Get the free plattecountycollector

Show details

Sheila L. Palmer Platte County Collector of Revenue Administration Building 415 3rd Street, Suite 40 Platte City, MO 64079 www.plattecountycollector.com Phone: 816-858-1905 Fax: 816-858-3357 Quarterly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign plattecountycollector form

Edit your plattecountycollector form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your plattecountycollector form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit plattecountycollector form online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit plattecountycollector form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

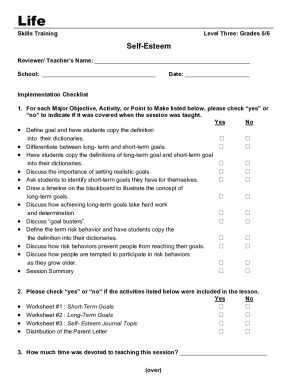

How to fill out plattecountycollector form

How to fill out plattecountycollector:

01

Start by visiting the official website of Platte County Collector. You can find the website by searching for "Platte County Collector" in your preferred search engine.

02

Once on the website, look for a section or tab that says "Property Tax Payments" or something similar. Click on that section to begin the process of filling out plattecountycollector.

03

You will be prompted to provide certain information, such as your name, address, and property details. Make sure to fill in all the required fields accurately to avoid any issues or delays in processing your payment.

04

Next, you will need to enter the amount you wish to pay for your property tax. Double-check the amount to ensure it matches the tax bill or statement you received from the Platte County Collector.

05

Choose your preferred payment method. Plattecountycollector usually offers various options such as paying online using a debit or credit card, electronic check, or by mail.

06

If paying online, you may be required to create an account or log in to an existing one. Follow the instructions provided to complete the payment process securely.

07

If paying by mail, make sure to include a check or money order for the specified amount, along with any required forms or documentation. Use the provided mailing address or verify it on the Platte County Collector's website.

08

Review all the information you have entered before finalizing the payment. Make sure everything is accurate to avoid any potential issues.

09

After submitting your payment, you should receive a confirmation or receipt, either online or via email. Keep this for your records, as proof of payment.

Who needs plattecountycollector:

01

Property owners in Platte County who have received a tax bill or statement from the county's collector's office need plattecountycollector. This applies to both residential and commercial property owners.

02

Individuals who prefer a convenient and secure method of paying their property taxes online may find plattecountycollector beneficial. It allows for quick and easy payment without the need to visit the collector's office in person or send payments through the mail.

03

Platte County residents who want to ensure timely payment of their property taxes to avoid penalties or interests can utilize plattecountycollector. It provides a streamlined process for submitting payments, reducing the chances of missing deadlines.

04

Those who prefer having access to their payment history and receipts in a digital format can benefit from plattecountycollector. It allows individuals to view and print their payment records anytime they need them.

05

Property owners who have questions or concerns regarding their tax bill or payment options can reach out to the Platte County Collector's office through plattecountycollector. It often provides contact information and customer support services to assist users with their inquiries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is plattecountycollector?

plattecountycollector is a tax form used in Platte County to report and pay property taxes.

Who is required to file plattecountycollector?

All property owners in Platte County are required to file plattecountycollector.

How to fill out plattecountycollector?

To fill out plattecountycollector, you need to provide information about your property, including its assessed value and any exemptions you qualify for. You also need to calculate and pay the appropriate amount of property taxes.

What is the purpose of plattecountycollector?

The purpose of plattecountycollector is to collect property taxes from property owners in Platte County to fund local government services and infrastructure.

What information must be reported on plattecountycollector?

On plattecountycollector, you must report details about your property, such as its address, assessed value, and any exemptions you qualify for.

How can I edit plattecountycollector form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your plattecountycollector form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send plattecountycollector form to be eSigned by others?

When you're ready to share your plattecountycollector form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit plattecountycollector form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign plattecountycollector form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your plattecountycollector form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Plattecountycollector Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.