Get the free Wholesalers Monthly Tax Return - lcc ne

Show details

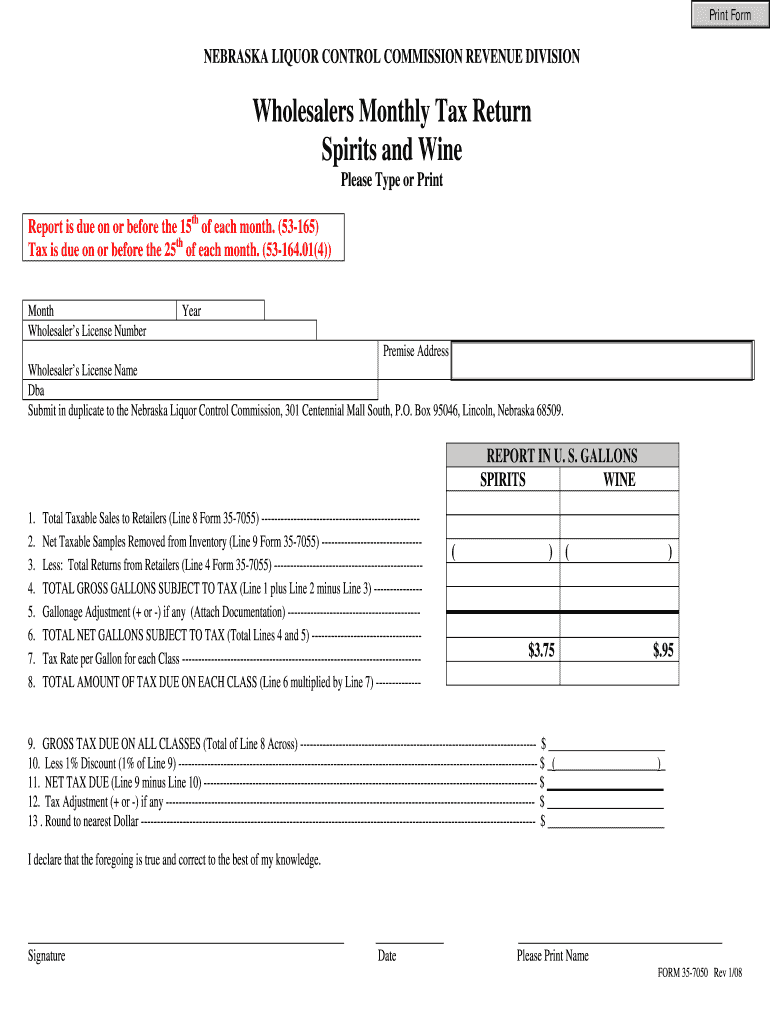

This document is used by wholesalers in Nebraska to report monthly tax returns for spirits and wine sales. It outlines the due dates for the report and tax payment, and provides sections for filling

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wholesalers monthly tax return

Edit your wholesalers monthly tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wholesalers monthly tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wholesalers monthly tax return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wholesalers monthly tax return. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wholesalers monthly tax return

How to fill out Wholesalers Monthly Tax Return

01

Gather all sales and purchase records for the month.

02

Calculate total sales revenue and total purchases.

03

Fill in the taxpayer identification information in the designated section.

04

Enter the total sales revenue and total purchases in their respective fields.

05

Deduct any allowable expenses from the total revenue.

06

Calculate the net taxable income.

07

Complete any required declarations or certifications.

08

Review the completed form for accuracy.

09

Submit the form by the specified deadline, either electronically or by mail.

Who needs Wholesalers Monthly Tax Return?

01

Wholesalers engaged in selling goods to retailers or other businesses.

02

Businesses required to report sales tax collections to the government.

03

Individuals or entities that have made taxable sales during the reporting period.

Fill

form

: Try Risk Free

People Also Ask about

What does VAT on return mean?

A value-added tax (VAT) Return calculates how much VAT a company should pay or expect to recover, by HMRC. In most cases Vat Returns, and the accompanying payments must be made quarterly to HMRC. When you first start your business, understanding the different taxes that may apply to you is essential.

What is VAT and what is its purpose?

What is VAT? VAT is an abbreviation for the term Value-Added Tax. It is an indirect tax on the consumption of goods and services in the economy. Revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to register for VAT.

How much is import tax in Brazil?

Import tax. ICMS (Imposto sobre Circulaçao de Mercadorias e Serviços or Tax on Commerce and Services): ICMS is a Brazilian state and import value-added tax (VAT). The average import tax for courier and postal shipments ranges between 17-19%.

What is IRRF in Brazil?

The Imposto de Renda Retido na Fonte (IRRF) tax applies to revenue from legal entities and natural persons. The collection of IRRF occurs when a company or person receives the revenue.

What does it mean to file VAT returns?

At the end of each tax period, VAT registered businesses or the 'taxable persons' must submit a 'VAT return' to Federal Tax Authority (FTA). A VAT return summarises the value of the supplies and purchases a taxable person has made during the tax period, and shows the taxable person's VAT liability.

What is VAT return?

A VAT Return is a form you fill in to tell HM Revenue and Customs ( HMRC ) how much VAT you've charged and how much you've paid to other businesses. You usually need to send a VAT Return to HMRC every 3 months. This is known as your 'accounting period'.

Who is required to file VAT returns?

VAT returns in the Philippines must be filed by all VAT-registered businesses to report their VAT collections and input tax credits. The monthly VAT return (BIR Form 2550M) and the quarterly VAT return (BIR Form 2550Q) summarise taxable sales, purchases, and VAT payable.

What is the PIS tax in Brazil?

PIS, an acronym for Social Integration Program, is a Brazilian tax established to primarily fund social programs and economic growth. It can also be found as PIS/PASEP. Introduced in the 1970s, the PIS has become a major tax imposed on companies' payroll and the turnover of various sectors of the economy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Wholesalers Monthly Tax Return?

The Wholesalers Monthly Tax Return is a tax document that wholesalers must submit to report their taxable sales and calculate the amount of tax owed to the relevant tax authority on a monthly basis.

Who is required to file Wholesalers Monthly Tax Return?

Wholesalers who engage in the sale of goods and services and are subject to sales tax in their jurisdiction are required to file the Wholesalers Monthly Tax Return.

How to fill out Wholesalers Monthly Tax Return?

To fill out the Wholesalers Monthly Tax Return, individuals must provide their business information, report total sales, specify exempt sales, calculate total taxable sales and tax due, and submit the completed form along with any payment to the relevant tax authority.

What is the purpose of Wholesalers Monthly Tax Return?

The purpose of the Wholesalers Monthly Tax Return is to ensure that wholesalers accurately report their sales activities and remit the appropriate amount of sales tax to the government, thus helping maintain tax compliance.

What information must be reported on Wholesalers Monthly Tax Return?

On the Wholesalers Monthly Tax Return, wholesalers must report their business information, total sales, exempt sales, total taxable sales, computation of tax owed, and any payments made or credits applied.

Fill out your wholesalers monthly tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wholesalers Monthly Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.