Get the free DEPOSIT IN LIEU OF SURETY BOND

Show details

This document serves as a contractual agreement for the deposit of cash or securities in lieu of a surety bond as required under the Mississippi Check Cashers Act.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deposit in lieu of

Edit your deposit in lieu of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deposit in lieu of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deposit in lieu of online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deposit in lieu of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

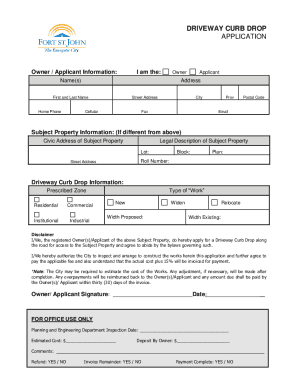

How to fill out deposit in lieu of

How to fill out DEPOSIT IN LIEU OF SURETY BOND

01

Obtain the DEPOSIT IN LIEU OF SURETY BOND form from the appropriate authority.

02

Carefully read the instructions provided with the form.

03

Provide your full legal name and contact information in the designated sections.

04

Indicate the amount of deposit you wish to submit, ensuring it meets any required minimum.

05

Attach any required documentation, such as proof of identity or financial statements.

06

Sign and date the form to certify the accuracy of the information provided.

07

Submit the completed form and deposit to the designated office or online portal.

Who needs DEPOSIT IN LIEU OF SURETY BOND?

01

Individuals or businesses required to post a surety bond but prefer to provide a cash deposit instead.

02

Property owners needing to comply with local regulations without incurring the cost of a surety bond.

03

Entities seeking a financial alternative that guarantees their compliance with legal obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is a surety deposit?

Usually, a surety bond or surety is a promise by a person or company (a surety or guarantor) to pay one party (the obligee) a certain amount if a second party (the principal) fails to meet some obligation, such as fulfilling the terms of a contract.

What is a surety payment?

In effect, a surety acts as a guarantee that a person or an organization assumes responsibility for fulfilling financial obligations in the event that the debtor defaults and is unable to make payments. The party that guarantees the debt is referred to as the surety or the guarantor.

What is the difference between a bond and a LOC?

A surety bond is a three-party contract in which the Surety guarantees the performance of the Principal to the Obligee. A Letter of Credit is a commitment by the issuer such as, for example, a bank, to the beneficiary to honor a complying request for payment.

What is an example of a surety?

The term surety refers to any party that guarantees the payment of a debt or performance of a contract. A financial institution, surety company, or underwriter is only one example of a surety. Any person or firm that is putting up the money or collateral on behalf of the principal is eligible to be a surety.

What is the meaning of surety bond?

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

What is the purpose of the surety?

The surety bond protects the obligee by guaranteeing performance to the obligee if the principal does not fulfill their obligation. Obligated to be liable for the performance of a contract, debt or failure of a duty of another party.

Is a surety bond refundable?

In most cases, the answer is no. Unlike a deposit or collateral, a surety bond premium is a non-refundable fee paid for the service of having a third-party (the surety) vouch for you. However, under certain conditions — such as early cancellation or duplicate bond coverage — you may be eligible for a partial refund.

What is a surety depositor?

In summary, the Depositor Bond provides a third party guarantee (from the insurance company who is called the Surety) that deposits will in fact be returned to the depositor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DEPOSIT IN LIEU OF SURETY BOND?

A deposit in lieu of surety bond is a financial security option where an individual or entity provides a monetary deposit as a substitute for a traditional surety bond, ensuring compliance with obligations or guarantees.

Who is required to file DEPOSIT IN LIEU OF SURETY BOND?

Individuals or businesses who are required by law or regulation to secure performance guarantees, often in the context of construction projects, permits, or other legal obligations, may be required to file a deposit in lieu of surety bond.

How to fill out DEPOSIT IN LIEU OF SURETY BOND?

To fill out a deposit in lieu of surety bond, one must complete the required forms provided by the relevant authority, include necessary information such as the amount of the deposit, details of the obligations covered, and submit any required documentation.

What is the purpose of DEPOSIT IN LIEU OF SURETY BOND?

The purpose of a deposit in lieu of surety bond is to provide a financial guarantee that the depositor will fulfill their contractual or legal obligations, thereby replacing the need for a surety bond while still ensuring compliance.

What information must be reported on DEPOSIT IN LIEU OF SURETY BOND?

Information that must be reported typically includes the depositor's name and contact information, the amount of the deposit, the specific obligations covered, and any relevant identification numbers or project details.

Fill out your deposit in lieu of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deposit In Lieu Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.