Get the free Employer Certification of Credits Earned and Used for Retirement - nhrs

Show details

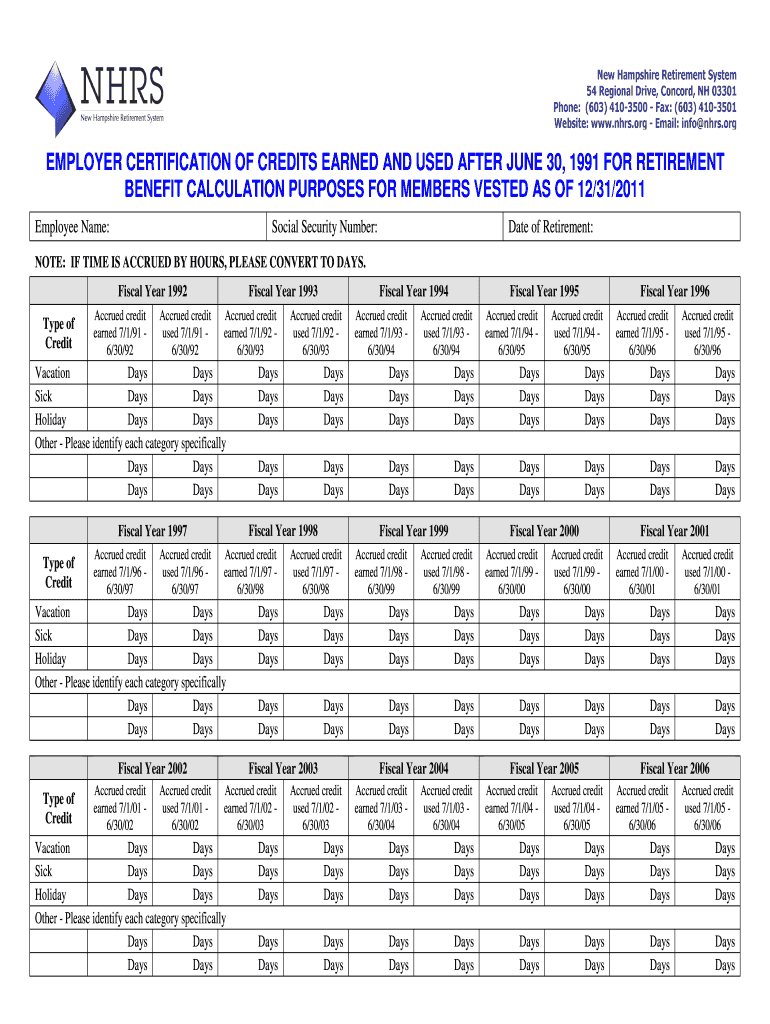

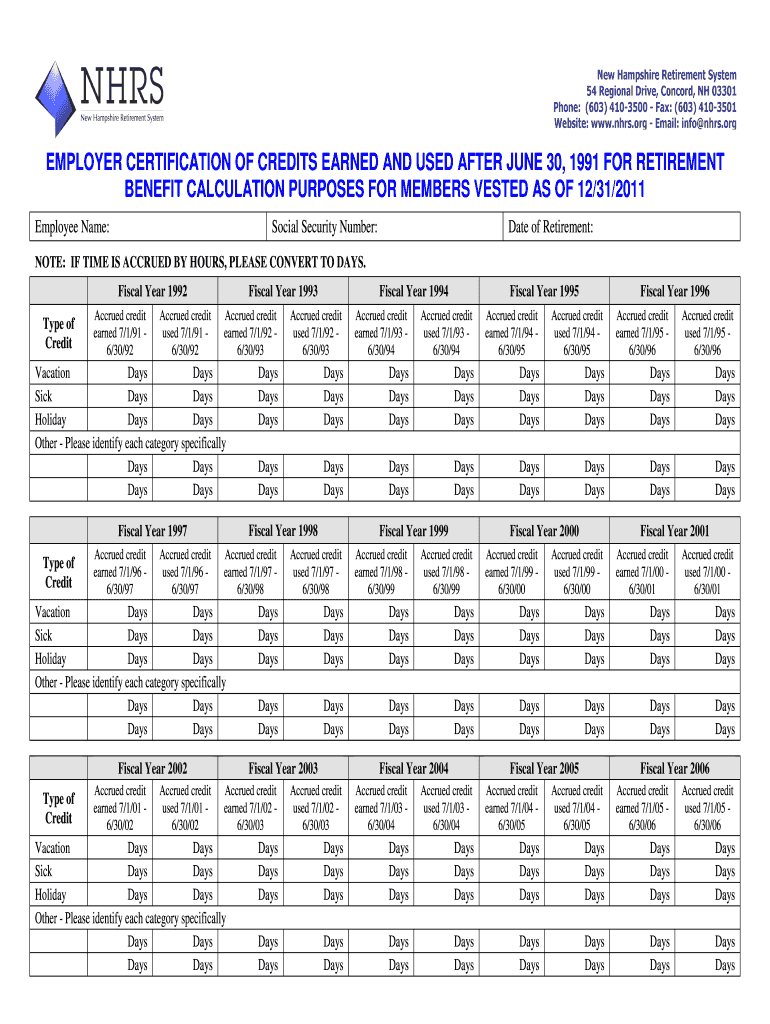

This document serves as a certification of credits earned and used by an employee for retirement benefit calculation purposes, specifically for members vested as of December 31, 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer certification of credits

Edit your employer certification of credits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer certification of credits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employer certification of credits online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit employer certification of credits. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer certification of credits

How to fill out Employer Certification of Credits Earned and Used for Retirement

01

Obtain the Employer Certification form from your employer or the relevant retirement agency.

