Get the free Mortgage Company Registration Application

Show details

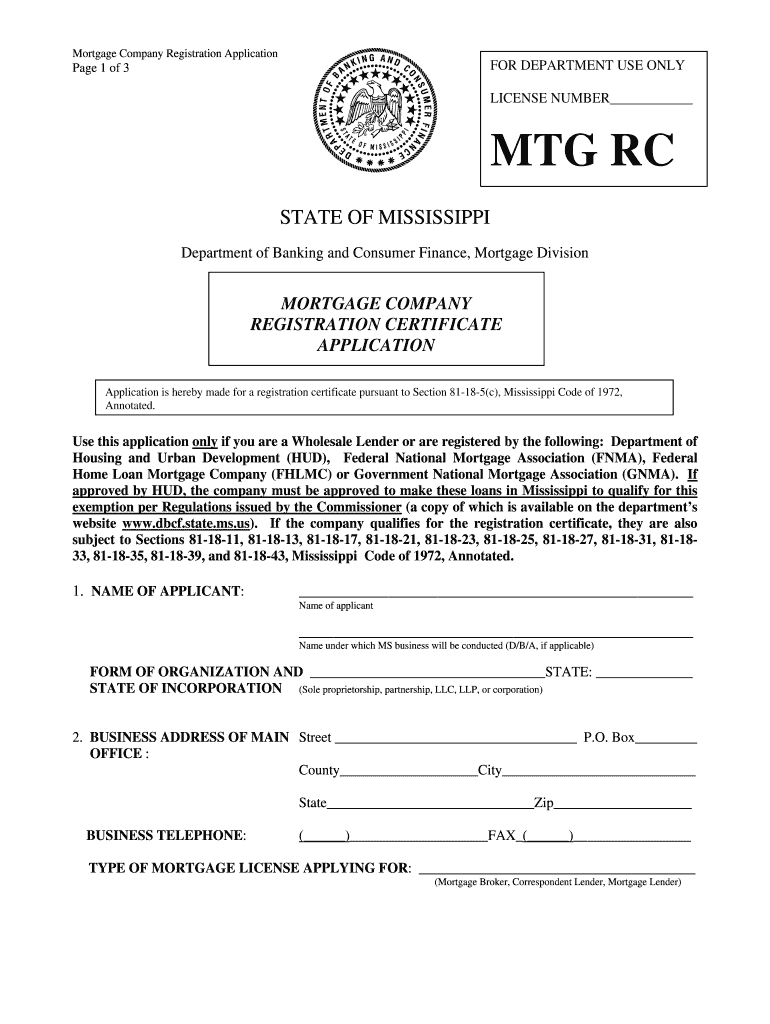

This application is for mortgage companies seeking registration certification pursuant to Mississippi law, particularly for Wholesale Lenders and those registered with certain federal agencies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage company registration application

Edit your mortgage company registration application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage company registration application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage company registration application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage company registration application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage company registration application

How to fill out Mortgage Company Registration Application

01

Gather necessary documents, such as business formation documents, financial statements, and personal identification.

02

Complete the application form, ensuring all sections are filled out accurately.

03

Provide details about the company's business structure, ownership, and management.

04

Include any required licensing information and disclosures about previous business activities.

05

Submit the application along with any required fees to the appropriate regulatory authority.

06

Follow up with the regulatory agency to check the status of the application.

Who needs Mortgage Company Registration Application?

01

Individuals or businesses looking to operate as a mortgage lender or broker.

02

Companies seeking to offer mortgage-related services to consumers.

03

Financial institutions that wish to expand into the mortgage industry.

Fill

form

: Try Risk Free

People Also Ask about

How to write a letter of explanation to a mortgage company?

Writing this letter is often simpler than it sounds. All you need to do is clearly explain the situation, provide any relevant dates, and include any documentation that supports your explanation. Being honest and direct can help your lender better understand your financial picture and keep your loan on track.

What are 6 types of mortgages?

Types of Mortgages under The Transfer of Property Act 1882 Simple Mortgage (Section 58(b)) Mortgage by Conditional Sale (Section 58(c)) Usufructuary Mortgage (Section 58(d)) English Mortgage (Section 58(e)) Mortgage by Deposit of Title Deeds (Section 58(f)) Anomalous Mortgage (Section 58(g))

What are the 4 parts of a mortgage?

There are four components to a mortgage payment. Principal, interest, taxes and insurance.

What are the 6 types of mortgages?

What are the 6 types of mortgages? The six main types are simple mortgage, mortgage by conditional sale, English mortgage, fixed-rate mortgage, usufructuary mortgage, and reverse mortgage.

How do I write a letter for a mortgage?

5 tips for a good letter of explanation Keep it short and to the point. The mortgage underwriter is looking for clarification on a specific issue, so stick to that topic. Emphasize the circumstances that led to the issue. Explain how your finances have improved. Proofread your letter. Be nice.

What is the approval process for a mortgage?

The mortgage process is complicated but can be broken into six steps: pre-approval, house shopping, mortgage application, loan processing, underwriting, and closing. It's a good idea to get pre-approval for a mortgage before you start looking for a property, so you know what you can afford.

What is a 5'6 arm mortgage?

Specifically, a 5/6 ARM is an adjustable rate mortgage that has a fixed rate for the first five years (hence the “5”) and then transitions to an adjustable rate for the remainder of the loan. The “6” denotes a rate “reset” every six months or biannually.

What are the most common types of mortgages?

The three main types of mortgages include conventional loans, government-insured loans and jumbo loans. Mortgages can have fixed rates or variable rates. The right home loan for you will depend on your down payment, debt and credit score.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Company Registration Application?

The Mortgage Company Registration Application is a formal document that mortgage companies must submit to regulatory authorities to obtain a license to operate legally within a specific jurisdiction.

Who is required to file Mortgage Company Registration Application?

Any business entity that intends to offer mortgage services, including lending, brokering, and servicing mortgage loans, is required to file a Mortgage Company Registration Application.

How to fill out Mortgage Company Registration Application?

To fill out the Mortgage Company Registration Application, applicants must complete all sections of the application form accurately, providing required documentation, such as proof of business structure, financial statements, and background information of key personnel.

What is the purpose of Mortgage Company Registration Application?

The purpose of the Mortgage Company Registration Application is to ensure that mortgage companies comply with state and federal regulations, maintain industry standards, and protect consumers in the mortgage market.

What information must be reported on Mortgage Company Registration Application?

Information that must be reported on the Mortgage Company Registration Application includes the company's business name, address, ownership structure, financial information, details about management, and any licensing or regulatory history.

Fill out your mortgage company registration application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Company Registration Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.