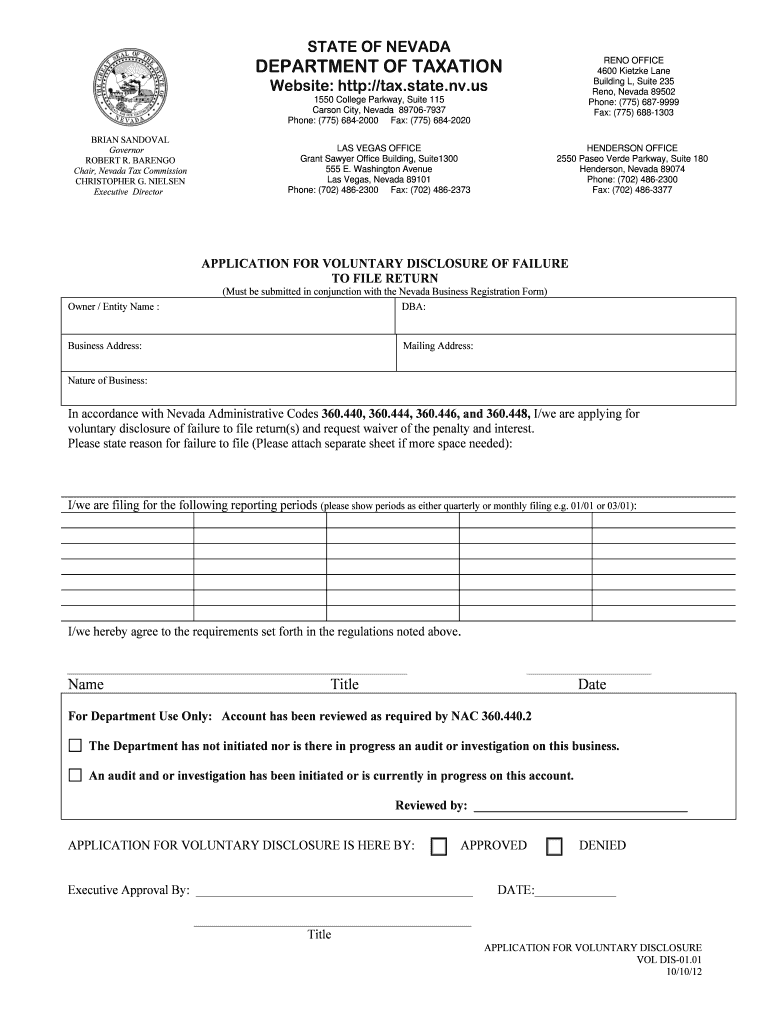

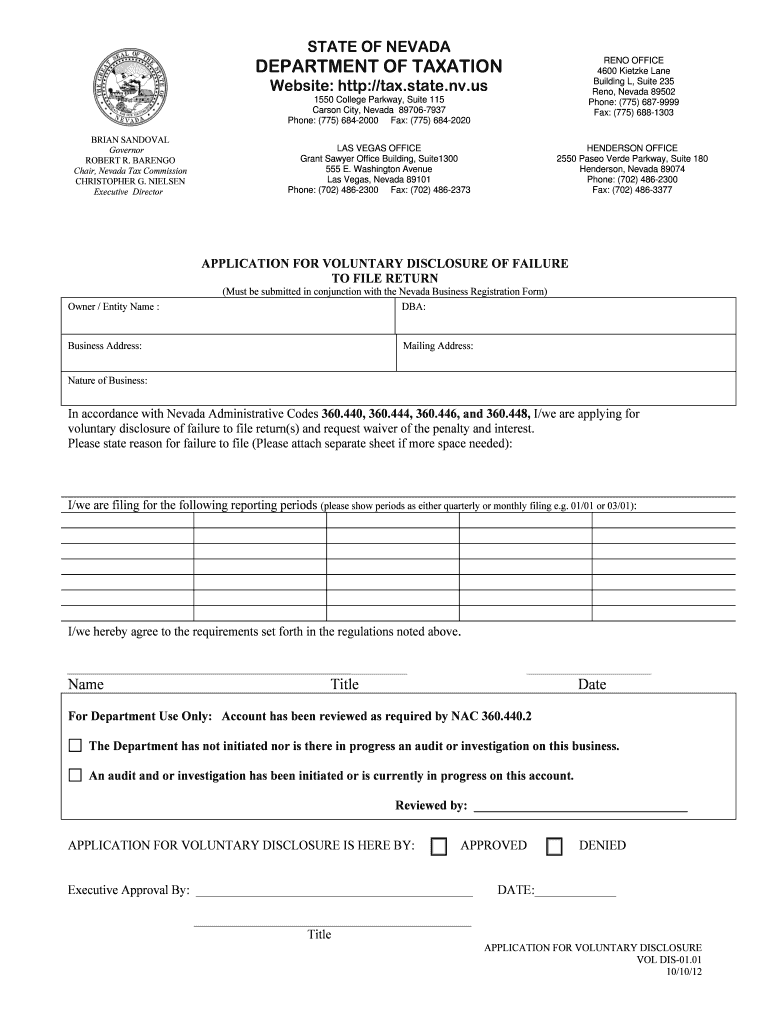

Get the free APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN - tax state nv

