Get the free PUBLIC EMPLOYEE BENEFIT PLAN - legislature mi

Show details

An analysis of Senate Bill 418 and related bills focusing on the establishment of a Public Employees Health Benefit plan to provide cost-effective medical, optical, or dental benefits for public employees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign public employee benefit plan

Edit your public employee benefit plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your public employee benefit plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit public employee benefit plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit public employee benefit plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

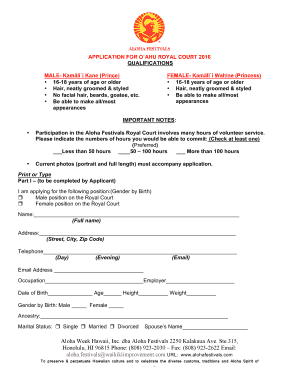

How to fill out public employee benefit plan

How to fill out PUBLIC EMPLOYEE BENEFIT PLAN

01

Obtain the PUBLIC EMPLOYEE BENEFIT PLAN form from your employer or the relevant benefits office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill in your personal information, including your name, contact details, and employee identification number.

04

Indicate your employment status and the position you hold within the organization.

05

Provide details about your dependent beneficiaries, if applicable, including their names and relationships to you.

06

Select the specific benefits you are applying for or that apply to your situation.

07

Review your completed form for any errors or missing information.

08

Submit the form to the designated benefits administrator or office by the specified deadline.

Who needs PUBLIC EMPLOYEE BENEFIT PLAN?

01

Public employees who are eligible for benefits provided by their employer.

02

Newly hired public employees who need to enroll in the benefits plan.

03

Current public employees who wish to update or change their benefits selections.

04

Dependents of public employees who are eligible for coverage under the benefits plan.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a defined benefit plan?

Contributions to Defined-Benefit Plans For example, a plan for a retiree with 30 years of service at retirement may state the benefit as an exact dollar amount, such as $150 per month per year of the employee's service. This plan would pay the employee $4,500 per month in retirement for life.

What is the difference between IAS 19 and GAAP?

IAS 19 imposes an asset ceiling; US GAAP does not IAS 19 imposes an asset ceiling that may restrict the amount of a recognized surplus, or increase a plan deficit. US GAAP does not limit the amount of the net defined benefit asset that can be recognized.

What is the IAS 19 accounting treatment?

IAS 19 prescribes the accounting treatment of short-term employee benefits, post employment benefits, other long-term employee benefits and termination benefits.

What is IAS 19 expenses?

IAS 19 requires an entity to recognise: a liability when an employee has provided service in exchange for employee benefits to be paid in the future; and. an expense when the entity consumes the economic benefit arising from the service provided by an employee in exchange for employee benefits.

What is an EBP audit?

The term “employee benefit plan” refers to a pension, 401(k) or profit-sharing plan, and the primary aim of an EBP audit is to accurately gauge the ability of the EBP to cover current and future benefits and payments. In short, it assesses the viability of your plan.

What is the accounting treatment for a defined benefit plan?

Defined Benefits Plan The pensions accounting treatment for defined benefit plans requires: Determine the fair value of the assets and liabilities of the pension plan at the end of the year. Determine the amount of pension expense for the year to be reported on the income statement.

What is the accounting standard as 19?

AS-19 deals with the accounting policies applicable for all types of leases except certain listed below. A lease is a transaction whereby an agreement is entered into by the lessor with the lessee for the right to use an asset by the lessee in return for a payment or series of payments for an agreed period of time.

What is the employee benefit plan?

Key types of employee benefit plans include retirement benefits, which can be either defined benefit or defined contribution plans; health benefits, which provide coverage for medical care; and leave benefits, which support employees during personal or family-related absences from work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PUBLIC EMPLOYEE BENEFIT PLAN?

The Public Employee Benefit Plan refers to a structured program that provides benefits, such as retirement plans, healthcare, and other related services, specifically designed for public employees.

Who is required to file PUBLIC EMPLOYEE BENEFIT PLAN?

Entities that administer public employee benefit plans, including state and local government agencies or other organizations that manage retirement and health benefits for public employees, are required to file.

How to fill out PUBLIC EMPLOYEE BENEFIT PLAN?

To fill out the Public Employee Benefit Plan, one should gather all necessary employee information, details of the benefits provided, financial data, and comply with any specific forms or instructions set forth by regulatory bodies.

What is the purpose of PUBLIC EMPLOYEE BENEFIT PLAN?

The purpose of the Public Employee Benefit Plan is to ensure that public employees receive essential benefits, thereby providing financial security and supporting their welfare throughout their careers and into retirement.

What information must be reported on PUBLIC EMPLOYEE BENEFIT PLAN?

Information required to be reported typically includes employee demographics, types of benefits offered, contribution rates, financial performance of the plan, and compliance with regulatory requirements.

Fill out your public employee benefit plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Public Employee Benefit Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.