Get the free TAXCREDIT - tcrc mo

Show details

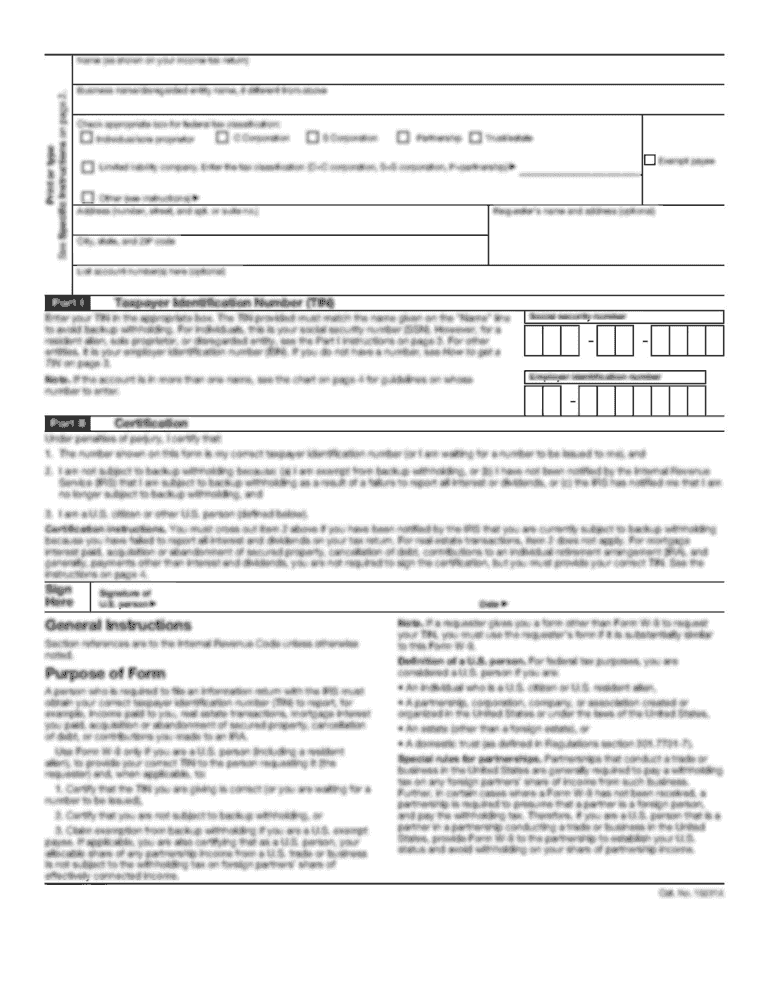

The document provides an analysis of the Maternity Homes tax credit program, detailing eligibility, benefits, costs, and performance measures related to contributions made to maternity homes in Missouri.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxcredit - tcrc mo

Edit your taxcredit - tcrc mo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxcredit - tcrc mo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxcredit - tcrc mo online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxcredit - tcrc mo. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxcredit - tcrc mo

How to fill out TAXCREDIT

01

Gather all necessary documentation including W-2 forms, 1099 forms, and any other income statements.

02

Determine your eligibility for tax credits based on your income level and personal circumstances.

03

Access the official IRS website or tax software to find the specific forms required for tax credits.

04

Carefully read the instructions provided with the tax credit form, making sure to follow them accurately.

05

Fill out the tax credit form, ensuring all information is correct and complete.

06

Double-check all calculations and ensure all applicable credits are claimed.

07

Submit the form along with your tax return by the relevant deadline.

Who needs TAXCREDIT?

01

Individuals or families with low to moderate income that qualify for tax assistance.

02

Students seeking to claim educational tax credits.

03

Caregivers or individuals supporting dependents that may qualify for tax credits.

04

Taxpayers looking to reduce their overall tax liability and increase their refund.

Fill

form

: Try Risk Free

People Also Ask about

What is tax deduction English?

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits.

What is the word tax deduction?

Meaning of tax deduction in English an amount or cost that can be subtracted from someone's income before calculating how much tax they owe: Taxpayers should use all the tax deductions available to them to keep their bill as low as possible.

What does it mean if something is a tax deduction?

Deductions reduce your taxable income. It works like this: your assessable income (money you earn from work or investments) minus your allowable deductions (such as costs you incur to earn your income) equals your taxable income (the amount you actually pay tax on).

Is tax credit good or bad?

Are Tax Credits Good or Bad? Tax credits reduce the amount of income tax you owe, allowing you to keep more of your hard-earned money. For most people, this is a good thing. Tax credits also benefit the federal government by promoting activities that strengthen the economy, environment and society.

What is the meaning of tax deduction?

What Is a Tax Deduction? A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe. You can choose the standard deduction — a single deduction of a fixed amount — or itemize deductions on Schedule A of your income tax return.

What is the meaning of tax credit?

A tax credit is a dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund.

What are 3 examples of tax credits?

Personal Credits California Earned Income Tax Credit. Child Adoption Costs Credit. Child and Dependent Care Expenses Credit. College Access Tax Credit. Dependent Parent Credit. Foster Youth Tax Credit. Joint Custody Head Of Household. Nonrefundable Renter's Credit.

What is tax deduction briefly?

Definition. A tax deduction is a total amount an individual can claim to reduce their tax liability. It is a provision that allows any individual to reduce the tax liability on the total income. Description. The deduction can be called the benefit through which you can save tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAXCREDIT?

A tax credit is an amount of money that taxpayers can deduct directly from their tax liability, reducing the total tax owed.

Who is required to file TAXCREDIT?

Taxpayers who qualify for tax credits based on their income, filing status, and specific deductions, must file to claim the credits.

How to fill out TAXCREDIT?

To fill out a tax credit form, gather necessary financial documentation, complete the applicable tax forms, and provide details regarding the specific credits you are claiming.

What is the purpose of TAXCREDIT?

The purpose of a tax credit is to incentivize certain behaviors or activities, provide financial relief, and reduce the overall tax burden for eligible taxpayers.

What information must be reported on TAXCREDIT?

Taxpayers must report their income, filing status, eligible expenses, and any supporting documentation required for the specific tax credits they are claiming.

Fill out your taxcredit - tcrc mo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxcredit - Tcrc Mo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.