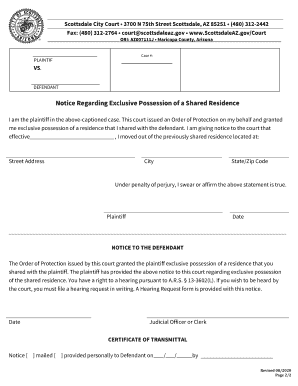

Get the free IFTA Additional Decal Application - dmv ne

Show details

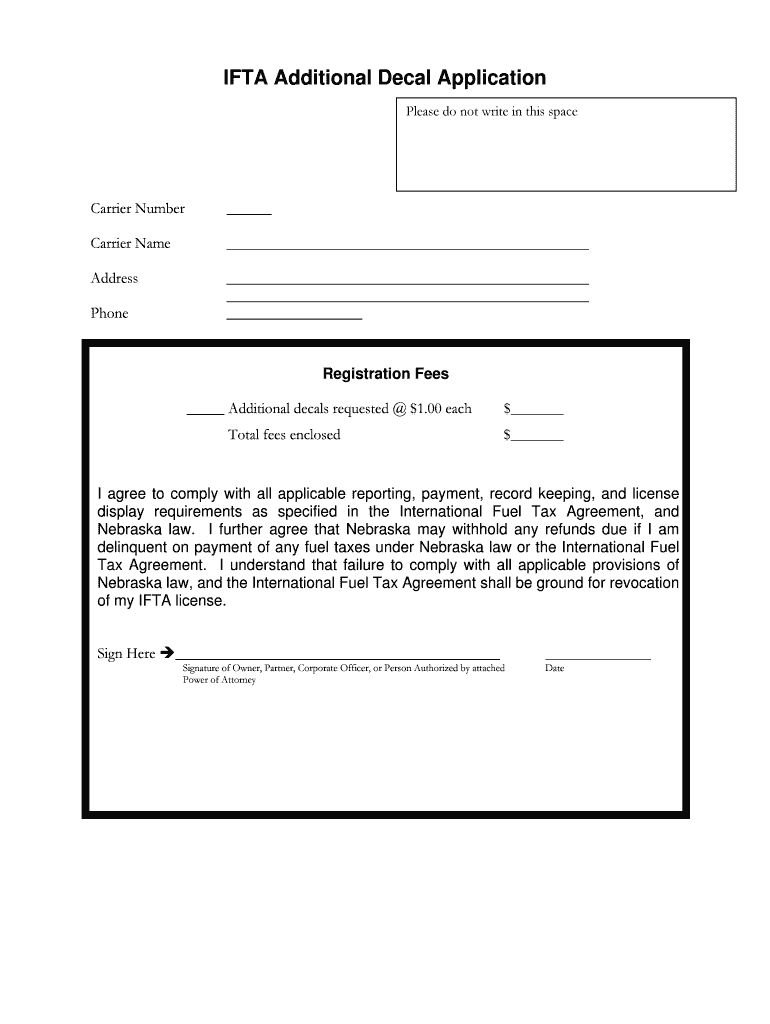

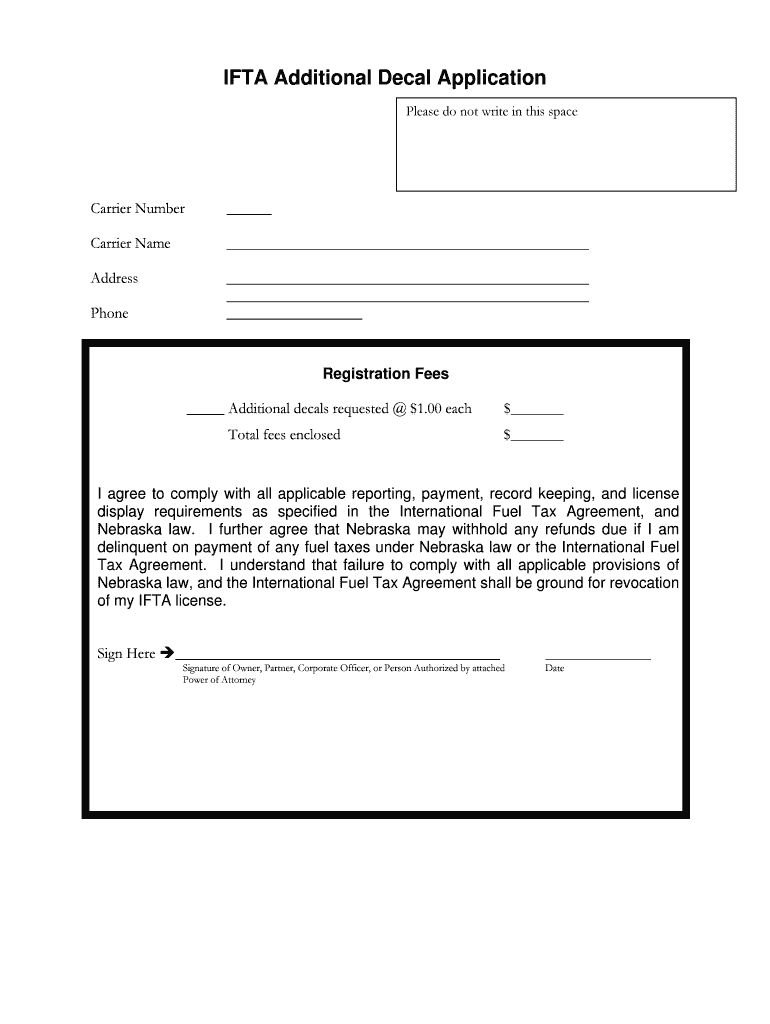

This document is used to apply for additional decals under the International Fuel Tax Agreement (IFTA), including information on registration fees and compliance with applicable laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ifta additional decal application

Edit your ifta additional decal application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifta additional decal application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ifta additional decal application online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ifta additional decal application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ifta additional decal application

How to fill out IFTA Additional Decal Application

01

Obtain the IFTA Additional Decal Application form from your state’s IFTA website or office.

02

Fill out the required information, including your name, business details, and vehicle information.

03

Specify the number of additional decals you are requesting.

04

Include payment for the application fee, if applicable.

05

Review the application for accuracy and completeness.

06

Submit the application form as directed, either by mail or online.

Who needs IFTA Additional Decal Application?

01

Businesses operating vehicles that travel through multiple states and require additional IFTA decals.

02

Fleet operators looking to register more vehicles under IFTA for the purpose of fuel tax reporting.

03

Any entity that has already registered for IFTA and needs more decals for additional vehicles.

Fill

form

: Try Risk Free

People Also Ask about

How to get IFTA sticker in GA?

Additional International Fuel Tax Agreement (IFTA) decals may be ordered by submitting a request through Georgia Tax Center. All decal requests are processed on the next business day and mailed to the address on file. IFTA decals are $3 per set. You are required to have one set per vehicle.

Do I need IFTA for local trucking?

Do local trucks need IFTA? Local trucks operating exclusively within a single jurisdiction typically do not need to file IFTA. IFTA is primarily for commercial vehicles that travel across multiple jurisdictions, such as interstate or international carriers.

How to get IFTA stickers in NY?

Buy a set of two decals for each qualified motor vehicle you operate under your IFTA license. There is an $8 fee for each set of two decals ordered. If you already have an IFTA license, you may buy IFTA decals online at OSCAR, or you may use Form IFTA-21 to order decals.