Show details

This document is used by individuals or entities in Nevada to apply for voluntary disclosure of their failure to file tax returns and to request a waiver of penalties and interest as outlined by the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for voluntary disclosure

Edit your application for voluntary disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for voluntary disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for voluntary disclosure online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for voluntary disclosure. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for voluntary disclosure

How to fill out APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN

01

Obtain the APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN form from the relevant tax authority's website or office.

02

Carefully read the instructions provided with the form to ensure all information required is understood.

03

Begin filling out the form by entering your personal information, including your name, address, and Social Security Number (SSN) or Tax Identification Number (TIN).

04

Provide details regarding the periods for which the returns were not filed, including tax year and corresponding due dates.

05

Explain the reasons for failing to file the returns, ensuring the explanation is clear and complete.

06

Include any additional information requested in the form, such as income details or deductions applicable to the unfiled returns.

07

Review the entire form for accuracy and completeness before signing and dating it.

08

Submit the completed application form according to the instructions provided, either online or by mail, and keep a copy for your records.

Who needs APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN?

01

Individuals who have failed to file their tax returns and want to rectify their tax status.

02

Taxpayers who may be facing potential penalties or legal issues due to unfiled returns.

03

Those seeking to disclose their noncompliance in a voluntary manner to avoid stricter enforcement actions.

Fill

form

: Try Risk Free

People Also Ask about

What percentage do you have to repay ERC voluntary disclosure program?

Advantages of the second ERC Voluntary Disclosure Program You need to repay only 85% of the ERC you received as a credit on your return or as a refund.

Is OVDp still available?

The Offshore Voluntary Disclosure Program (OVDP) has closed. Refer to the OVDP FAQs for an outline of the sunset provisions. See Form 14457, Voluntary Disclosure Practice Preclearance Request and Application PDF , which provides instructions detailing the current guidance regarding the voluntary disclosure practice.

How to make voluntary disclosure?

The Process of Making a Voluntary Disclosure to SARS The applicant must complete and submit a VDP01 form via eFiling or at a SARS branch, providing all the relevant information and supporting documents about the default or non-compliance.

How do I file a voluntary disclosure?

To make a voluntary disclosure, you must complete and submit form RC199 to the CRA. You can submit the form electronically or by mail. The safest way to submit it is through an experienced Canadian tax lawyer.

How much does a voluntary disclosure agreement cost?

Cost of VDA Costs can range from $2 - 20K+ per state to utilize a third party tax advisor to support the process, in particular serving as a confidential third party to maintain anonymity through the process in some states.

What is an example of a voluntary disclosure?

Types and examples Voluntary disclosures can include strategic information such as company characteristics and strategy, nonfinancial information such socially responsible practices, and financial information such as stock price information.

What are the rules for voluntary disclosure?

A voluntary disclosure occurs when a taxpayer provides information that is truthful, timely, and complete. The taxpayer must cooperate with the IRS in determining his or her correct tax liability and make arrangements to pay the IRS in full.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN?

The APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN is a legal form that allows individuals or entities to voluntarily disclose any failure to file tax returns to the relevant tax authority, thereby seeking to resolve any outstanding tax obligations and potential penalties.

Who is required to file APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN?

Individuals or entities who have failed to file their tax returns within the required deadlines are required to submit this application to come forward voluntarily and rectify their tax filing status.

How to fill out APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN?

To fill out the APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN, one must provide personal or business information, specify the tax years for which the returns were not filed, detail the reasons for the failure, and include any supporting documentation that may assist in the review of the application.

What is the purpose of APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN?

The purpose of this application is to encourage compliance by allowing taxpayers to proactively disclose their failure to file returns, thereby mitigating potential penalties and interest while resolving their tax liabilities.

What information must be reported on APPLICATION FOR VOLUNTARY DISCLOSURE OF FAILURE TO FILE RETURN?

The application must report the taxpayer's name, contact information, tax identification number, details of the unfiled tax returns including tax years, reason for the failure to file, and any related financial information that the tax authority may require for assessment.

Fill out your application for voluntary disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Voluntary Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.