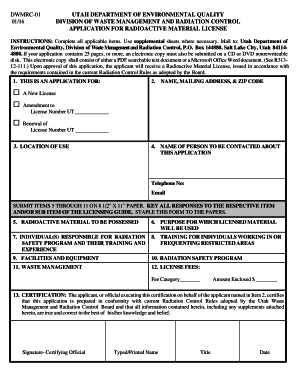

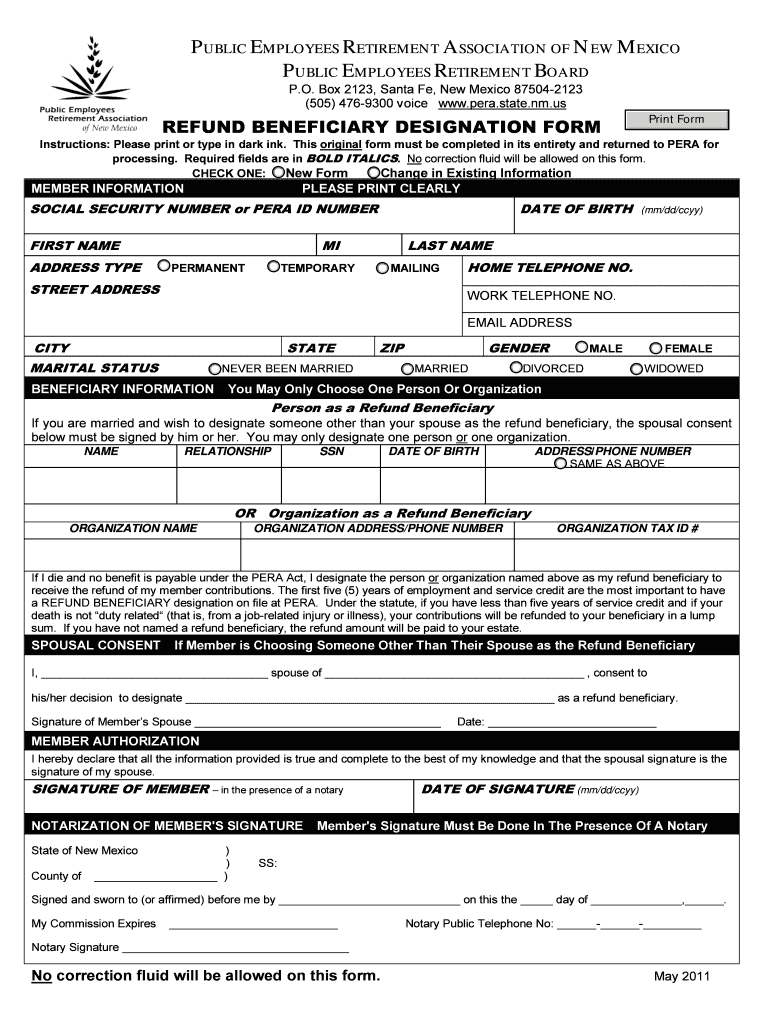

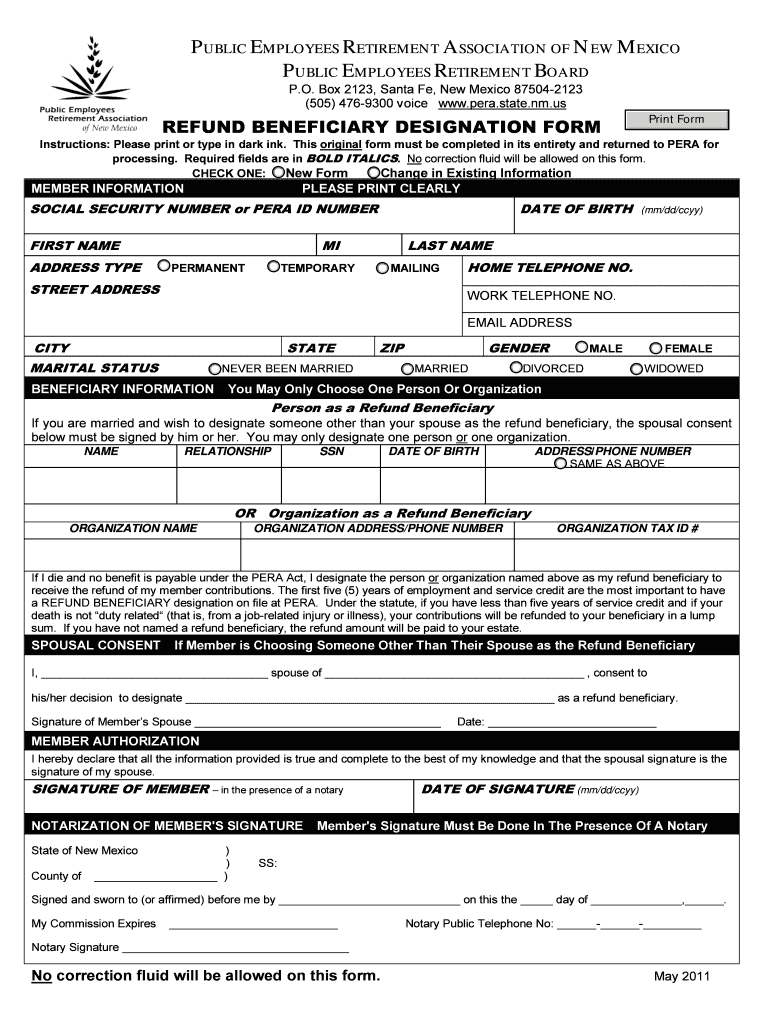

Get the free REFUND BENEFICIARY DESIGNATION FORM

Show details

This form is used by members of the Public Employees Retirement Association of New Mexico to designate a refund beneficiary for their contributions, ensuring that, in the event of their passing, specified

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refund beneficiary designation form

Edit your refund beneficiary designation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refund beneficiary designation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing refund beneficiary designation form online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit refund beneficiary designation form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refund beneficiary designation form

How to fill out REFUND BENEFICIARY DESIGNATION FORM

01

Obtain the Refund Beneficiary Designation Form from the appropriate source.

02

Start by filling in your personal information, including your full name, address, and contact details.

03

Identify the account from which the refund will be processed; include account numbers if necessary.

04

Specify the name of the beneficiary who will receive the refund.

05

Fill in the beneficiary's details such as their relationship to you, address, and contact information.

06

Review the form for accuracy to ensure all information is correct and complete.

07

Sign and date the form at the designated area to confirm its legitimacy.

08

Submit the completed form according to the instructions provided, either by mail or electronically.

Who needs REFUND BENEFICIARY DESIGNATION FORM?

01

Individuals receiving refunds from organizations or agencies, such as tax refunds, insurance, or loan repayments.

02

Anyone who wants to designate a specific person to receive their refund in the event they are unable to do so themselves.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a beneficiary designation?

For example, if you name your three cousins as your primary beneficiaries, you can name the children of each cousin as alternate primary beneficiaries. Then, if one cousin dies before you do, their share will be divided between their children who are named as alternate primary beneficiaries.

Who should I not name as a beneficiary?

Other Risky Beneficiary Choices to Avoid Estranged relatives or former spouses – Family relationships can be complicated, so think carefully if an estranged relative or ex-spouse really aligns with your wishes. Pets – Pets can't legally own property, so naming them directly as beneficiaries is problematic.

What is an example of a designated beneficiary?

Best example: If the beneficiary is one of your children and they are deceased, their share would then go to their grandchildren if they had any.

What to write in beneficiary account description?

Providing details like the beneficiary's full name, account number, and other bank information helps minimise the chance of funds going to the wrong account.

