Get the free REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM - bsd dli mt

Show details

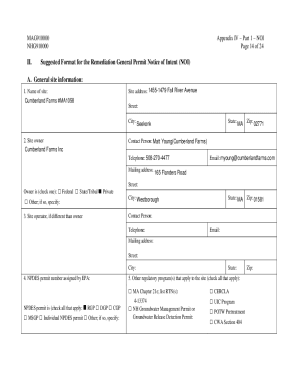

This form is used by licensed non-resident addiction counselors to report services rendered in Montana and to register their information with the state program. It includes sections for personal information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report of non-resident report

Edit your report of non-resident report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report of non-resident report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit report of non-resident report online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit report of non-resident report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report of non-resident report

How to fill out REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM

01

Obtain the REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM from the relevant authority or website.

02

Begin filling out the personal information section with your full name, address, and contact details.

03

Indicate your non-resident status clearly in the designated section of the form.

04

Provide details of the services you will be providing while in the area.

05

Include the dates you intend to offer these services.

06

Attach any necessary documentation that supports your application (e.g., identification or proof of services).

07

Review all information for accuracy and completeness.

08

Submit the completed form along with any required fees to the appropriate office.

Who needs REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM?

01

Individuals or businesses offering services in a region where they do not reside.

02

Non-resident contractors, freelancers, or consultants requiring formal registration.

03

Any person or entity seeking to comply with local regulations for non-resident service providers.

Fill

form

: Try Risk Free

People Also Ask about

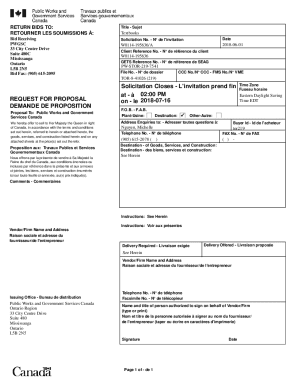

Does Canada report NR4 to the IRS?

Information received by the Canada Revenue Agency on the Form NR4 is regularly reported to the IRS through information exchange conducted under the U.S.-Canada income tax treaty.

How do I claim back non-resident withholding tax in Canada?

To get a refund of excess or incorrectly withheld Part XIII tax, a non-resident has to fill out Form NR7-R, Application for Refund of Part XIII Tax Withheld.

Who is a non-resident of Canada for tax purposes?

You may be considered a non-resident of Canada if you did not have significant residential ties with Canada and one of the following applies: You lived outside Canada throughout the year (except if you were a deemed resident of Canada) You stayed in Canada for less than 183 days in the tax year.

How do I register as a non-resident in the Netherlands?

If you are a non-resident or staying in the Netherlands for a maximum of 4 months, you can register with the Non-Residents Register (RNI). You can register at one of the 19 municipalities with an RNI desk , and you can choose the municipality where you want to do this.

How to report Canadian T4 on US tax return?

Compliance Checklist for Canadian Income Gather your Canadian tax documents: T4, T3, T5 slips, Canadian tax return. Convert Canadian dollars to US dollars using the average exchange rate. Complete Form 1040 to report worldwide income. File Form 1116 for the Foreign Tax Credit (FTC).

How long does it take to get BSN in the Netherlands?

As soon as you are registered with the BRP, you will automatically receive a letter containing your BSN from the government. You will usually receive a letter containing your BSN within 4 weeks of your registration in the BRP.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

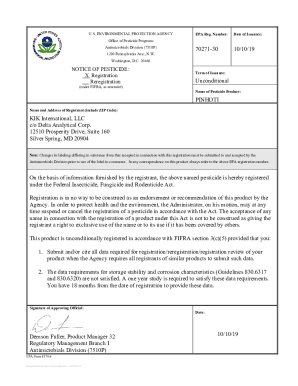

What is REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM?

The REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM is a document used by non-residents to declare their provision of services and to register for taxation purposes in a specific jurisdiction.

Who is required to file REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM?

Non-residents who provide services within the jurisdiction and are subject to local tax regulations are required to file this form.

How to fill out REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM?

To fill out the form, non-residents must provide their personal information, details about the services rendered, the duration of service, and any relevant identification or registration numbers as prescribed by local tax authorities.

What is the purpose of REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM?

The purpose of the form is to ensure compliance with tax regulations by documenting the services provided by non-residents and facilitating the appropriate taxation of those services.

What information must be reported on REPORT OF NON-RESIDENT REPORT OF SERVICES & REGISTRATION FORM?

Information that must be reported includes the non-resident's name, address, contact information, type and description of services provided, duration of services, and any applicable tax identification numbers.

Fill out your report of non-resident report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report Of Non-Resident Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.