IL RUT-25 Instructions 2010 free printable template

Get, Create, Make and Sign il rut25 instructions use tax fill form

Editing illinois rut 25 instructions vehicle transaction form online

Uncompromising security for your PDF editing and eSignature needs

IL RUT-25 Instructions Form Versions

How to fill out illinois rut 25 instructions form online

How to fill out IL RUT-25 Instructions

Who needs IL RUT-25 Instructions?

Video instructions and help with filling out and completing illinois rut 25 instructions vehicle form blank

Instructions and Help about illinois rut 25 instructions tax transaction form

In this video I'm going to show you how easy it is to create a fillable form in Microsoft Word first we're going to take a look at a quick example in this example is of a probationary evaluation form that I created and as you'll notice I have fillable fields in this form that you can tab through or select with your mouse as you type through the form so if I have the employees name up here, and then I can tab over to the date, and then I can also select with my mouse where I want to go if I have a checkbox I click there, and it checks the box, so this is an easy form that you can tab through, and I'm going to show you exactly how you can make one of these forms for yourself the form that we're going to make is an as an employee status change form and this is a typical form it's also called a personnel action form, but it's a form that you use between HR and payroll to make status changes for employees and so here what we're going to do is use legacy tools to insert those text fields checkboxes and even drop form fields that you can create in Microsoft Word, so first we're going to go up here in our search area, and we're going to type legacy tools and legacy tools pops up over here and as you'll notice you go over here, and you have these first three icons have the text form field the checkbox form field and the drop-down form field that you can use and insert into your form, so first I'm going to go ahead and select the text form field for the date and as soon as I enter this in I can select it by highlighting it, and then I can change the formatting so if I want the form to be filled in whoever is typing it in say I want it to be a little bigger and italics, so it stands out different from the form itself that I created with all the bold text so right there I have formatted this to be italics and the font size of 12 and if I copy and paste, so I hit CTRL C to copy that I can enter that in anywhere that I want a form field and this is anywhere where I want the person who's going to use this form and fill in this form to type in text so all I have to do is can hit control V and paste that everywhere that I want that text field to go and then when I get down to this area I want to have a drop-down form field, so I'm going to go back up here to my search area where I have legacy tools, and then I'm going to select the drop-down form field all right it looks exactly the same as the text form field right but if you double-click on it is opens a window and lets you insert your criteria that you want to put into your drop-down, so we're going to say please select we're going to add that, and maybe we're going to say status is active on leave or inactive, and you can enter in as many form fields as you want over here on the right if you want to move these things up and down you can do that with these little arrows, and then you just click OK and now when you lock your form the person who's gonna use the form and fill it in is going to be able to make a...

People Also Ask about illinois rut instructions use tax transaction

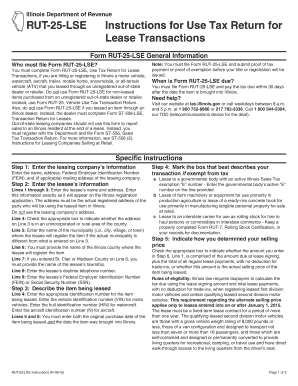

What is a rut-25 LSE form?

What is a rut 25 LSE?

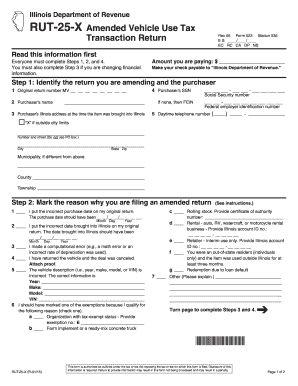

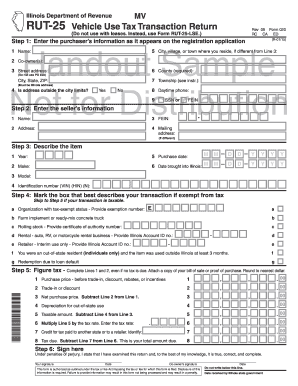

What is Rut 25 tax Illinois?

How do I know if I owe Illinois use tax?

What is the tax rate for Rut-25 in Illinois?

What is the vehicle Use Tax transaction return form rut-25?

How do I report Use Tax in Illinois?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send illinois rut 25 instructions tax transaction form template to be eSigned by others?

How do I edit illinois rut 25 instructions return straight from my smartphone?

How do I fill out illinois 25 instructions vehicle use transaction blank on an Android device?

What is IL RUT-25 Instructions?

Who is required to file IL RUT-25 Instructions?

How to fill out IL RUT-25 Instructions?

What is the purpose of IL RUT-25 Instructions?

What information must be reported on IL RUT-25 Instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.