Get the free 1999 Nebraska Corporation Income Tax - revenue ne

Show details

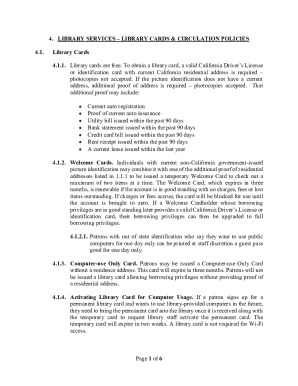

Instructions for completing the Nebraska Corporation Income Tax Return, Form 1120N, outlining who must file, the tax rate, payment information, and additional requirements for various types of corporations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1999 nebraska corporation income

Edit your 1999 nebraska corporation income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1999 nebraska corporation income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1999 nebraska corporation income online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1999 nebraska corporation income. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1999 nebraska corporation income

How to fill out 1999 Nebraska Corporation Income Tax

01

Obtain a copy of the 1999 Nebraska Corporation Income Tax form.

02

Fill in the corporation's name, address, and federal Employer Identification Number (EIN) at the top of the form.

03

Complete the income section by reporting total income from all sources.

04

Deduct allowable business expenses to calculate the taxable income.

05

Fill out any additional schedules required based on the types of income and deductions.

06

Calculate the tax due by applying the appropriate tax rate to the taxable income.

07

Include any tax credits that the corporation is eligible for in the respective sections.

08

Sign and date the form, verifying the accuracy of the information provided.

09

Submit the completed form by the specified filing deadline, either electronically or via mail.

Who needs 1999 Nebraska Corporation Income Tax?

01

Any corporation that operates in Nebraska and has taxable income for the year 1999 is required to file the Nebraska Corporation Income Tax.

Fill

form

: Try Risk Free

People Also Ask about

What was the corporate tax rate in the 90s?

Historical US Federal Corporate Income Tax Rates and Brackets, 1909 to 2025 YearTaxable Income BracketsRates 1993-2017 $15,000,000-$18,333,333 38% 1993-2017 Over $18,333,333 35% 1988-1992 First $50,000 15% 1988-1992 $50,000-$75,000 25%21 more rows • Jan 1, 2025

What was the US tax rate in 1990?

Using this consis- tent definition of income, the average tax rates were 13.56 percent for 1985; 13.59 percent for 1986; 13.49 for 1987; 13.71 percent for 1988; 13.58 percent for 1989; and 13.41 percent for 1990.

What year was the highest corporate tax rate?

The Corporate Tax Rate in the United States stands at 21 percent. Corporate Tax Rate in the United States averaged 31.99 percent from 1909 until 2025, reaching an all time high of 52.80 percent in 1968 and a record low of 1.00 percent in 1910. source: Internal Revenue Service.

When did corporate income tax change?

Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions.

What was the income tax rate in 1999?

The average tax rate on all taxable returns increased approximately 0.4 percentage points from 1998 to 15.7 percent in 1999. On these taxable returns, the average adjusted gross income (less deficit) (AGI) rose 6.4 percent to $59,028, while average total income tax increased to $9,280, a 9.5-percent increase.

What is the Nebraska corporate income tax rate?

State Corporate Income Tax Rates as of January 1, 2024 StateRates Mississippi 5.0% > Missouri 4.0% > Montana 6.75% > Nebraska 5.58% >79 more rows • Jan 23, 2024

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1999 Nebraska Corporation Income Tax?

The 1999 Nebraska Corporation Income Tax is a state tax imposed on the taxable income of corporations operating in Nebraska for the year 1999.

Who is required to file 1999 Nebraska Corporation Income Tax?

Corporations that are organized or doing business in Nebraska and that have taxable income are required to file the 1999 Nebraska Corporation Income Tax.

How to fill out 1999 Nebraska Corporation Income Tax?

To fill out the 1999 Nebraska Corporation Income Tax, corporations must complete the appropriate tax forms provided by the Nebraska Department of Revenue, reporting their income, deductions, and credits accurately.

What is the purpose of 1999 Nebraska Corporation Income Tax?

The purpose of the 1999 Nebraska Corporation Income Tax is to generate revenue for the state government, which is used to fund public services and infrastructure.

What information must be reported on 1999 Nebraska Corporation Income Tax?

Corporations must report their total income, deductions, taxable income, and any applicable credits on the 1999 Nebraska Corporation Income Tax form.

Fill out your 1999 nebraska corporation income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1999 Nebraska Corporation Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.