Get the free North Dakota Office of State Tax Commissioner Form 40 - nd

Show details

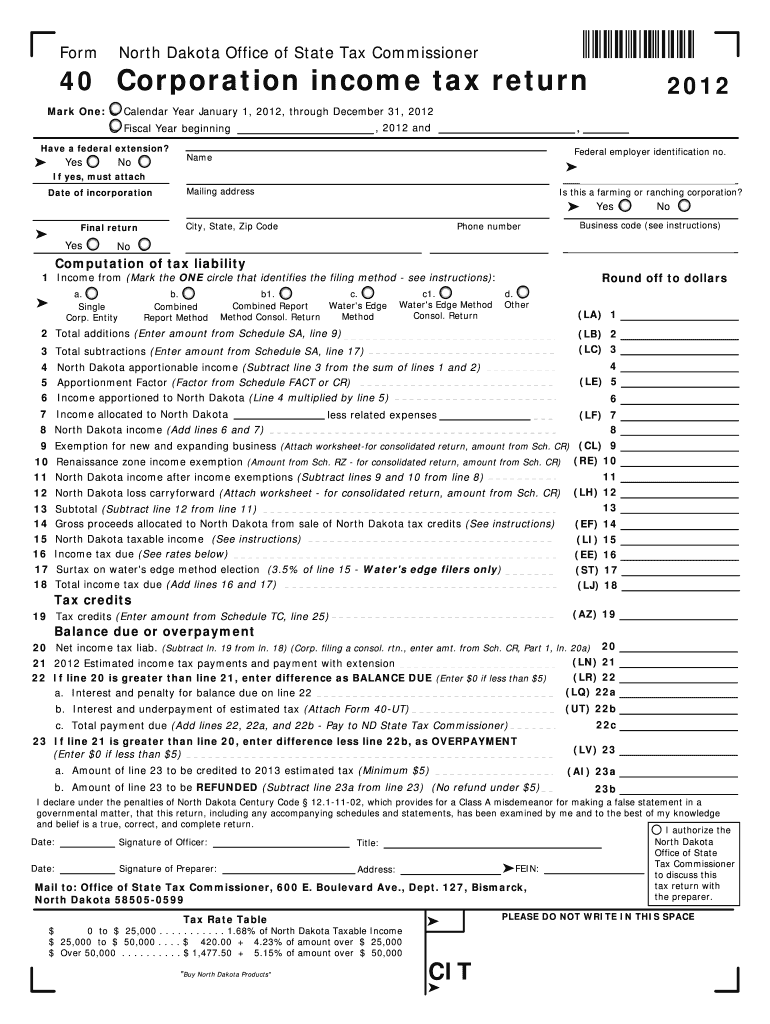

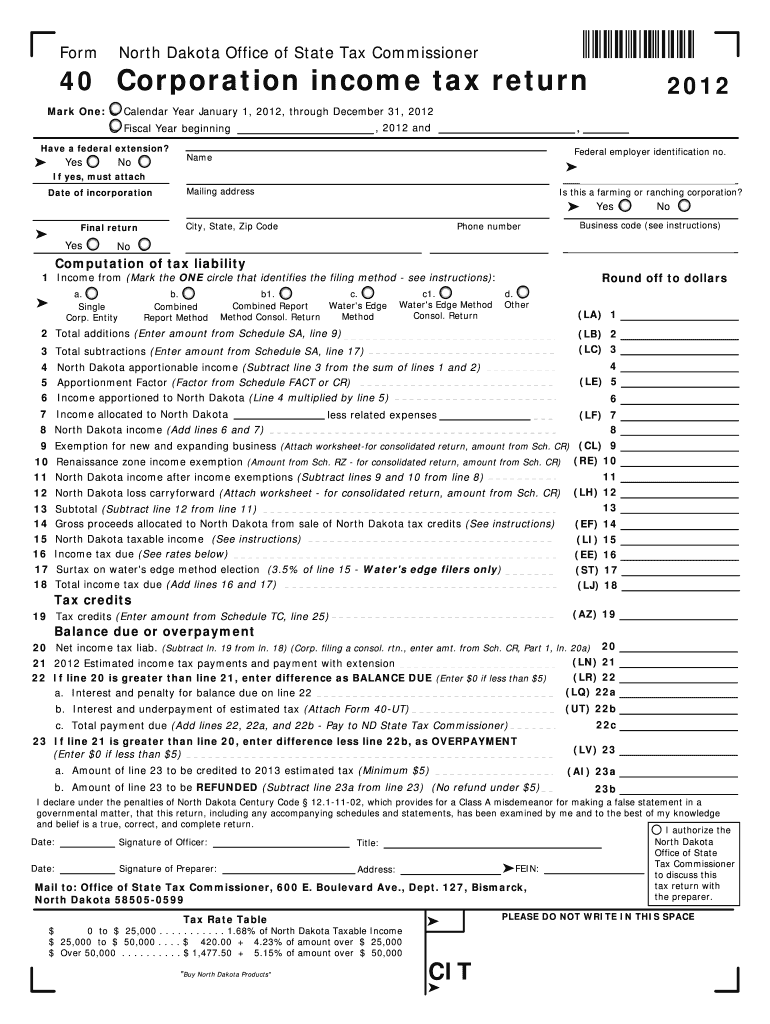

Este formulario se utiliza para declarar el impuesto sobre la renta de las corporaciones en Dakota del Norte, permitiendo la presentación de ingresos, deducciones, y créditos fiscales, así como

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign north dakota office of

Edit your north dakota office of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your north dakota office of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit north dakota office of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit north dakota office of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out north dakota office of

How to fill out North Dakota Office of State Tax Commissioner Form 40

01

Obtain a copy of Form 40 from the North Dakota Office of State Tax Commissioner website or request a paper form.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Report your federal adjusted gross income (AGI) in the designated section of the form.

04

Complete the state-specific adjustments by following the instructions provided for additions and subtractions.

05

Calculate your North Dakota taxable income by subtracting the adjustments from your federal AGI.

06

Refer to the tax tables provided in the form to determine your tax liability based on your taxable income.

07

Include any applicable credits and deductions as instructed on the form.

08

If applicable, report any additional taxes such as the Alternative Minimum Tax (AMT).

09

Sign and date the form, certifying that the information provided is accurate and complete.

10

Submit the completed Form 40 by the tax filing deadline, either electronically or via mail.

Who needs North Dakota Office of State Tax Commissioner Form 40?

01

Individuals and married couples who are residents of North Dakota and have a filing requirement or want to claim a refund.

02

Anyone who has earned income and resides in North Dakota, including part-time residents and those who derive income from North Dakota sources.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my PA tax return?

Overview. Pennsylvania tax records are confidential and may be released only to the taxpayer or pursuant to a release signed by the taxpayer. However, taxpayers can access their tax records 24/7 via their online myPATH account.