How do I get an IFTA sticker in NJ?

New New Jersey IFTA Fuel Tax Accounts You can submit a New Jersey application by mail or in person to the Motor Vehicle Commission. There is a $10 fee for each set of decals. You will need one set per qualified vehicle. You should receive the decals in 1-2 weeks.

How much does it cost to get an IFTA in Texas?

There are no fees associated with IFTA registration, licenses or decals. The minimum penalty is $50 or 10 percent of your total tax liability, whichever is greater. The minimum penalty applies to all late reports including no operations, no tax due and credit reports.

Do I need IFTA for local trucking?

Do local trucks need IFTA? Local trucks operating exclusively within a single jurisdiction typically do not need to file IFTA. IFTA is primarily for commercial vehicles that travel across multiple jurisdictions, such as interstate or international carriers.

How do I register for IFTA in Florida?

To establish an IFTA account in Florida, an APPLICATION FOR INTERNATIONAL FUEL TAX AGREEMENT and accompanying decal order form must be completed. Applicants are required to provide their business name and Federal Employer Identification Number (FEIN) on the application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IFTA Additional Decal Application?

The IFTA Additional Decal Application is a form used by commercial vehicle operators to request additional decals for their vehicles under the International Fuel Tax Agreement (IFTA).

Who is required to file IFTA Additional Decal Application?

Individuals or businesses that operate qualified motor vehicles and need additional decals for their vehicles to comply with IFTA requirements are required to file this application.

How to fill out IFTA Additional Decal Application?

To fill out the IFTA Additional Decal Application, you need to provide information such as your business name, account number, vehicle details, and the number of additional decals requested. Ensure that all required fields are completed and accurate.

What is the purpose of IFTA Additional Decal Application?

The purpose of the IFTA Additional Decal Application is to enable carriers to obtain the necessary decals that allow them to operate their vehicles across IFTA jurisdictions legally.

What information must be reported on IFTA Additional Decal Application?

The information that must be reported includes the applicant's business details, IFTA account number, vehicle identification, and the number of additional decals being requested.

Fill out your ifta additional decal application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifta Additional Decal Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.