Get the free SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT

Show details

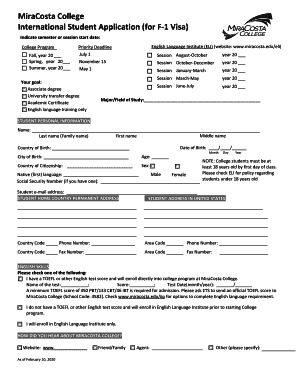

This document serves as an affidavit for declaring vehicles operated under the Supplemental Governmental Services Tax in Nevada.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental governmental services tax

Edit your supplemental governmental services tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental governmental services tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supplemental governmental services tax online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit supplemental governmental services tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental governmental services tax

How to fill out SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT

01

Obtain the SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT form from the appropriate government website or office.

02

Read the instructions included with the form carefully to understand the requirements.

03

Fill in your personal or business information at the top of the form, including name, address, and contact information.

04

Provide detailed information about your supplemental governmental services for which you are claiming the tax exemption.

05

Attach any required documentation that supports your claim (e.g., receipts, contracts, etc.).

06

Review the completed form for accuracy and completeness.

07

Sign and date the affidavit where indicated.

08

Submit the completed form and any attachments to the designated government agency by the specified deadline.

Who needs SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT?

01

Businesses or individuals who provide supplemental governmental services and wish to claim tax exemptions or credits related to those services.

Fill

form

: Try Risk Free

People Also Ask about

What is the supplemental government services tax in Nevada?

The minimum Governmental Services Tax is $16.00. The Governmental Services Tax is 4 cents on each $1 of the depreciated DMV Valuation. The Supplemental Governmental Services Tax is 1 cent on each $1 of the depreciated DMV Valuation.

How much income is required for an affidavit of support i-864?

I-864P, 2025 HHS Poverty Guidelines for Affidavit of Support Sponsor's Household Size100% of HHS Poverty Guidelines*125% of HHS Poverty Guidelines* 2 $21,150 $26,437 3 $26,650 $33,312 4 $32,150 $40,187 5 $37,650 $47,0625 more rows • Feb 28, 2025

What is proof of relationship for I-864A?

Proper documentation, such as most recent federal tax returns, birth certificates, and proof of residence must be submitted to USCIS to prove the relationship and shared residence. The household members do not have to be US citizens or permanent residents.

What is an I-864 affidavit of support under section 213A of the INA?

Form I-864, Affidavit of Support under Section 213A of the INA, is a contract an individual signs agreeing to use their financial resources to support the intending immigrant named on the affidavit.

What is the Affidavit of support in English?

An Affidavit of Support, also called the Form I-864, is a document an individual signs to accept financial responsibility for the applicant who is coming to live in the United States. The person who signs the Affidavit of Support is also called the “sponsor.”

What is Form I-864 Affidavit of Support under section 213A?

Form I-864, Affidavit of Support under Section 213A of the INA, is a contract an individual signs agreeing to use their financial resources to support the intending immigrant named on the affidavit.

Can I submit an I-864 electronically?

Can I file Form I-864 online? If you received Form I-864 through the National Visa Center (NVC), you can submit it online through the Consular Electronic Application Center (CEAC).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT?

The Supplemental Governmental Services Tax Affidavit is a legal document used by individuals or entities to affirm their compliance with specific tax obligations related to supplemental governmental services.

Who is required to file SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT?

Typically, individuals or businesses that receive or provide supplemental governmental services and are subject to the associated tax requirements are required to file this affidavit.

How to fill out SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT?

To fill out the affidavit, applicants should provide their identifying information, details about the services rendered, tax identification numbers, and any required signatures, following the specific format outlined by the governing tax authority.

What is the purpose of SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT?

The purpose of the affidavit is to ensure transparency and compliance with tax regulations related to supplemental governmental services, allowing authorities to track and manage tax liabilities.

What information must be reported on SUPPLEMENTAL GOVERNMENTAL SERVICES TAX AFFIDAVIT?

The affidavit must typically report the name and address of the filer, the nature of the services provided, the amount of tax owed, relevant identification numbers, and any applicable dates related to the services or tax due.

Fill out your supplemental governmental services tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Governmental Services Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.