What should I put for beneficiary percentage?

1 Answer 1 The primary beneficiary percentages should add to 100%. The contingent beneficiary percentages should show the percentage of the failed transfer to the primary beneficiary that goes to the contingent beneficiary (ie 100% in your example).

Which would be described as a beneficiary designation?

Beneficiary designations are people other than yourself listed to receive ownership, property, or funds for certain types of assets. Assets with a beneficiary designation will pass to the named beneficiary — even if a different person is listed in the will.

Who is the default beneficiary designation?

You can name multiple beneficiaries for several types of accounts. Most have a default provision that says who the beneficiary will be if you don't name one. Often times the default is your estate. However, this may not reflect your wishes and could have tax consequences.

What beneficiary type should I choose?

Many people choose the following beneficiaries: A spouse or long-term partner. Adult children. Other family members or close friends. A trust - a legal entity that manages an inheritance on behalf of your heirs and pays out the money over time, which might be an option if you want minor children to receive assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REFUND BENEFICIARY DESIGNATION FORM?

The REFUND BENEFICIARY DESIGNATION FORM is a document used to designate a person or entity that will receive any refund of benefits paid out under a specific program or policy.

Who is required to file REFUND BENEFICIARY DESIGNATION FORM?

Typically, individuals or entities receiving benefits that may result in a refund are required to file the REFUND BENEFICIARY DESIGNATION FORM to ensure that the designated beneficiary receives the funds appropriately.

How to fill out REFUND BENEFICIARY DESIGNATION FORM?

To fill out the REFUND BENEFICIARY DESIGNATION FORM, you must provide your personal information, such as your name and contact details, as well as the beneficiary's information, including their name, relationship to you, and contact details. You may also need to sign and date the form.

What is the purpose of REFUND BENEFICIARY DESIGNATION FORM?

The purpose of the REFUND BENEFICIARY DESIGNATION FORM is to clearly identify who will receive any refunds from a benefits program, helping to ensure that the funds are distributed according to the wishes of the original recipient.

What information must be reported on REFUND BENEFICIARY DESIGNATION FORM?

The information that must be reported on the REFUND BENEFICIARY DESIGNATION FORM includes the beneficiary's name, relationship to the individual designating them, contact information, and any additional information required by the issuing agency or organization.

Fill out your refund beneficiary designation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refund Beneficiary Designation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.