Get the free HEALTH SAVINGS ACCOUNT (HSA) - APPLICATION AND REVOCABLE DESIGNATION OF BENEFICIARY(...

Show details

This form is used to apply for a Health Savings Account (HSA) and designate beneficiaries. It requires information about the HSA owner, their health plan coverage, and the designation of primary and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account hsa

Edit your health savings account hsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account hsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health savings account hsa online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit health savings account hsa. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account hsa

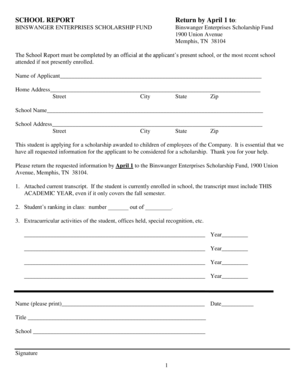

How to fill out HEALTH SAVINGS ACCOUNT (HSA) - APPLICATION AND REVOCABLE DESIGNATION OF BENEFICIARY(IES)

01

Obtain the HSA application form from your HSA provider.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Indicate the type of HSA account you are applying for (individual or family).

04

Provide information regarding your employment and any other relevant financial details.

05

Designate your beneficiaries by completing the section provided for beneficiary information.

06

Review the application for any errors or omissions.

07

Sign and date the application to certify its accuracy.

08

Submit the completed application to your HSA provider either online or by mail.

Who needs HEALTH SAVINGS ACCOUNT (HSA) - APPLICATION AND REVOCABLE DESIGNATION OF BENEFICIARY(IES)?

01

Individuals who want to save money for medical expenses tax-free.

02

Those enrolled in high-deductible health plans (HDHPs).

03

Anyone seeking to manage healthcare costs and prepare for future medical expenditures.

04

Individuals looking for a tax-advantaged savings option for healthcare.

Fill

form

: Try Risk Free

People Also Ask about

What happens to HSA money if you don't spend it?

Unspent HSA funds roll over from year to year. You can hold and add to the tax-free savings to pay for medical care later. HSAs may earn interest that can't be taxed. You generally can't use HSA funds to pay premiums.

What disqualifies you from contributing to an HSA?

If you are enrolled in Medicare, you cannot contribute to an HSA. But you can still use any remaining funds in your account to pay for eligible medical expenses. Check to see if you are HSA-eligible every month to avoid any surprise taxes or penalties later on.

What happens to HSA funds when someone dies?

Both accounts let you make pre-tax contributions and grow tax-free earnings. But only an HSA lets you take tax-free distributions for qualified medical expenses. After age 65 you can use your health savings account for any expense, you'll simply pay ordinary income taxes—just like a 401(k).

Is a health savings account the same as an HSA?

Both accounts let you make pre-tax contributions and grow tax-free earnings. But only an HSA lets you take tax-free distributions for qualified medical expenses. After age 65 you can use your health savings account for any expense, you'll simply pay ordinary income taxes—just like a 401(k).

What is the downside of an HSA?

If you have a severe illness or medical emergency, you could drain what you added to your HSA and still pay high excess out-of-pocket costs if you haven't met your deductible.

What is a beneficiary designation for an HSA?

What happens to an HSA at death? Like an IRA account, when a person sets up an HSA, they name a beneficiary. If the beneficiary is a surviving spouse, the unused portion of the decedent's HSA passes directly to the spouse and becomes his or her HSA; there is no tax liability.

What is the difference between HSA and health savings account?

There would be no tax advantages in leaving the assets in the account to a trust account. The trust would incur immediate tax liability on the fair market value of the HSA for any funds left to the trust. If one has charitable organizations they want to support, they can name them as beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HEALTH SAVINGS ACCOUNT (HSA) - APPLICATION AND REVOCABLE DESIGNATION OF BENEFICIARY(IES)?

It is a form that allows individuals to establish a Health Savings Account (HSA) and designate one or more beneficiaries who will receive the funds in the account upon the account holder's death. This designation can be revoked or changed at any time.

Who is required to file HEALTH SAVINGS ACCOUNT (HSA) - APPLICATION AND REVOCABLE DESIGNATION OF BENEFICIARY(IES)?

Individuals who wish to open a Health Savings Account (HSA) and want to designate beneficiaries must file this application. It is applicable to anyone eligible to contribute to an HSA under IRS guidelines.

How to fill out HEALTH SAVINGS ACCOUNT (HSA) - APPLICATION AND REVOCABLE DESIGNATION OF BENEFICIARY(IES)?

To fill out the form, provide your personal details, including your name, address, and Social Security number. Specify the HSA account information and list the designated beneficiaries, including their names, relationships, and contact information. Make sure to sign and date the form.

What is the purpose of HEALTH SAVINGS ACCOUNT (HSA) - APPLICATION AND REVOCABLE DESIGNATION OF BENEFICIARY(IES)?

The purpose is to formally establish an HSA and ensure that the funds can be passed on to designated beneficiaries upon the account holder's death, allowing for potential tax advantages and ease of transfer.

What information must be reported on HEALTH SAVINGS ACCOUNT (HSA) - APPLICATION AND REVOCABLE DESIGNATION OF BENEFICIARY(IES)?

The information that must be reported includes the account holder's personal information, account details, the names and relationships of the designated beneficiaries, their contact information, and the signature of the account holder, along with the date of the application.

Fill out your health savings account hsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Hsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.