KS TR-85 2004 free printable template

Show details

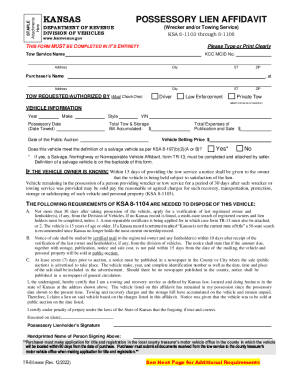

STAPLE Attachments Here KANSAS DEPARTMENT OF REVENUE DIVISION OF VEHICLES www.ksrevenue.org POSSESSOR LIEN AFFIDAVIT (Wrecker and/or Towing Service) KSA 8-1103 through 8-1108 Please Type or Print

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS TR-85

Edit your KS TR-85 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS TR-85 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS TR-85 online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KS TR-85. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS TR-85 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS TR-85

How to fill out KS TR-85

01

Gather all necessary documentation and information required for the KS TR-85 form.

02

Start filling in the applicant's details, including name, address, and contact information.

03

Provide the purpose of the application clearly in the designated section.

04

Fill out the specific sections related to the project or request, ensuring accuracy in details.

05

Include any supporting documents as required and reference them in the appropriate sections of the form.

06

Review all filled information for any errors or omissions before submitting.

07

Submit the form through the designated submission channel, whether online or in-person.

Who needs KS TR-85?

01

Individuals or organizations applying for specific permits or approvals that require the KS TR-85 form.

02

Professionals or businesses involved in projects that fall under regulatory oversight necessitating this documentation.

03

Any stakeholders who need to document their compliance with relevant laws or regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I remove a lien from my car title in Kansas?

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

How do I file a lien against a property in Kansas?

ing to the mechanics lien law, after your notices are served timely the lien must be filed in the county recorder's office in the county where the property is located. The lien may either be served by certified mail, return receipt requested, or personally served on each of the parties.

How long do you have to file a lien in Kansas?

Lien must be filed within 3 months of last providing materials or labor, unless a one-month extension is filed and served. Action to enforce must be commenced within 1 year of filing of lien.

How do you put a lien on a car in Kansas?

To perfect a security interest on a vehicle, a NSI must be filed within 30 days of date of purchase. To file a NSI you will need to complete Form TR-730 and mail to the Division of Vehicles or file through the Kansas E-lien system.

How do you put a lien on a property in Kansas?

ing to the mechanics lien law, after your notices are served timely the lien must be filed in the county recorder's office in the county where the property is located. The lien may either be served by certified mail, return receipt requested, or personally served on each of the parties.

How do I get a title after paying off my car loan in Kansas?

Titles After Loan Payoff If you would like to remove the lien holder's name from the title, you must fill out an application for a reissue title (TR-720B) and bring it, along with your current vehicle registration, title and lien release to any one of the tag offices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get KS TR-85?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the KS TR-85. Open it immediately and start altering it with sophisticated capabilities.

Can I create an eSignature for the KS TR-85 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your KS TR-85 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete KS TR-85 on an Android device?

Use the pdfFiller app for Android to finish your KS TR-85. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is KS TR-85?

KS TR-85 is a tax form used in the state of Kansas for reporting specific types of transactions or tax obligations.

Who is required to file KS TR-85?

Individuals or entities engaged in certain taxable activities as specified by the Kansas Department of Revenue are required to file KS TR-85.

How to fill out KS TR-85?

To fill out KS TR-85, taxpayers must provide their identification details, report relevant income or expenditure, and follow the instructions laid out by the Kansas Department of Revenue.

What is the purpose of KS TR-85?

The purpose of KS TR-85 is to ensure compliance with tax obligations and provide the state with accurate information regarding taxable activities.

What information must be reported on KS TR-85?

Information that must be reported on KS TR-85 includes taxpayer identification, types of transactions, amounts involved, and any applicable deductions or credits.

Fill out your KS TR-85 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS TR-85 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.