NE Lottery 10-029-93 2003 free printable template

Show details

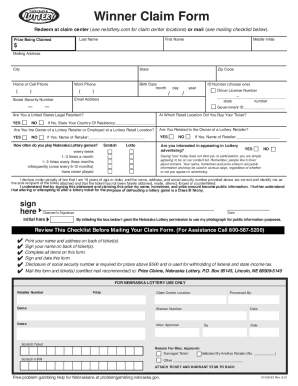

RESET FORM Nebraska Lottery Winner Claim Form INSTRUCTIONS TO CLAIMANT REQUIRED INFORMATION (PLEASE PRINT CLEARLY) Name (Last, First, Middle Initial) ? ? ? ? ? Print your name and address on back

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE Lottery 10-029-93

Edit your NE Lottery 10-029-93 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE Lottery 10-029-93 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NE Lottery 10-029-93 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NE Lottery 10-029-93. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE Lottery 10-029-93 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE Lottery 10-029-93

How to fill out NE Lottery 10-029-93

01

Start by obtaining the NE Lottery 10-029-93 form from the official Nebraska Lottery website or authorized retailers.

02

Read the instructions carefully before filling out the form.

03

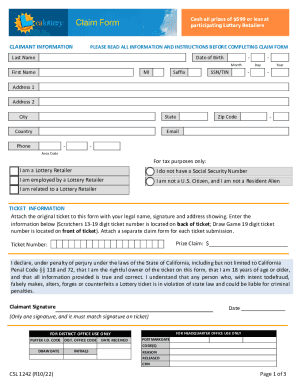

Complete the personal information section, including your name, address, and social security number.

04

Indicate the type of claim you are submitting (e.g., prize claim, refund, etc.).

05

Provide details of the ticket or transaction, such as ticket number, date of purchase, and any other relevant information.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the form as directed, either through mail or in person at a designated lottery office.

Who needs NE Lottery 10-029-93?

01

Anyone who has won a prize from the Nebraska Lottery and needs to claim their winnings.

02

Individuals looking to request a refund or file a dispute regarding a lottery ticket.

03

Players of the Nebraska Lottery who want to formally document their transactions for record-keeping.

Fill

form

: Try Risk Free

People Also Ask about

How do I cash in my Nebraska Lottery ticket?

Winning tickets of $500 or below can be claimed at any Nebraska Lottery Retailer location. Cash prizes of $501 to $19,999 must be claimed at any of the Lottery's five Regional Claim Center offices, Lottery headquarters or by mail.

What happens if you win the lottery in Nebraska?

There is never a fee to claim Nebraska Lottery prizes. Prizes up to $500 can be claimed at any Nebraska Lottery retailer. Some retailers reserve the right to pay prizes only up to a certain level due to security concerns. Prizes of $501 to $19,999 must be claimed by mail or at a Regional Lottery Claim Center.

What to do if you win the lottery in Nebraska?

There is never a fee to claim Nebraska Lottery prizes. Prizes up to $500 can be claimed at any Nebraska Lottery retailer. Some retailers reserve the right to pay prizes only up to a certain level due to security concerns. Prizes of $501 to $19,999 must be claimed by mail or at a Regional Lottery Claim Center.

Can you remain anonymous if you win Mega Millions?

The North American Association of State and Provincial Lotteries, a nonprofit trade association, says players cannot remain anonymous in most jurisdictions.

What states can you keep your lottery winnings a secret?

What states in America allow Powerball winners to be anonymous? Florida. In May 2022, Florida passed a law that allows winners of $250,000 or more to remain anonymous for 90 days. Illinois. The Illinois jackpot winner may elect to remain anonymous. Maryland. Minnesota. Mississippi. Montana. North Dakota. Ohio.

Can you claim lottery anonymously in Nebraska?

Right now only seven states allow lottery winners to maintain their anonymity: Delaware, Kansas, Maryland, North Dakota, Texas, Ohio and South Carolina.

What happens if I win the lottery?

Lottery winners can claim their winnings in one lump sum payment or annual payments over time. Lottery winnings are treated as regular income and subject to state and federal income taxes.

How do I check my Nebraska Lottery ticket?

