Get the free MORTGAGE REVENUE BOND

Show details

This document outlines the details of the 2011A-5 Mortgage Revenue Bond issue by the Mississippi Home Corporation, including important program changes, loan types, rates, and application processes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage revenue bond

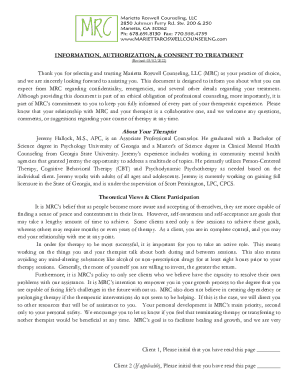

Edit your mortgage revenue bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage revenue bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

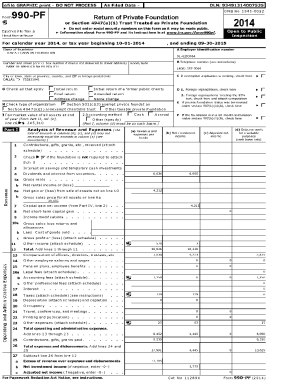

Editing mortgage revenue bond online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage revenue bond. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

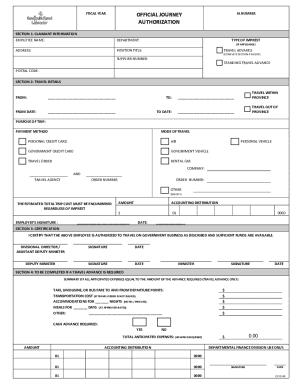

How to fill out mortgage revenue bond

How to fill out MORTGAGE REVENUE BOND

01

Gather necessary documentation: Collect personal financial information, including income, credit history, and asset details.

02

Determine eligibility: Ensure that you meet the income and purchase price limits set by the mortgage revenue bond program.

03

Fill out the application: Complete the mortgage revenue bond application form accurately and completely.

04

Submit your application: Send the completed application and supporting documents to your chosen lender or the administering agency.

05

Wait for approval: The lender will review your application and will notify you if you have been approved for the mortgage revenue bond.

Who needs MORTGAGE REVENUE BOND?

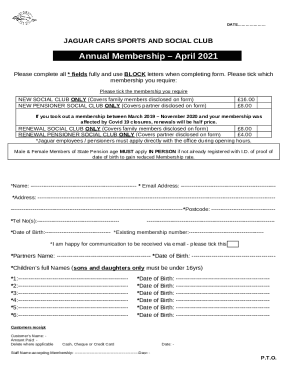

01

First-time homebuyers looking for affordable home financing options.

02

Low- to moderate-income individuals or families seeking housing assistance.

03

People needing financial support for down payment and closing costs.

Fill

form

: Try Risk Free

People Also Ask about

What is a revenue bond?

A revenue bond is an obligation issued to finance a revenue-producing enterprise. Both the principal and interest of such bonds are paid exclusively from the earnings of the enterprise. As a general rule, such issues do not have any claim on the general credit or taxing power of the governmental unit that issues them.

What is the revenue bond?

Revenue bonds are a class of municipal bonds issued to fund public projects which then repay investors from the income created by that project. For instance, a toll road or utility can be financed with municipal bonds with creditors' interest and principal repaid from the tolls or fees collected.

What does MRB stand for in finance?

Mortgage Revenue Bond (Mrb): Meaning, Benefits. Trade.

Are revenue bonds high risk?

Revenue bonds link repayment to the financial success of specific projects, offering potentially higher yields than general obligation bonds but with greater risk since repayment hinges on the project's performance.

What is a mortgage bond?

A mortgage bond is a bond that is secured by a mortgage, or a pool of mortgages, that are typically backed by real estate holdings and real property, such as equipment. The income stream of a mortgage bond comes from the mortgage payments that homeowners make on their mortgages.

What is an income bond?

Financial Terms By: I. Income bond. A bond whose payment of interest is contingent on sufficient earnings. These bonds are commonly used during the reorganization of a failed or failing business.

What is the difference between a bond and a mortgage?

What are Bonds and Mortgages? 'Bonds and Mortgages' are types of investments. A bond is a promise by a company or government to pay back a loan with interest. A mortgage, on the other hand, is a loan secured by real estate.

What is the difference between revenue and general obligation bonds?

General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source, such as income from a toll road or sewer system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE REVENUE BOND?

A Mortgage Revenue Bond (MRB) is a type of municipal bond issued by state or local governments to provide funding for mortgage loans to low- and moderate-income homebuyers. The funds raised from these bonds are used to finance affordable housing, allowing eligible borrowers to access favorable interest rates and other assistance.

Who is required to file MORTGAGE REVENUE BOND?

Individuals or entities participating in the mortgage loan financing process, particularly those who receive bond proceeds for home loans, are typically required to file documentation related to the Mortgage Revenue Bond. This often includes lenders, state housing finance agencies, and sometimes borrowers who receive assistance.

How to fill out MORTGAGE REVENUE BOND?

Filling out a Mortgage Revenue Bond form generally requires providing specific information about the borrower, the property, and the loan terms. It's essential to include details such as the borrower's income, the purchase price of the home, and the loan amount. Forms can vary by jurisdiction, so it is important to refer to the specific instructions provided by the issuing authority.

What is the purpose of MORTGAGE REVENUE BOND?

The purpose of Mortgage Revenue Bonds is to promote affordable housing by providing lower-cost financing options to qualified homebuyers. These bonds help increase access to homeownership for low- and moderate-income individuals and families, contributing to community development and economic stability.

What information must be reported on MORTGAGE REVENUE BOND?

Information that must be reported on Mortgage Revenue Bonds typically includes the bond amount, interest rate, maturity date, and specific details about the mortgage loans funded by the bonds. Additionally, it may require reporting on borrower eligibility, property location, and compliance with income limits or other regulations.

Fill out your mortgage revenue bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Revenue Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.