Get the free Financial Disclosure Statement - Form 20 - ethics gov state md

Show details

This document serves as a preliminary disclosure statement required by the Maryland Public Ethics Law for members of the General Assembly to report any substantial changes in their financial interests

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial disclosure statement

Edit your financial disclosure statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial disclosure statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial disclosure statement online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial disclosure statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

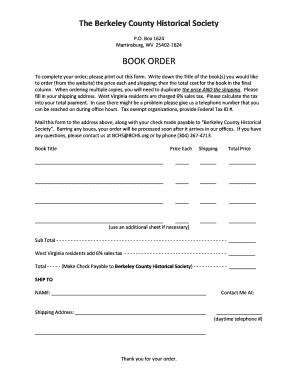

How to fill out financial disclosure statement

How to fill out Financial Disclosure Statement - Form 20

01

Obtain the Financial Disclosure Statement - Form 20 from the relevant authority or website.

02

Begin by filling out your personal information at the top of the form, including your name, address, and contact information.

03

Fill in the details of your income, including salary, bonuses, and any other sources of income.

04

List all your assets, including bank accounts, properties, stocks, and other investments.

05

Provide information on your liabilities, such as loans, mortgages, and any other debts you may have.

06

Disclose any additional relevant financial information as required by the form.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form to the designated authority by the deadline provided.

Who needs Financial Disclosure Statement - Form 20?

01

Individuals involved in legal proceedings that require disclosure of financial information.

02

Parties in divorce cases that necessitate a financial overview.

03

Clients seeking legal aid or services where financial standing needs to be assessed.

04

People involved in bankruptcy proceedings.

05

Anyone required by court order to provide detailed financial information.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between Form 20-F and Form F 1?

SEC Form F-1 is the registration required for foreign companies that want to be listed on a U.S. stock exchange. Any amendments or changes that have to be made by the issuer are filed under SEC Form F-1/A. After the foreign issuer's securities are issued, the company is required to file Form 20-F annually.

What is the purpose of Form 20-F?

Form 20-F is the form used for an annual report of a foreign private issuer (“FPI”) filed with the U.S. Securities and Exchange Commission (the “SEC”).

Who files Form 20-F?

SEC Form 20-F is an annual report filing for non-U.S. and non-Canadian companies that have securities trading in the U.S. SEC Form 20-F helps standardize the reporting requirements of foreign-based companies. The company must also make the report available to shareholders through the company's website.

What is the purpose of Form 20-F?

Form 20-F is the form used for an annual report of a foreign private issuer (“FPI”) filed with the U.S. Securities and Exchange Commission (the “SEC”).

Who files Form 20-F?

SEC Form 20-F is a form issued by the Securities and Exchange Commission (SEC) that must be submitted by all "foreign private issuers" with listed equity shares on exchanges in the U.S. Form 20-F calls for the submission of an annual report within four months of the end of a company's fiscal year or if the fiscal year-

Is a 20F like a 10K?

SEC Form 20-F is the primary disclosure document for foreign private issuers that are listed on U.S. exchanges. Equivalent to the 10-K, Form 20-F provides reporting information about the company's key operational details, market risks, corporate governance and financial statements.

What is form F-1 used for?

Form F-1 is the registration statement form most commonly used by foreign private issuers (certain non-US issuers) selling securities in a registered offering in the US for the first time.

Is a 20F like a 10K?

SEC Form 20-F is the primary disclosure document for foreign private issuers that are listed on U.S. exchanges. Equivalent to the 10-K, Form 20-F provides reporting information about the company's key operational details, market risks, corporate governance and financial statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Disclosure Statement - Form 20?

Financial Disclosure Statement - Form 20 is a document required to report financial interests, assets, liabilities, and income for transparency in financial dealings, often used by government officials and employees.

Who is required to file Financial Disclosure Statement - Form 20?

Individuals required to file the Financial Disclosure Statement - Form 20 typically include government officials, employees, and other individuals in positions of trust or authority who must disclose their financial interests to avoid conflicts of interest.

How to fill out Financial Disclosure Statement - Form 20?

To fill out the Financial Disclosure Statement - Form 20, individuals should collect all necessary financial information, accurately report incomes, assets, liabilities, and any other required disclosures, and follow the specific instructions provided on the form.

What is the purpose of Financial Disclosure Statement - Form 20?

The purpose of the Financial Disclosure Statement - Form 20 is to ensure transparency and accountability among public officials and employees by providing a clear overview of their financial interests and potential conflicts.

What information must be reported on Financial Disclosure Statement - Form 20?

The Financial Disclosure Statement - Form 20 must report information including sources of income, asset details, liabilities, and any financial interests that could potentially conflict with the individual's public duties.

Fill out your financial disclosure statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Disclosure Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.