Get the free 60-EXT - nd

Show details

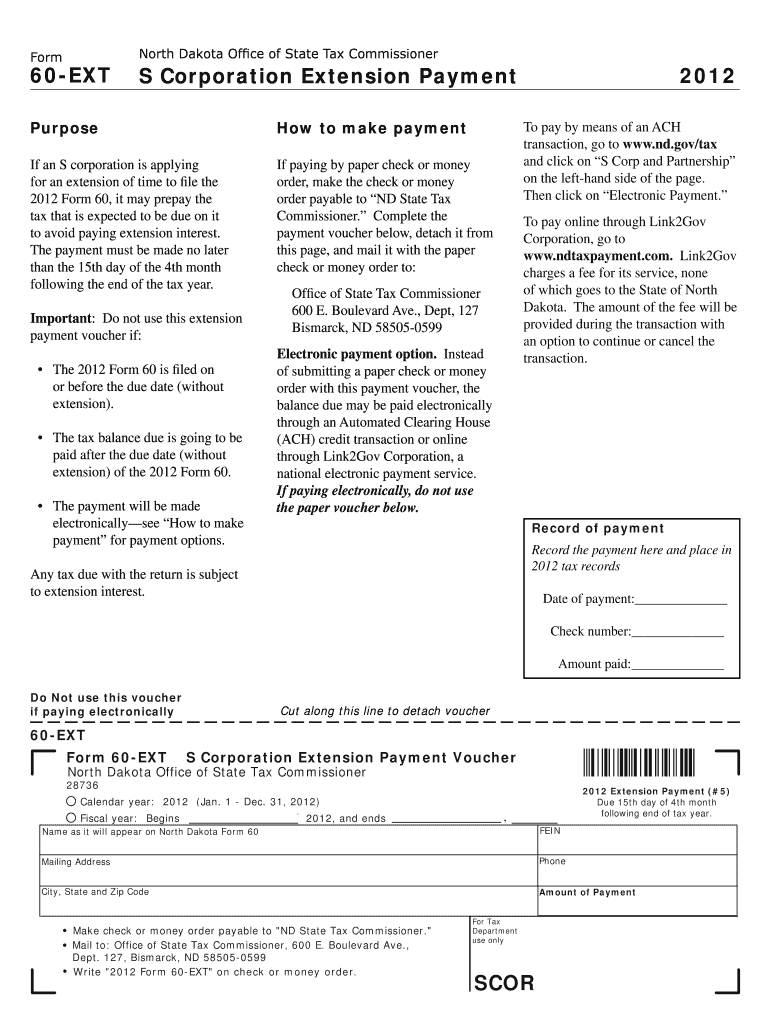

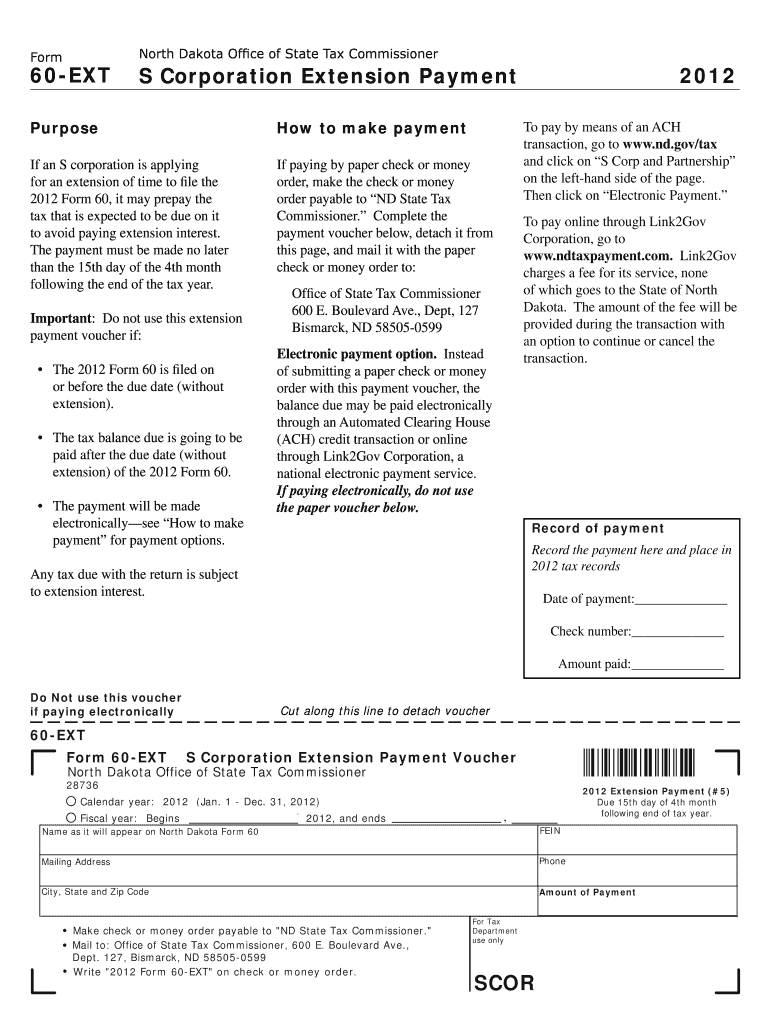

This form is used by S corporations in North Dakota to make a payment for an extension of time to file their 2012 Form 60, allowing them to avoid extension interest by prepaying expected taxes due.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 60-ext - nd

Edit your 60-ext - nd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 60-ext - nd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 60-ext - nd online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 60-ext - nd. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 60-ext - nd

How to fill out 60-EXT

01

Download the IRS Form 60-EXT from the official IRS website.

02

Provide your name and address at the top of the form.

03

Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

04

Indicate the type of extension you are requesting.

05

Specify the tax year for which you are requesting the extension.

06

Estimate your total tax liability for the year.

07

Provide any payments already made towards your tax liability.

08

Calculate the amount you owe and enter it on the form.

09

Sign and date the form.

10

Submit the completed form to the appropriate IRS address.

Who needs 60-EXT?

01

Individuals who need extra time to file their tax returns.

02

Businesses that require additional time to complete their tax filings.

03

Taxpayers who anticipate difficulties in meeting the standard filing deadline.

Fill

form

: Try Risk Free

People Also Ask about

What is the structure of the English Extension 1?

The HSC Extension 1 English exam will consist of two sections; Section I: Common Module — Literary Worlds and Section II: Electives. Section I is where this module will be assessed, and there will be one question in response to a stimulus and/or unseen text.

How hard is English Extension 1?

Yes, it is generally considered more challenging due to its focus on theoretical analysis, creative writing and the complexity of the texts studied. However, it is highly rewarding for students who enjoy literature and critical thinking.

What is the best way to study for English?

