Get the free Nevada Department of Taxation Annual Insurance Premium Tax Return - tax state nv

Show details

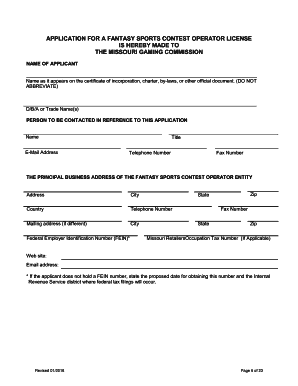

This document serves as the Annual Insurance Premium Tax Return for insurance companies operating in Nevada, detailing various premiums, credits, and tax calculations for the year 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nevada department of taxation

Edit your nevada department of taxation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nevada department of taxation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nevada department of taxation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nevada department of taxation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nevada department of taxation

How to fill out Nevada Department of Taxation Annual Insurance Premium Tax Return

01

Obtain the Nevada Department of Taxation Annual Insurance Premium Tax Return form.

02

Fill in your insurance company's name, address, and tax identification number.

03

Complete the section detailing premium amounts collected during the tax year.

04

Calculate any allowable deductions if applicable.

05

Determine the total insurance premium tax owed based on the applicable rate.

06

Review and sign the return to certify that the information provided is accurate.

07

Submit the completed form along with any payment required to the Nevada Department of Taxation by the deadline.

Who needs Nevada Department of Taxation Annual Insurance Premium Tax Return?

01

Any insurance company that conducts business and collects premiums in Nevada must file the Annual Insurance Premium Tax Return.

02

Insurance providers licensed in Nevada, whether domestic or foreign, are also required to submit this return.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Nevada tax return?

Since Nevada does not collect an income tax on individuals, you are not required to file a NV state income tax return.

What is the premium rate of insurance?

Premium – The amount you pay to an insurance company for an insurance policy. Rate – The cost of insurance per exposure unit ($1,000 of home coverage or one year of auto coverage).

What is the premium tax in Nevada?

When are state premium taxes due? State Tax on Life Insurance and Annuity Premium As of January 1, 2023 NV - Nevada no premium tax on qualified monies 3.50% SD - South Dakota no premium tax on qualified monies 1.25% on first $500,000 TX - Texas 0.04% 0.04% WV - West Virginia 1.00% 1.00%6 more rows

How to verify a Nevada resale certificate?

Nevada Go to the Nevada Department of Taxation Permit Search page. Under “Reseller Permit Search” choose to search either by Business Name, Business Permit Number (TID) (recommended), or by Address. Enter the specified information, confirm you are not a robot, then click “Search” for results.

What is the insurance premium tax in Nevada?

About Nevada Insurance Premium Tax and the Rates A tax rate of 3.5 percent is imposed on insurers for the privilege of transacting business in this State. Qualified Risk Retention Groups pay a premium tax of 2%. The premium tax is due on March 15th of each year on premiums written in the prior calendar year.

How to calculate IPT?

How is IPT calculated? The Government sets IPT which is calculated as a percentage of your premium, meaning the higher your premium cost, the greater the tax. For example: If your annual premium is £300, with 12% IPT, it will be £336.

Where do I find my Nevada MBT number?

It is issued by the Nevada Department of Taxation. You'll receive your MBT account number with your “New Nevada Employer Welcome Package.”

What is the state tax rate in Nevada?

Rate Sheets: The base State Sales Tax rate in Nevada is 6.85%. However, local jurisdictions can add additional taxes, which can make the total Sales Tax rate vary significantly from one area to another.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nevada Department of Taxation Annual Insurance Premium Tax Return?

The Nevada Department of Taxation Annual Insurance Premium Tax Return is a form used by insurance companies operating in Nevada to report and pay the annual insurance premium tax based on the premiums they collect.

Who is required to file Nevada Department of Taxation Annual Insurance Premium Tax Return?

Insurance companies that are licensed to conduct business in Nevada are required to file the Nevada Department of Taxation Annual Insurance Premium Tax Return.

How to fill out Nevada Department of Taxation Annual Insurance Premium Tax Return?

To fill out the Nevada Department of Taxation Annual Insurance Premium Tax Return, insurance companies must provide their business information, calculate the total premiums written, apply the appropriate tax rates, and report any deductions or credits.

What is the purpose of Nevada Department of Taxation Annual Insurance Premium Tax Return?

The purpose of the Nevada Department of Taxation Annual Insurance Premium Tax Return is to ensure that insurance companies accurately report their insurance premiums and pay the corresponding taxes to the state of Nevada.

What information must be reported on Nevada Department of Taxation Annual Insurance Premium Tax Return?

The information that must be reported includes total premiums collected, deductions for certain types of insurance, the calculation of tax owed, and any applicable credits.

Fill out your nevada department of taxation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nevada Department Of Taxation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.