MO MODES-4633 2012 free printable template

Show details

MODES-4633 (10-12) AI. Q.C. MISSOURI DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS. SELF-EVALUATION QUESTIONNAIRE. 1. Have you ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MODES-4633

Edit your MO MODES-4633 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MODES-4633 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO MODES-4633 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO MODES-4633. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MODES-4633 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MODES-4633

How to fill out MO MODES-4633

01

Obtain the MO MODES-4633 form from the relevant authority or website.

02

Start by filling in the personal information section, including your name, address, and contact information.

03

Provide the required details in the specific sections according to the instructions provided on the form.

04

Ensure that all entries are accurate and complete to avoid any processing delays.

05

Review the form for any errors or omissions before submission.

06

Submit the completed MO MODES-4633 form to the appropriate department either electronically or by mail, as specified.

Who needs MO MODES-4633?

01

Individuals or organizations required to report specific data as mandated by regulatory authorities.

02

Professionals involved in compliance reporting or regulatory submissions.

03

Participants in programs or grants that require documentation through MO MODES-4633.

Fill

form

: Try Risk Free

People Also Ask about

What do Missouri employees have the right to?

Under Missouri law, employees are entitled to certain leaves or time off, including voting leave, jury duty leave, crime victim leave, emergency responder leave, military leave and Civil Air Patrol leave.

How do I contact the Missouri Department of Labor?

Contact the Department of Labor To file for Unemployment Insurance (UI) Benefits or to get Claims Information: Toll Free: 800-320-2519. Jefferson City: 573-751-9040. Kansas City: 816-889-3101. Springfield: 417-895-6851. St. Louis: 314-340-4950.

What do employees have the right to?

The right to be paid fair wages for the work that is performed. The right to a work environment that is free of harassment and discrimination of all types. The right to not be retaliated against for filing a complaint against an employer.

Can self-employed get unemployment in Missouri?

The Missouri Department of Labor and Industrial Relations' (DOLIR's) Division of Employment Security (DES) is now processing unemployment claims for the self-employed, gig workers, independent contractors, and those who otherwise do not qualify for regular unemployment benefits and have been impacted by the coronavirus

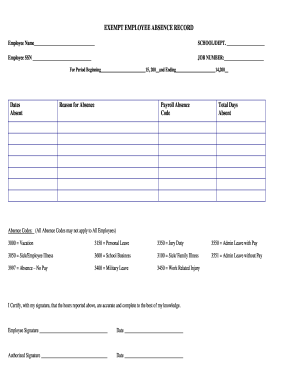

What are exempt employees rights in Missouri?

Executive, administrative, managerial, faculty and professional positions are classified as exempt and no overtime is paid or compensatory time earned. Because exempt employees are not eligible for overtime, they are not required to keep a record of the hours they work but must report time away from work (leave).

What is Missouri labor law?

Missouri also has "right to work" laws that prohibit union membership as a condition of employment. Like most states, Missouri labor laws require at least a minimum wage payment, prohibit discrimination, and allow employees to take leave from work when necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MO MODES-4633?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific MO MODES-4633 and other forms. Find the template you need and change it using powerful tools.

How do I edit MO MODES-4633 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing MO MODES-4633.

How do I edit MO MODES-4633 on an Android device?

You can make any changes to PDF files, like MO MODES-4633, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is MO MODES-4633?

MO MODES-4633 is a tax form used in the state of Missouri for reporting certain tax information related to income or business activities.

Who is required to file MO MODES-4633?

Individuals or businesses that meet specific criteria set by the state of Missouri, such as those engaged in certain types of business activities or income reporting requirements, are required to file MO MODES-4633.

How to fill out MO MODES-4633?

To fill out MO MODES-4633, you should gather the required information, such as income details and business identifiers, and follow the instructions provided on the form to ensure all sections are completed accurately.

What is the purpose of MO MODES-4633?

The purpose of MO MODES-4633 is to collect relevant tax information for the state of Missouri to ensure compliance with state tax laws and to facilitate proper assessment of any taxes owed.

What information must be reported on MO MODES-4633?

Information that must be reported on MO MODES-4633 includes taxpayer identification, income details, deductions, and any other pertinent financial information as required by the state tax regulations.

Fill out your MO MODES-4633 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MODES-4633 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.