02

Fill in your personal information such as name, employee ID, and position held.

03

Indicate the dates of employment for which credits are being certified.

04

Provide details of the credits earned, including types of credits (e.g., sick leave, vacation time) and the corresponding amounts.

05

Have an authorized representative of your employer sign the certification to verify the accuracy of the information.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the applicable retirement agency or office.

Who needs Employer Certification of Credits Earned and Used for Retirement?

01

Employees who are nearing retirement and need to certify their earned credits for retirement benefits.

02

Employers who are required to document employees' earned credits for their retirement plans.

03

Human resource departments that manage employee records for retirement certifications.

Fill

form

: Try Risk Free

People Also Ask about

How can I find out the balance of my retirement account?

How to check 401(k) balance in 4 ways Phone. Call the plan administrator at the company that holds your 401(k) account and ask about your account. Your employer's website. Online. Statements. Track your progress toward retirement goals. Ensure your investments align with your risk tolerance. Adjust contributions.

What are SEP simple and qualified plans?

SEP, SIMPLE, and qualified plans offer you and your employees a tax-favored way to save for retirement. You can deduct contributions you make to the plan for your employees. If you are a sole proprietor, you can deduct contributions you make to the plan for yourself.

What is the credit for retirement contributions?

The maximum contribution amount that may qualify for the credit is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). Use the chart below to calculate your credit. Example: Jill, who works at a retail store, is married and earned $41,000 in 2021.

How do I find my retirement account?

You can contact the plan administrator at your former employer or union to see whether you earned a retirement benefit from your past employment. If you aren't sure how to reach the employer or union, an EBSA Benefits Advisor can assist you in locating them.

How to get the retirement savings contribution credit?

To claim a Savers Credit, you have to be: be age 18 or older. not be a full-time student. not be claimed as a dependent on someone else's tax return. have made your retirement contribution during the tax year for which you are filing your return. meet the income requirements.

What is the simple and qualified SEP plan?

SEP, SIMPLE, and qualified plans offer you and your employees a tax-favored way to save for retirement. You can deduct contributions you make to the plan for your employees. If you are a sole proprietor, you can deduct contributions you make to the plan for yourself.

Why am I not getting a retirement savings contribution credit?

Why does TurboTax say I do not qualify for the Retirement Savings Contribution Credit? This is a nonrefundable credit. If your income tax liability is already zero without this credit, you don't get this credit; it cannot be used to reduce your income tax liability below zero.

Who is not eligible to claim the Saver's credit?

Eligibility requirements for the Saver's Credit To qualify, you must be 18 or older, not a full-time student, and not claimed as a dependent on someone else's tax return.

How do I not claim my retirement savings contribution credit?

You can avoid getting the credit by telling TurboTax in the Retirement Savings Contributions Credit section that you were a full-time student, even if you were not. Doing so won't affect your tax return in any other way.

How do I find out all my retirement accounts?

How to find your 401(k) from past jobs Contact previous employers. It may seem obvious, but one of the quickest ways to track down an old 401(k) plan is to go directly to the source. Review past W-2 tax forms. Check your mail. Search the National Registry. Search Form 5500 Directory. State unclaimed property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employer Certification of Credits Earned and Used for Retirement?

Employer Certification of Credits Earned and Used for Retirement is a document used to verify the total credits an employee has earned and utilized towards their retirement benefits. It serves as an official record of an employee's service time and contributions for retirement purposes.

Who is required to file Employer Certification of Credits Earned and Used for Retirement?

Employers who participate in retirement plans regulated by specific retirement laws or policies are required to file the Employer Certification of Credits Earned and Used for Retirement for their employees to ensure accurate accounting of retirement credits.

How to fill out Employer Certification of Credits Earned and Used for Retirement?

To fill out the Employer Certification of Credits Earned and Used for Retirement, an employer must provide the employee's identifying information, the total number of credits earned, the time period during which these credits were accrued, and any credits that have been claimed or used for retirement purposes.

What is the purpose of Employer Certification of Credits Earned and Used for Retirement?

The purpose of the Employer Certification of Credits Earned and Used for Retirement is to ensure that employees' retirement accounts are accurately maintained and reflect the correct amount of service time and contributions, ultimately facilitating the retirement process.

What information must be reported on Employer Certification of Credits Earned and Used for Retirement?

The report must include the employee's name, identification number, total credits earned, credits used, employment dates, and any other relevant information that supports the calculation of retirement benefits.

Fill out your employer certification of credits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Certification Of Credits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.