Get the free Post-Retirement Beneficiary Renunciation of Survivorship Pension - nhrs

Show details

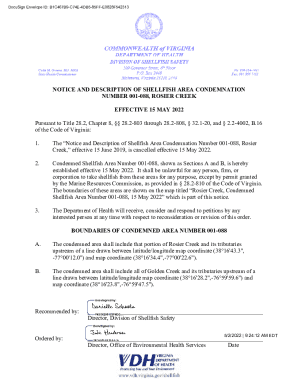

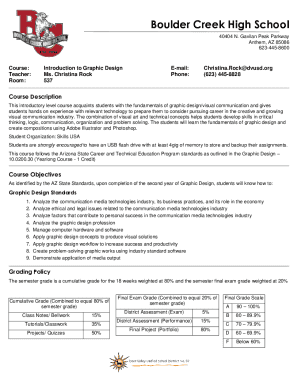

Nhrs. org - Email info nhrs. org POST- RETIREMENT BENEFICIARY RENUNCIATION OF SURVIVORSHIP PENSION The beneficiary of a retiree who elected Survivorship Option 2 3 or 4 at retirement and designated a single beneficiary may choose to voluntarily renounce any and all entitlement to a lifetime survivorship pension provided the renunciation occurs prior to the retiree s death. SECTION I - TO BE COMPLETED BY THE BENEFICIARY Print Beneficiary Name Beneficiary Social Security Beneficiary Phone...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign post-retirement beneficiary renunciation of

Edit your post-retirement beneficiary renunciation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your post-retirement beneficiary renunciation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit post-retirement beneficiary renunciation of online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit post-retirement beneficiary renunciation of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out post-retirement beneficiary renunciation of

How to fill out Post-Retirement Beneficiary Renunciation of Survivorship Pension

01

Obtain the Post-Retirement Beneficiary Renunciation of Survivorship Pension form from your retirement plan administrator.

02

Read the instructions carefully to understand the purpose and implications of the renunciation.

03

Fill in your personal information, including your name, address, and retirement account details.

04

Identify the beneficiary or beneficiaries you are renouncing rights to in the appropriate section of the form.

05

Sign and date the form to validate your decision to renounce the survivorship pension rights.

06

Submit the completed form to the appropriate office or individual as indicated in the instructions.

Who needs Post-Retirement Beneficiary Renunciation of Survivorship Pension?

01

Individuals who are retiring and wish to renounce the survivorship benefits for a previously designated beneficiary.

02

Retirees who have changed their beneficiary information and want to formalize their new decisions.

03

Participants in a pension plan who are looking to adjust their beneficiary designations post-retirement.

Fill

form

: Try Risk Free

People Also Ask about

How much is the CPP death benefit?

The CPP death benefit is a simple, one-time payment of $2,500, which is paid out immediately after death. Most commonly, it is paid to the estate of the deceased. However, it can also be paid out to alternate beneficiaries, such as: whoever paid or will pay the funeral expenses.

What are the survivor benefits for Otpp?

If you die before receiving 10 years' worth of pension payments, your eligible survivor will receive 100% of your lifetime retirement pension for the balance of the 10 years. You can choose this benefit, at a minimal cost. This benefit is free and automatic if you don't have an eligible spouse at retirement.

How long do survivor benefits last?

Child survivor benefits are generally paid until age 18 or high school graduation. In addition, adults who were disabled before age 22 can receive childhood survivors benefits at any age.

What is the death benefit for Otpp?

If you die before receiving 10 years' worth of pension payments, your eligible survivor will receive 100% of your lifetime retirement pension for the balance of the 10 years. You can choose this benefit at a minimal cost. If you don't have an eligible spouse at retirement, this benefit is free and automatic.

What is the payment on death benefits?

A Pay on Death (POD), aka Transfer on Death (TOD) and Totten Trust, allows the account owner to designate a specific beneficiary who will receive the funds in the account upon their death, bypassing the probate process.

How do I claim my survivors pension?

Apply using a paper application complete the Canada Pension Plan survivor's pension and children's benefits application form (ISP1300) include copies of the documents, if any. mail the form and documents or drop them off at a Service Canada office, and.

What is the survivor benefit of the pension?

Joint and Survivor Benefit: monthly payments based on you and your spouse's lifetime. This means that should the pension-earner die first, the spouse will continue to receive survivor's benefits from your spouse's pension.

What is the lump sum of pension benefits when someone dies?

The lump sum death benefit allowance applies at a relevant benefit crystallisation event when someone dies or on the payment of a serious ill-health lump sum. It is important to remember most tax-free lump sum benefits paid during the individual's lifetime are also deducted from this allowance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Post-Retirement Beneficiary Renunciation of Survivorship Pension?

Post-Retirement Beneficiary Renunciation of Survivorship Pension is a formal process in which a retiree or beneficiary renounces their right to receive a survivorship pension that would otherwise pass to them upon the death of the retired employee.

Who is required to file Post-Retirement Beneficiary Renunciation of Survivorship Pension?

Typically, the retiree or the designated beneficiary of the retirement plan is required to file the Post-Retirement Beneficiary Renunciation of Survivorship Pension.

How to fill out Post-Retirement Beneficiary Renunciation of Survivorship Pension?

To fill out the form, the individual must provide personal information including their name, address, and relationship to the retiree, as well as details regarding the pension plan. They must also sign and date the form, affirming their decision to renounce the survivorship benefits.

What is the purpose of Post-Retirement Beneficiary Renunciation of Survivorship Pension?

The purpose of the Post-Retirement Beneficiary Renunciation of Survivorship Pension is to legally document the relinquishment of rights to survivorship benefits, thereby ensuring clarity in the distribution of pension benefits after the retiree's death.

What information must be reported on Post-Retirement Beneficiary Renunciation of Survivorship Pension?

The report must include the retiree's name, the beneficiary's information, details of the retirement plan, a statement of renunciation, and signatures of the retiree and the beneficiary.

Fill out your post-retirement beneficiary renunciation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Post-Retirement Beneficiary Renunciation Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.