Get the free CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT) - nhrs

Show details

Este formulario se utiliza para designar beneficiarios por fallecimiento tras la jubilación en el Sistema de Jubilación de New Hampshire.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign change of death beneficiaryies

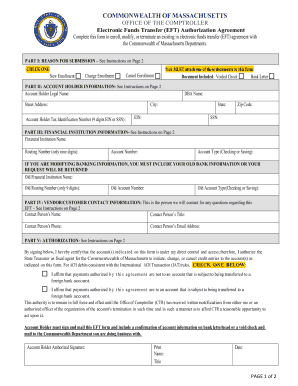

Edit your change of death beneficiaryies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your change of death beneficiaryies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit change of death beneficiaryies online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit change of death beneficiaryies. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out change of death beneficiaryies

How to fill out CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT)

01

Obtain the CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT) form from your retirement plan provider.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill out your personal details at the top of the form, including your name, address, and retirement account number.

04

List the new beneficiaries you wish to designate, including their full names and relationship to you.

05

Indicate the percentage of your benefits each beneficiary will receive, ensuring the total equals 100%.

06

Sign and date the form to certify the changes.

07

Submit the completed form to your retirement plan provider, keeping a copy for your records.

Who needs CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT)?

01

Individuals who wish to change their designated beneficiaries for their retirement account after retirement.

02

Retirees who have had changes in their personal situation, such as marriage, divorce, or the death of a previous beneficiary.

03

Anyone who wants to ensure their retirement benefits are directed to the intended recipients.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my dad's 401k?

Contact the 401(k) company and ask them what they need. It's usually an official copy of the POA document. With that you should be able to access the money without the help of an attorney. But you still may need an attorney for other issues that arise as your father's disease progresses. I wish you the best.

What is a post retirement death benefit?

Post-Retirement Death Benefit This is a one-time, lump sum benefit payable to your beneficiaries if you die after retiring directly from service, or within one year of leaving public employment. Not all retirees are eligible — it depends on your retirement plan and tier.

Who inherits retirement?

Some retirement plans require specific beneficiaries under the terms of the plan (such as a spouse or child). Beneficiaries of an IRA, and most plans, have the option of taking a lump-sum distribution of the inherited account at any time.

Can I get my dad's pension if he died?

When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant's designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity).

What happens to my dad's retirement when he dies?

When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant's designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity).

What happens when the beneficiary of a pension dies after?

If you don't designate a beneficiary or if the original beneficiary has since died and you failed to assign a replacement or don't have a contingent beneficiary, your pension will be distributed ing to the rules specified in your pension plan and in some cases, your state of residence.

Can I change my pension beneficiary after I retire?

Remember: You can change your Option 1 beneficiary at any time . non-domestic partner beneficiary disclaims their entitlement to your CalPERS benefits Do not have a qualifying life event that allows you to change your retirement payment option . Remember: You can change your Option 1 beneficiary at any time .

Can I collect my deceased spouse's retirement?

In most typical claims for benefits a: Surviving spouse, at full retirement age or older, generally gets 100% of the worker's basic benefit amount. Surviving spouse, age 60 or older, but younger than full retirement age, gets between 71% and 99% of the worker's basic benefit amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT)?

CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT) refers to the process by which a retiree can update or designate new beneficiaries to receive death benefits from their retirement plan upon their passing.

Who is required to file CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT)?

Individuals who have retired and wish to update their death benefits designations are required to file CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT). This includes retirees who have experienced changes in personal circumstances, such as marriage, divorce, or the death of a previously designated beneficiary.

How to fill out CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT)?

To fill out the CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT), retirees need to provide their personal information, details of current beneficiaries, and the new beneficiary's information. The form must be signed and dated, and may require notarization depending on the organization's requirements.

What is the purpose of CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT)?

The purpose of CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT) is to ensure that the death benefits are distributed according to the retiree's current wishes and personal circumstances, providing clarity and avoiding potential disputes among heirs.

What information must be reported on CHANGE OF DEATH BENEFICIARY(IES) (POST-RETIREMENT)?

The information that must be reported includes the retiree's name, retirement account details, the names and contact information of current and new beneficiaries, the relationship to the retiree, and any percentage or share allocation of the benefits among multiple beneficiaries.

Fill out your change of death beneficiaryies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Change Of Death Beneficiaryies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.