Share Work out the practical details. Practice does make perfect. Purchase a test-specific textbook or prep guide. Scribble down a new word every day. Challenge your ears by listening to podcasts. Watch TV shows or films (without subtitles). Read English-language newspapers and magazines. Study on the go with an app.

Does the North Dakota Partnership accept federal extension?

You may have extended time to file your North Dakota individual, corporation, S corporation, partnership, or fiduciary income tax return by receiving a federal extension or a North Dakota extension.

How to study for English extension 1?

Tips for Success in English Extension 1 Develop Analytical Skills: Practice deconstructing texts to understand how meaning is constructed through language, form and context. Enhance Writing Abilities: Work on articulating your ideas clearly and concisely.

What is the file extension ND?

ND) files are configuration files that allow QuickBooks Desktop to access a company file in a network or multi-user environment.

How to study for English language paper 1?

The key points to remember are: identify language and structural features; use quotations from the text to demonstrate these features; analyse how the quotation proves your point; evaluate how successfully this achieves the effect from the question; focus on the specifics of the question; and.

What extension is 60?

60 - the Malaysian country code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 60-EXT?

60-EXT is a form used by taxpayers to apply for an extension of time to file their tax returns.

Who is required to file 60-EXT?

Taxpayers who need additional time to file their federal income tax returns are required to file 60-EXT.

How to fill out 60-EXT?

To fill out 60-EXT, provide your personal information such as name, address, Social Security number, and the tax year for which you are requesting the extension.

What is the purpose of 60-EXT?

The purpose of 60-EXT is to provide taxpayers with an extension of time to file their tax returns without incurring penalties.

What information must be reported on 60-EXT?

On 60-EXT, you must report your name, address, Social Security number, type of return you are filing, and the reason for the extension.

Fill out your 60-ext - nd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

60-Ext - Nd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.