Can you file North Dakota taxes online?

North Dakota participates in the Internal Revenue Service's Federal/State Modernized E-File program. This allows you to file and pay both your federal and North Dakota income tax return at the same time.

What is the PA tax registration form?

Form PA-100 (Pennsylvania Enterprise Registration Form) is used by Pennsylvania businesses to register for certain tax accounts with the Pennsylvania Department of Revenue and the Pennsylvania Department of Labor and Industry. New businesses file PA-100 to set up state tax accounts.

Does North Dakota tax non-residents?

A nonresident of North Dakota (which means you do not live here for more than 7 months) is required to file a North Dakota individual income tax return if: 1) you are required to file a federal return, AND 2) receive income from a source in North Dakota.

Where do I find my PA 40 form?

Where do I get a PA-40 form? You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is North Dakota Office of State Tax Commissioner Form 40?

North Dakota Office of State Tax Commissioner Form 40 is the state income tax return form used by individuals filing their income taxes in North Dakota.

Who is required to file North Dakota Office of State Tax Commissioner Form 40?

Residents of North Dakota who earn income above the minimum filing threshold are required to file Form 40, as well as non-residents who have income sourced from North Dakota.

How to fill out North Dakota Office of State Tax Commissioner Form 40?

To fill out Form 40, taxpayers need to report their personal information, income details, deductions, and tax credits. The form provides guidelines and worksheets to assist in calculating tax obligations.

What is the purpose of North Dakota Office of State Tax Commissioner Form 40?

The purpose of Form 40 is to report and calculate individual income tax liabilities for residents and non-residents with income from North Dakota, ensuring compliance with state tax laws.

What information must be reported on North Dakota Office of State Tax Commissioner Form 40?

Form 40 requires reporting personal information such as name, address, and social security number; income sources like wages and business income; deductions; and any tax credits or exemptions claimed.

Fill out your north dakota office of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

North Dakota Office Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.