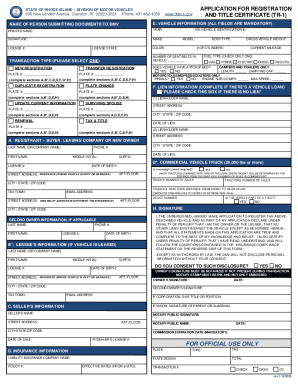

RI TR-1 2006 free printable template

Show details

Penalties for failure to comply with the provisions of the act my result in fines and/or suspension of license and registration. The existence of this act and it s requirements does not prevent the possibility that the applicant may be involved in an accident with an owner or operator of a motor vehicle who is without financial responsibility. OFFICIAL USE ONLY REGISTRATION CHECKLIST Date MISSING Identification Name missing Income tax block Operator Control 401 462-0800 Bill of sale 401...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI TR-1

Edit your RI TR-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI TR-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing RI TR-1 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit RI TR-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI TR-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI TR-1

How to fill out RI TR-1

01

Obtain the RI TR-1 form from the official state website or local tax office.

02

Fill in your personal information, including name, address, and contact details.

03

Complete the section regarding your income sources accurately.

04

Provide any deductions or credits you may qualify for.

05

Review all information for accuracy and completeness.

06

Sign and date the form.

07

Submit the completed form by the designated deadline, either online or by mail.

Who needs RI TR-1?

01

Residents of Rhode Island who need to report their income for tax purposes.

02

Taxpayers who qualify for specific tax credits or deductions.

03

Individuals seeking to amend their previous tax filings.

Instructions and Help about RI TR-1

Fill

form

: Try Risk Free

People Also Ask about

How do you fill out the back of a RI title?

0:58 3:51 Rhode Island SELLER Title Transfer Instructions - YouTube YouTube Start of suggested clip End of suggested clip Next fill in the odometer reading and the space provided enter your mileage. Exactly as it appearsMoreNext fill in the odometer reading and the space provided enter your mileage. Exactly as it appears on your odometer. And do not include tenths.

How do I write a bill of sale for a car in RI?

How Do I Write a Rhode Island Bill of Sale? The names of the parties (printed) The date of the bill of sale. Certain information about the item being sold. The amount the item was sold for. The signatures of the involved parties. In some instances, the bill of sale may need to be notarized.

Does a bill of sale have to be notarized in RI?

Does a bill of sale have to be notarized in Rhode Island? No. A vehicle bill of sale for a private party transfer does not need to be notarized.

How long is a bill of sale good for in Rhode Island?

How long can you drive with a Bill of Sale in RI? The number of days the plates can be used prior to registration is as follows: RI Dealer: 20 calendar days from date on bill of sale. RIGL 31-4-3. Out-of-state Dealer: 72 hours from date on bill of sale.

Do you need a bill of sale to register a car in RI?

To register your vehicle you will need the bill of sale; the title, signed by the owner of the vehicle that is listed on the front of the title; proof of Rhode Island insurance on the vehicle; a completed TR-1 (Title & Registration application) form; and a completed Sales Tax form.

Is a bill of sale required in Rhode Island?

Getting a bill of sale in Rhode Island is legally required to transfer vehicle ownership. The state provides a summary of responsibilities during a vehicle transaction for both the seller and the buyer.

Does a car bill of sale need to be notarized in RI?

Does a bill of sale have to be notarized in Rhode Island? No. A vehicle bill of sale for a private party transfer does not need to be notarized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the RI TR-1 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your RI TR-1.

How do I fill out the RI TR-1 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign RI TR-1 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit RI TR-1 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign RI TR-1 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is RI TR-1?

RI TR-1 is a tax form used in the state of Rhode Island for reporting certain transactions and income to the state tax authorities.

Who is required to file RI TR-1?

Individuals and businesses that engage in specific transactions or meet certain income thresholds in Rhode Island are required to file RI TR-1.

How to fill out RI TR-1?

To fill out RI TR-1, you need to provide personal and business information, income details, and any applicable deductions as outlined in the form's instructions.

What is the purpose of RI TR-1?

The purpose of RI TR-1 is to ensure that all taxable transactions and income are reported accurately to the Rhode Island tax authorities for proper assessment and collection.

What information must be reported on RI TR-1?

Information that must be reported on RI TR-1 includes your name, address, social security number or business identification number, detailed description of income or transactions, and any tax liability.

Fill out your RI TR-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI TR-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.