Get the free MO-C - dor mo

Show details

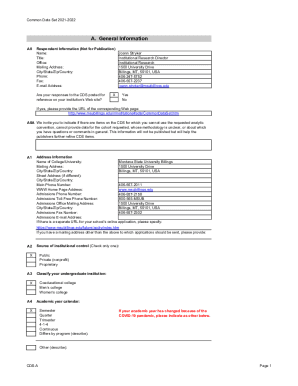

This schedule is used for computing the Missouri dividends allowed as a deduction pursuant to Section 143.431.2, RSMo, specifically for corporations using the single factor apportionment method.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mo-c - dor mo

Edit your mo-c - dor mo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mo-c - dor mo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mo-c - dor mo online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mo-c - dor mo. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mo-c - dor mo

How to fill out MO-C

01

Obtain the MO-C form from the appropriate tax authority website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information in the designated sections.

04

Provide any required financial information accurately.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form as required.

07

Submit the completed form by the specified deadline.

Who needs MO-C?

01

Individuals who have income that requires reporting to the state.

02

Taxpayers claiming certain deductions or credits.

03

Residents of the state who are required to file for state tax purposes.

04

Businesses operating within the state that meet filing requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is the moc?

Management of change (MOC) is a policy companies use to manage any health, safety or environmental risks that arise when facilities, employees, or operations are updated, added, or otherwise modified.

What does it mean to be a moc?

Meaning of MOC in English abbreviation for man or men of colour: a man who does not consider himself to be white, or men who do not consider themselves to be white: A group of colleagues, all men of colour (MOC) and women of colour (WOC), were walking across campus.

What is the meaning of moc?

Meaning of MOC in English abbreviation for man or men of colour: a man who does not consider himself to be white, or men who do not consider themselves to be white: A group of colleagues, all men of colour (MOC) and women of colour (WOC), were walking across campus.

What is the full meaning of moc?

Management of Change. Memorandum of Cooperation. man of color: a man of color; a nonwhite man.

What does moc mean in slang?

Masculine of center (abbreviated as MoC) is a broad gender expression term used to describe a person who identifies or presents as being more masculine than feminine.

What does moc mean in slang?

Masculine of center (abbreviated as MoC) is a broad gender expression term used to describe a person who identifies or presents as being more masculine than feminine.

What is mo co?

mo.co is a MMO-RPG style game centered around fighting monsters to collect materials to level up you and your items, and progress through different levels, along with the story.

What does Mo stand for in English?

A modus operandi (often shortened to M.O. or MO) is an individual's habits of working, particularly in the context of business or criminal investigations, but also generally. It is a Latin phrase, approximately translated as 'mode (or manner) of operating'.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MO-C?

MO-C is a form used by taxpayers in Missouri to calculate and report their Missouri income tax credits.

Who is required to file MO-C?

Taxpayers who are claiming certain tax credits in Missouri must file the MO-C form along with their state income tax return.

How to fill out MO-C?

To fill out MO-C, taxpayers need to provide their personal information, report the tax credits they are claiming, and follow the instructions provided on the form.

What is the purpose of MO-C?

The purpose of MO-C is to ensure that taxpayers properly report and claim income tax credits available in Missouri.

What information must be reported on MO-C?

The information that must be reported on MO-C includes taxpayer identification details, the specific tax credits being claimed, and any required supportive documentation.

Fill out your mo-c - dor mo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mo-C - Dor Mo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.