Get the free NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT - com ohio

Show details

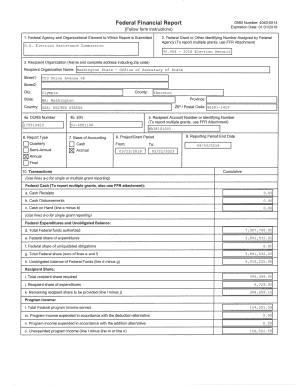

This document serves as a mandatory disclosure regarding the escrow of property taxes and the components covered by the regular monthly payment for a loan.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of escrow of

Edit your notice of escrow of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of escrow of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of escrow of online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit notice of escrow of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of escrow of

How to fill out NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT

01

Obtain the NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT form from your lender or online.

02

Fill in your personal information, including your name, address, and loan account number.

03

Indicate the property address associated with the escrow.

04

Specify the estimated yearly taxes and any other additional costs to be added to the escrow account.

05

Review the regular monthly payment amount calculated based on the mortgage terms.

06

Sign and date the form to validate your submission.

07

Submit the completed form to your lender via mail or electronically as instructed.

Who needs NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT?

01

Homeowners who have a mortgage and wish to manage their property taxes and insurance payments through an escrow account.

02

Individuals looking to ensure timely payment of taxes and prevent penalties.

03

Borrowers who prefer to simplify their monthly budgeting by including taxes and insurance within their mortgage payments.

Fill

form

: Try Risk Free

People Also Ask about

Is being in escrow a good thing?

No, it's not a good thing. Having taxes and insurance in escrow provides financial security and prevents surprise expenses. It's a common practice for mortgage lenders and can help you budget effectively. If it's not in escrow, you should consider setting up your own system to ensure you're covered.

What does it mean if your home is in escrow?

In financial transactions, the term "in escrow" indicates an item, such as money or property, is being held by a third party until legal conditions have been met to transfer it. This transfer is usually done on behalf of a buyer and seller.

What happens when you are in escrow?

Escrow is used when the property is bought, sold, or refinanced. An escrow ensures that the seller receives payment for the home and that the buyer gets title to the property. The escrow company is a neutral third party. They hold money and title to the property until both the buyer and seller agree to release them.

What does escrow mean in simple terms?

An Escrow is an arrangement for a third party to hold the assets of a transaction temporarily. The assets are kept in a third-party account and are only released when all terms of the agreement have been met. The use of an escrow account in a transaction adds a degree of safety for both parties.

What does it mean to be in escrow?

Feb 4, 2025. 8-minute read. If you're buying a home, you'll probably hear the word “escrow” used in a few different contexts. Essentially, escrow is a financial arrangement where a neutral third party holds funds or assets on behalf of two parties involved in a transaction until specific conditions are met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT?

The NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT is a document that informs a lender or mortgage servicer about the arrangement for collecting property taxes and possibly other expenses to be deposited into an escrow account, ensuring that funds are available to pay those bills on behalf of the borrower.

Who is required to file NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT?

Typically, borrowers who have an escrow account as part of their mortgage agreement are required to file the NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT to ensure their taxes and insurance are paid on time.

How to fill out NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT?

To fill out the NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT, the borrower should provide their personal information, loan details, monthly payment amounts, and any other relevant information requested on the form. It’s important to ensure accuracy to avoid future complications.

What is the purpose of NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT?

The purpose of the NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT is to communicate to the mortgage servicer the expected payments for property taxes and to organize the payment schedule, ensuring the borrower’s obligations are met.

What information must be reported on NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT?

On the NOTICE OF ESCROW OF TAXES & REGULAR MONTHLY PAYMENT, borrowers must report their name, property address, loan number, the amount of monthly tax payments, and any other pertinent details required by the lender, such as insurance information or changes in payment amounts.

Fill out your notice of escrow of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Escrow Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.