The Ticket Scanner in the Nebraska Lottery mobile app lets you check Scratch and Lotto tickets for prizes just like the Check-A-Ticket machines at retailers. Here are some tips for using the Ticket Scanner feature: For Scratch tickets, completely remove the coating over the barcode on the front of the ticket.

How much does Nebraska tax lottery winnings?

Nebraska also has a 5% state tax withholding — about $46.4 million — plus additional state taxes due, taking your total net payout on the lump sum to about $521.8 million. If you take the annuity option, you would receive 30 average annual payments of about $63.3 million — before taxes.

Why does California forbid lottery winners to remain anonymous?

ing to California public disclosure laws, your name is public record. That means the media will likely attempt to contact you to ask a lot of fun questions about your win! Their efforts are made easier in this day and age of internet search engines.

Can lottery winners remain anonymous in the US?

Only 11 states in the nation allow winners to remain anonymous. If you are hoping to stay as incognito as long as possible regarding your wins, there are a few things you can do: First, only disclose the bare minimum amount of information required by law.

What time can you cash in scratch tickets Nebraska?

Hours: 8:00 a.m. - 4:30 p.m.

How do you stay anonymous after winning the lottery?

By using a trust, you may be able to keep your identity a secret. Check local and state laws regarding trusts when it applies to lottery winnings and anonymity.

Why can't lottery winners remain anonymous?

Lawmakers have cited safety and privacy concerns for lottery winners who have their personal information released. States that grant anonymity each have their own limitations or restrictions, including prize thresholds or a limited time period where a person can remain anonymous.

How much taxes do you pay on lottery winnings in Nebraska?

Nebraska also has a 5% state tax withholding — about $46.4 million — plus additional state taxes due, taking your total net payout on the lump sum to about $521.8 million. If you take the annuity option, you would receive 30 average annual payments of about $63.3 million — before taxes.

How long does it take to get the money when you win the lottery?

If you elected the cash option or if your prize is only offered in a single payment, your check should arrive approximately six to eight weeks from your claim date. If your prize is to be paid in installments, your first payment should be available within six to eight weeks from your claim date.

How can I hide my identity after winning the lottery?

Buying a lottery ticket in a state that does not require winners to come forward is an effective way to conceal your identity. Another way is to not tell anyone you scored the jackpot or change much of your lifestyle to avoid having your identity revealed.

How do you claim lottery winnings?

Winners of all prizes should surrender the tickets within 30 days. Income tax of 30% is deducted on all prizes above Rs 10,000. Thus, a person winning Rs 1 lakh will have a net earning of Rs 61,600. Tickets of prizes less than Rs 1 lakh are to be submitted to the District Lottery Office.

How do I hide that I won the lottery?

By using a trust, you may be able to keep your identity a secret. Check local and state laws regarding trusts when it applies to lottery winnings and anonymity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NE Lottery 10-029-93 to be eSigned by others?

When you're ready to share your NE Lottery 10-029-93, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the NE Lottery 10-029-93 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NE Lottery 10-029-93 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit NE Lottery 10-029-93 on an Android device?

You can make any changes to PDF files, like NE Lottery 10-029-93, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is NE Lottery 10-029-93?

NE Lottery 10-029-93 is a form used by individuals or entities to report lottery winnings in the state of Nebraska.

Who is required to file NE Lottery 10-029-93?

Individuals or businesses that have received lottery winnings that exceed a certain threshold are required to file NE Lottery 10-029-93.

How to fill out NE Lottery 10-029-93?

To fill out NE Lottery 10-029-93, obtain the form from the Nebraska Lottery website, complete the required personal information, report your winnings, and submit it to the appropriate tax authority.

What is the purpose of NE Lottery 10-029-93?

The purpose of NE Lottery 10-029-93 is to ensure that all lottery winnings are reported for tax purposes and to facilitate proper taxation of those winnings.

What information must be reported on NE Lottery 10-029-93?

NE Lottery 10-029-93 requires the reporting of the winner's name, Social Security number, address, amount won, and any other pertinent details as stipulated on the form.

Fill out your NE Lottery 10-029-93 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE Lottery 10-029-93 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.