation also evaluates companies' fulfillment of contractual obligations to their policyholders and claimants.

What is the market conduct exam in insurance?

A market conduct exam is an investigation by insurance regulators to determine whether an insurer has followed laws relating to the distribution of products to consumers and settlement of claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MARKET CONDUCT EXAMINATION REPORT?

The MARKET CONDUCT EXAMINATION REPORT is a document prepared by insurance regulators to evaluate the market practices of insurance companies. It assesses the conduct of insurers in areas such as pricing, claim handling, and customer service to ensure compliance with state laws and regulations.

Who is required to file MARKET CONDUCT EXAMINATION REPORT?

Insurance companies and entities engaged in the sale of insurance products are typically required to file a MARKET CONDUCT EXAMINATION REPORT. This includes both domestic and foreign insurers operating within a regulatory jurisdiction.

How to fill out MARKET CONDUCT EXAMINATION REPORT?

To fill out a MARKET CONDUCT EXAMINATION REPORT, insurers must gather relevant data related to their market practices, complete the required sections of the report form accurately, and ensure that all documentation supporting the information provided is included. It may involve detailing operational processes, providing statistical data, and answering specific regulatory inquiries.

What is the purpose of MARKET CONDUCT EXAMINATION REPORT?

The purpose of the MARKET CONDUCT EXAMINATION REPORT is to protect consumers by ensuring that insurance companies operate fairly, transparently, and in accordance with legal standards. It aims to identify unfair practices, enhance regulatory oversight, and promote a competitive insurance market.

What information must be reported on MARKET CONDUCT EXAMINATION REPORT?

The MARKET CONDUCT EXAMINATION REPORT must include information on the company's policies and procedures, complaint handling and resolution processes, claims payment practices, marketing and sales practices, as well as any other relevant data that reflects the company's market conduct and compliance with regulations.

Fill out your market conduct examination report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Market Conduct Examination Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.