Get the free TAXPAYER INFO PACKET - tax state nv

Show details

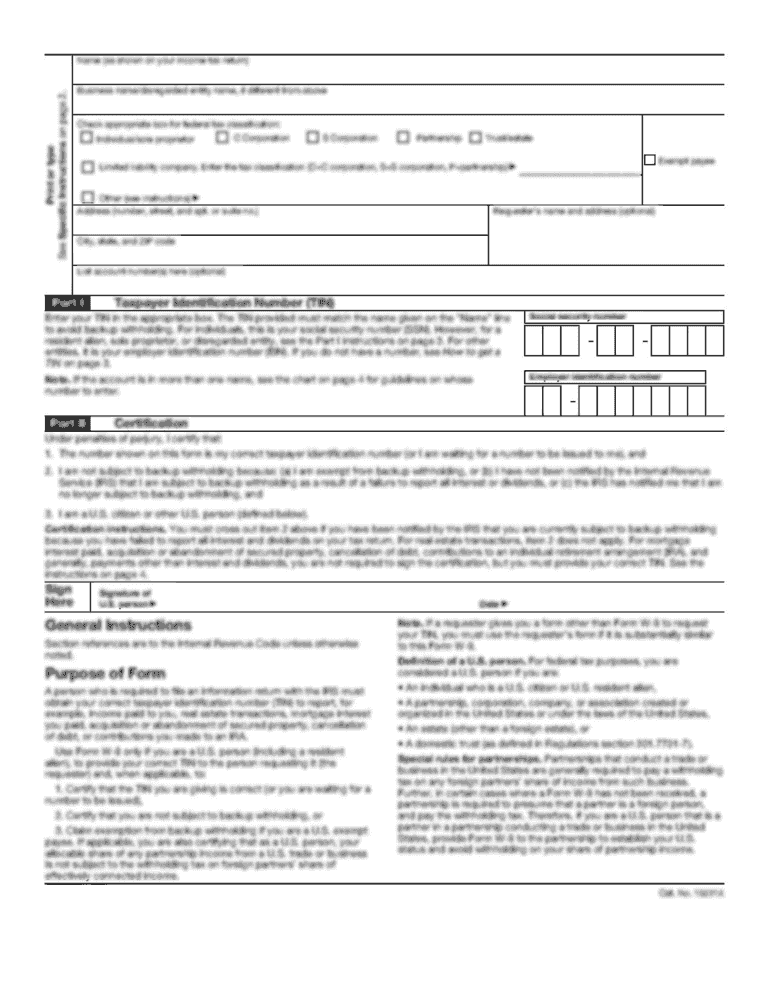

This document serves as an informational packet from the Nevada Department of Taxation, providing important details about taxes, forms, payments, and services for taxpayers in Nevada.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxpayer info packet

Edit your taxpayer info packet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxpayer info packet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxpayer info packet online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit taxpayer info packet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxpayer info packet

How to fill out TAXPAYER INFO PACKET

01

Begin by gathering all necessary personal information, such as your name, address, and Social Security number.

02

Collect relevant financial documents, including W-2 forms, 1099 forms, and any other income-related paperwork.

03

Fill out the form carefully, ensuring all information is accurate and matches your financial documents.

04

Review all entries for typos or errors before finalizing the packet.

05

Include any additional required documentation, such as proof of deductions or credits.

06

Sign and date the packet, if required, to complete the submission.

Who needs TAXPAYER INFO PACKET?

01

Individuals filing their income tax returns.

02

Self-employed individuals reporting business income.

03

Anyone applying for tax credits or deductions.

04

Tax professionals assisting clients with tax filings.

Fill

form

: Try Risk Free

People Also Ask about

Should I use form 1040 or 1040A?

The 1040A is a simpler version of Form 1040. You can use it if you meet the 1040A requirements, which are less complex than those for a 1040. If you're filing a paper return and meet the requirements, using the simpler 1040A reduces the chance for both: Costly errors.

What is the taxpayer information summary?

Taxpayer Information Summary (TIS) is an information category wise aggregated information summary for a taxpayer.

What is the best way to call the IRS?

You can call 1-800-829-1040 to get answers to your federal tax questions 24 hours a day. Tax forms and instructions for current and prior years are available by calling 1-800-829-3676. You can also order free publications on a wide variety of tax topics.

How do I call the IRS from outside the US?

800-829-4933 for business callers. 267-941-1000 for international callers or overseas taxpayers.

Is a tin the same as my SSN?

The Taxpayer Identification Number (TIN) is an umbrella term and it comprises several different types of tax IDs. The three most important TIN's are Social Security Number (SSN), Employer Identification Number (EIN), and Individual Taxpayer Identification Number (ITIN).

How much does it cost to call the IRS from the UK?

So, if you're worried about being on hold with the IRS for a long time, you can call the IRS' mainline number 800–829–1040, and be on hold for any amount of time, and it won't cost you even 1 cent.

What number is 1 800 829 8310?

What Is the IRS' Phone Number for CP2000? The IRS' contact information is displayed on the CP2000 notice in the top right corner of the letter: Phone number: 1-800-829-8310.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAXPAYER INFO PACKET?

The TAXPAYER INFO PACKET is a document that provides essential information about a taxpayer's obligations, rights, and the necessary paperwork required for proper tax filing.

Who is required to file TAXPAYER INFO PACKET?

Individuals and entities who have a tax obligation, including self-employed individuals, businesses, and those claiming specific tax credits or deductions, are typically required to file a TAXPAYER INFO PACKET.

How to fill out TAXPAYER INFO PACKET?

To fill out a TAXPAYER INFO PACKET, gather all relevant financial documentation, provide accurate personal and financial information, and follow the instructions provided with the packet to ensure completeness and accuracy.

What is the purpose of TAXPAYER INFO PACKET?

The purpose of the TAXPAYER INFO PACKET is to inform taxpayers of their tax responsibilities, assist in the correct filing process, and provide a clear outline of necessary documentation and information needed for tax purposes.

What information must be reported on TAXPAYER INFO PACKET?

The information that must be reported on a TAXPAYER INFO PACKET typically includes personal identification details, income sources, deductions claimed, credits applicable, and any other pertinent financial information necessary for tax assessment.

Fill out your taxpayer info packet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxpayer Info Packet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.