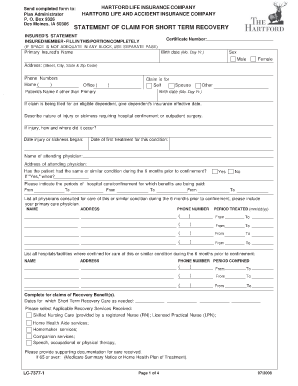

Get the free line of credit ssfcu form

Show details

(b) We will not be responsible for merchandise or services purchased by you with Priceline Checks. We will not be responsible for the refusal of any person or entity to honor Priceline Checks. (d)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign line of credit ssfcu

Edit your line of credit ssfcu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your line of credit ssfcu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing line of credit ssfcu online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit line of credit ssfcu. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out line of credit ssfcu

How to fill out line of credit ssfcu:

01

Visit the official website of SSFCU.

02

Go to the "Services" section and click on "Loans".

03

Choose "Line of Credit" and click on "Apply Now".

04

Fill out the online application form with personal and financial information.

05

Provide accurate details about your income, employment, and any other required information.

06

Review the application form for any errors or incomplete fields before submitting.

07

Submit the completed application form and wait for a response from SSFCU.

Who needs line of credit ssfcu:

01

Individuals who require flexible access to funds on an ongoing basis.

02

Those who may have irregular income or expenses and need financial security.

03

Small business owners who require working capital or wish to finance their operations.

04

People looking to consolidate higher-interest debt into a more manageable repayment plan.

05

Individuals or businesses looking to establish or improve their credit history.

Overall, anyone who wants a flexible and convenient source of funds for various purposes can benefit from a line of credit offered by SSFCU.

Fill

form

: Try Risk Free

People Also Ask about

What is the routing number for 314088637?

SSFCU routing numbers for wire transfers The routing number for SSFCU for domestic and international wire transfer is 314088637.

What is a federal line of credit?

A personal line of credit is a revolving credit that you can access as you need it, instead of borrowing one lump sum. A maximum limit will be set at the outset, and you can draw on those funds up to the maximum amount as expenses come up.

What bank routing number is 324377516?

America First Credit Union's ABA/routing number is 324377516.

How much to open an account at Security Service Federal Credit Union?

Please call to apply: 1.888.415.7878 Must meet membership requirements and must open and maintain a Security Service Basic Savings Account with a $5 balance. The minimum balance required to open a Power Protected Checking account is $25.00. A minimum of $5 is required to earn APY for all Savings accounts.

Whose routing is 314089681?

RBFCU's Routing Number is 314089681.

How much can you withdraw from Ssfcu?

Daily transaction limits: $1,000 ATM withdrawal $12,000 signature-based transactions $12,000 What is my PIN for my debit card?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in line of credit ssfcu?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your line of credit ssfcu to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit line of credit ssfcu in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your line of credit ssfcu, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete line of credit ssfcu on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your line of credit ssfcu, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is line of credit ssfcu?

A line of credit at SSFCU is a revolving credit account that allows members to borrow funds up to a certain limit set by the credit union.

Who is required to file line of credit ssfcu?

Members of SSFCU who are approved for a line of credit are required to file the necessary documentation.

How to fill out line of credit ssfcu?

To fill out a line of credit application at SSFCU, members must provide personal and financial information as requested by the credit union.

What is the purpose of line of credit ssfcu?

The purpose of a line of credit at SSFCU is to provide members with a flexible borrowing option that can be used for various personal or business needs.

What information must be reported on line of credit ssfcu?

Members must report their income, employment details, credit history, and any other relevant financial information when applying for a line of credit at SSFCU.

Fill out your line of credit ssfcu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Line Of Credit Ssfcu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.