Get the free Charitable Organization Ticket Donation Acknowledgment - boxing nv

Show details

This document serves as an acknowledgment for the donation of tickets from a promoter to a charitable organization for an event related to unarmed combat, ensuring compliance with state regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable organization ticket donation

Edit your charitable organization ticket donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable organization ticket donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable organization ticket donation online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit charitable organization ticket donation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable organization ticket donation

How to fill out Charitable Organization Ticket Donation Acknowledgment

01

Start with your organization's name and logo at the top of the document.

02

Include the date of the acknowledgment.

03

Clearly state that the letter is an acknowledgment of the ticket donation.

04

Mention the donor's name and address.

05

Provide details about the donated tickets (event name, date, number of tickets).

06

Include a statement about the charitable purpose of the event.

07

Clearly state the fair market value of the tickets donated.

08

Thank the donor for their generosity and support of your organization.

09

Provide your organization's tax identification number if applicable.

10

Close the letter warmly and include a contact number for any questions.

Who needs Charitable Organization Ticket Donation Acknowledgment?

01

Charitable organizations seeking to acknowledge ticket donations from individuals or businesses.

02

Donors who need a formal record for tax purposes.

03

Nonprofits hosting events that require ticket donations.

Fill

form

: Try Risk Free

People Also Ask about

How to write an acknowledgement for a donation?

What To Include in Donor Acknowledgement Letters Donor's name. Address the donor by name. Organization's name. Clearly state your nonprofit's name to make the letter official and avoid confusion. Donation amount and date. Type of donation. Tax information. Mission impact. Closing with gratitude. Clear Subject Line.

What to say when receiving a donation?

Generic donation thank you quotes “Thank you so much for your donation. “We know you have a lot of choices when it comes to donating, and we are so grateful that you chose to donate to our cause. “We have a lot of work to do, and your generous donation helps us get that important work done.”

What is an example of a disclaimer statement?

"[The author] assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an "as is" basis with no guarantees of completeness, accuracy, usefulness or timeliness"

What is a good sentence for donation?

He would be worth more but for large donations to charity. She and her family are now reliant on food donations. But please remember it is a charity and make some donation if you want help or advice. It added that the company policy now was not to make political donations.

How do you say thank you for a charitable donation?

Some experts recommend that your acknowledgment read something like, “Thank you for recommending the generous grant of $500.00 that we received on <date> through your donor advised fund at Fidelity Charitable.”

What is a good quote for donations?

It's not how much we give but how much love we put into giving. If you haven't got any charity in your heart, you have the worst kind of heart trouble. Every good act is charity. A man's true wealth hereafter is the good that he does in this world to his fellows.

What is an example of a donation disclaimer?

Below are a few examples of a good legal disclaimer: CPWJ is a Section 501(c) (3) charitable organization, EIN 56-2430722. All donations are deemed tax-deductible absent any limitations on deductibility applicable to a particular taxpayer. No goods or services were provided in exchange for your contribution.

What is an example of a short donation message?

Examples of “please donate” messages: “Please support our cause with a small donation today!” “Your donation will make a real impact on the lives of others. Please consider donating today. Thank you for your generosity.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Charitable Organization Ticket Donation Acknowledgment?

Charitable Organization Ticket Donation Acknowledgment is a document that confirms the charitable receipt of tickets donated to a nonprofit organization for fundraising purposes, allowing donors to claim tax deductions for their contributions.

Who is required to file Charitable Organization Ticket Donation Acknowledgment?

Organizations that receive ticket donations for charitable purposes are required to file Charitable Organization Ticket Donation Acknowledgment. This typically includes nonprofit organizations, charities, and other entities that qualify under relevant tax-exempt guidelines.

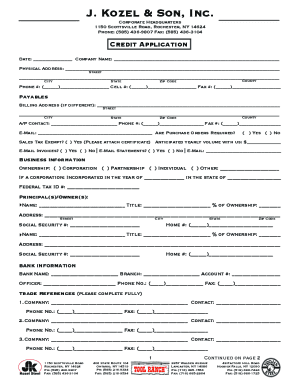

How to fill out Charitable Organization Ticket Donation Acknowledgment?

To fill out a Charitable Organization Ticket Donation Acknowledgment, the organization must include details such as the donor's name, contact information, a description of the donated tickets, their estimated value, and the date of the donation. It should be signed by an authorized representative of the organization.

What is the purpose of Charitable Organization Ticket Donation Acknowledgment?

The purpose of the Charitable Organization Ticket Donation Acknowledgment is to provide donors with a formal acknowledgment of their contributions, enabling them to claim tax deductions when filing their tax returns, and to ensure that the organization maintains accurate records of donations.

What information must be reported on Charitable Organization Ticket Donation Acknowledgment?

The information that must be reported on the Charitable Organization Ticket Donation Acknowledgment includes the donor's name and contact details, the description of the donated tickets, the estimated fair market value of the tickets, the date of donation, and a statement confirming that no goods or services were received in exchange for the donation.

Fill out your charitable organization ticket donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Organization Ticket Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.