Get the free NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004

Show details

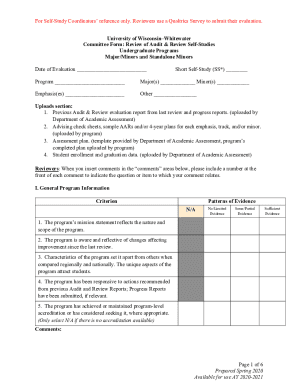

This document provides a summary of the actuarial valuation results for the State Employees' Retirement System Cash Balance Benefit Fund, detailing the funding requirements, actuarial methods, assumptions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nebraska public employees retirement

Edit your nebraska public employees retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska public employees retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nebraska public employees retirement online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nebraska public employees retirement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nebraska public employees retirement

How to fill out NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004

01

Obtain the NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004 form from the official website or your HR department.

02

Read the instructions carefully to ensure you understand the requirements.

03

Fill in your personal information in the designated fields, including your name, address, and employee ID.

04

Provide details about your employment, such as your position, department, and length of service.

05

Indicate your beneficiaries by writing their names and relationship to you.

06

Complete any additional sections required, such as financial information or previous retirement contributions.

07

Review the entire form for accuracy and completeness.

08

Sign and date the form in the specified area.

09

Submit the completed form to your HR department or as directed in the instructions.

Who needs NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004?

01

State employees of Nebraska who wish to enroll in the retirement system.

02

Individuals transitioning from other retirement plans seeking to consolidate their benefits.

03

New employees looking to establish retirement savings.

04

Anyone interested in understanding their retirement options and planning for their financial future.

Fill

form

: Try Risk Free

People Also Ask about

What is a 403 B plan commonly referred to as?

A 403(b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain 501(c)(3) tax-exempt organizations. Employees save for retirement by contributing to individual accounts. Employers can also contribute to employees' accounts. Choose a 403(b) plan.

What is a 403b plan vs 401k?

403(b) plans and 401(k) plans are very similar but with one key difference: whom they're offered to. While 401(k) plans are primarily offered to employees in for-profit companies, 403(b) plans are offered to not-for-profit organizations and government employees.

Which retirement plan was designed for employees of public school systems?

A 403(b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain 501(c)(3) tax-exempt organizations. Employees save for retirement by contributing to individual accounts. Employers can also contribute to employees' accounts.

Do Nebraska state employees get a pension?

Cash balance pension benefits generally involve annual pay credits coupled with an annual interest credit. In Nebraska these benefits are financed in a shared cost model, employees contribute 4.8% of pay to finance their retirement benefit, and employers match that contribution at 156% of the employee rate.

What is a Roth 403 B plan?

The Roth 403(b) was designed to combine the benefits of saving in your tax-deferred workplace retirement plan with the advantage of avoiding taxes on your money when you withdraw it at retirement.

What is the difference between a 401k and a money purchase plan?

Money Purchase Pension Plan vs 401(k) In a money purchase plan, the employer provides the funding with optional employee contribution. With a 401(k), employees fund accounts with elective salary deferrals and option employer contributions.

What type of retirement plan is NPERS Nebraska?

Cash Balance/Defined Contribution Plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004?

The Nebraska Public Employees Retirement Systems 2004 refers to the retirement plans and regulations established for public employees in Nebraska, aimed at providing retirement benefits and ensuring financial security for eligible members.

Who is required to file NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004?

Public employees who are part of the state or local government employment in Nebraska and participate in the retirement systems are required to file the NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004.

How to fill out NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004?

To fill out the NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004, individuals must complete the required forms, providing accurate personal information, employment details, and retirement plan selections, ensuring all sections are properly filled and required documentation is attached.

What is the purpose of NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004?

The purpose of the NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004 is to provide a structured retirement plan that ensures public employees in Nebraska can save for and receive retirement benefits, thereby promoting financial stability in retirement.

What information must be reported on NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004?

The NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMS 2004 requires reporting information such as personal identification details, employment history, contributions made to the retirement plan, the type of retirement plan selected, and beneficiary information.

Fill out your nebraska public employees retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Public Employees Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.