Get the free Mortgage Broker Bond Example - mld nv

Show details

This document serves as a bond for mortgage brokers, ensuring compliance with the provisions of Nevada Revised Statutes related to mortgage lending and protecting consumers from damages due to violations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage broker bond example

Edit your mortgage broker bond example form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage broker bond example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage broker bond example online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage broker bond example. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

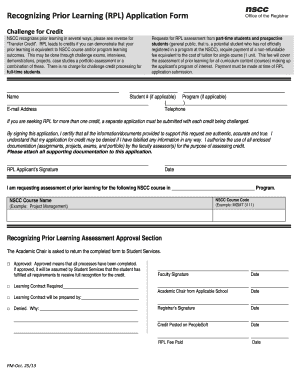

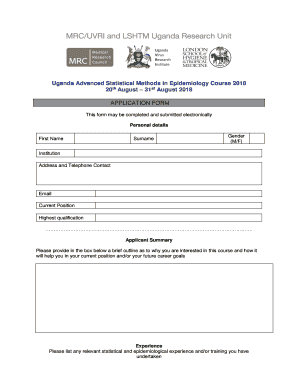

How to fill out mortgage broker bond example

How to fill out Mortgage Broker Bond Example

01

Gather necessary documents: Collect your personal identification, business information, and any required financial statements.

02

Understand the bond amount: Determine the amount required by the state for the mortgage broker bond.

03

Find a surety company: Research and select a reputable surety company that offers mortgage broker bonds.

04

Complete the application: Fill out the application form provided by the surety company accurately.

05

Provide required information: Submit any supporting documents required by the surety company, such as credit history and financial statements.

06

Review the bond terms: Carefully read and understand the terms and conditions of the bond.

07

Pay the premium: Pay the bond premium, which is a percentage of the total bond amount.

08

Receive your bond: Once approved, the surety company will issue the mortgage broker bond.

Who needs Mortgage Broker Bond Example?

01

Licensed mortgage brokers who operate in the state requiring the bond.

02

Individuals or businesses that provide mortgage-related services.

03

Entities looking to comply with state regulations for mortgage brokerage.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a mortgage bond?

For example, a company borrowed $1 million from a bank and put its equipment up as collateral. The bank is the holder of the mortgage bond and owns a claim on the company's equipment. The company pays interest and the principal back to the bank through periodic coupon payments.

How do mortgage bonds work?

The key feature of mortgage bonds is their fixed-income nature. Investors receive regular interest payments funded by the mortgage payments made by homeowners. If borrowers default, bondholders have the legal right to claim and sell the underlying properties to recover their investments.

What is the minimum surety bond for a mortgage broker?

California Financial Code Section 22112 requires individuals file a minimum $25,000 surety bond amount when applying for a state finance lender or finance broker license.

What is a bond in a mortgage?

A home loan or bond, is a loan that a bank is willing to make to you over a long term (20 or 30 years). In return, the bank gets to charge you interest on the amount loaned and holds your property as collateral in case you can't make your monthly payments.

What is a broker surety bond?

Key Points about a Freight Broker Surety Bond: The bond protects shippers and carriers by ensuring freight brokers fulfill their contractual obligations. Premiums range between 1.25% and 10% of the bond amount, determined by the broker's financial history.

What is the ratio for surety bonds?

The most critical liquidity ratios for bonding include: Current Ratio (Current Assets / Current Liabilities): A ratio of 1.5 or higher is often preferred by sureties, indicating that the company has sufficient short-term assets to cover its liabilities.

What is the minimum surety bond amount for a mortgage broker?

California Financial Code Section 22112 requires individuals file a minimum $25,000 surety bond amount when applying for a state finance lender or finance broker license.

What determines the amount of a surety bond?

Surety premium is calculated based on several factors that assess the risk and financial stability of the party seeking the surety bond. To determine the premium, the surety provider considers the applicant's credit history, industry experience, financial statements, and the type and size of the bond required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Broker Bond Example?

A Mortgage Broker Bond Example is a legally binding agreement that ensures mortgage brokers adhere to specific regulations and ethical practices while conducting business.

Who is required to file Mortgage Broker Bond Example?

Mortgage brokers, who are licensed to facilitate loans between lenders and borrowers, are required to file a Mortgage Broker Bond.

How to fill out Mortgage Broker Bond Example?

To fill out a Mortgage Broker Bond Example, one must provide details such as the broker's name, business address, bond amount, and the surety company's information.

What is the purpose of Mortgage Broker Bond Example?

The purpose of a Mortgage Broker Bond Example is to protect clients and the public by ensuring that the broker operates honestly and complies with state regulations.

What information must be reported on Mortgage Broker Bond Example?

Information that must be reported includes the broker's name, the bond amount, the duration of the bond, the surety company, and any applicable state license numbers.

Fill out your mortgage broker bond example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Broker Bond Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.