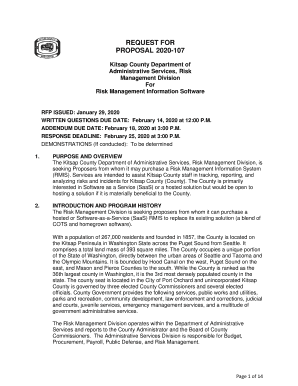

Get the free 2013 Low Income Housing Tax Credit Proposal - ohiohome

Show details

This document outlines the proposal for the Summit Estates project, which aims to provide affordable senior housing in Cincinnati's Roselawn neighborhood as part of a broader master planned development.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 low income housing

Edit your 2013 low income housing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 low income housing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013 low income housing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2013 low income housing. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 low income housing

How to fill out 2013 Low Income Housing Tax Credit Proposal

01

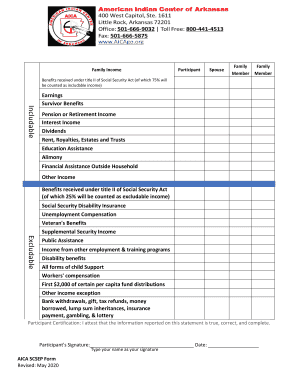

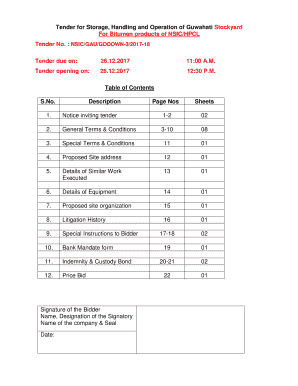

Gather necessary documentation including income and expense reports, project plans, and funding sources.

02

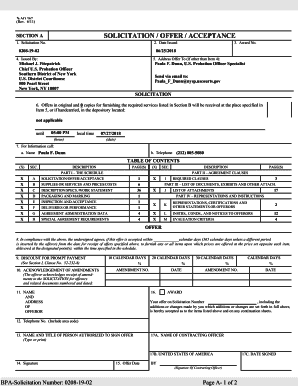

Complete the application form, ensuring all sections are filled out accurately.

03

Provide detailed information on the proposed location, including site maps and demographic data.

04

Outline the project’s development schedule and financial projections.

05

Demonstrate compliance with applicable federal, state, and local housing regulations.

06

Include letters of support from local government and community organizations.

07

Review the proposal for any errors and ensure it meets submission guidelines.

08

Submit the proposal by the designated deadline, ensuring copies are made for your records.

Who needs 2013 Low Income Housing Tax Credit Proposal?

01

Nonprofit organizations and developers focusing on affordable housing projects.

02

State and local governments seeking to enhance housing options for low-income residents.

03

Investors looking to fund developments that qualify for tax credits.

04

Housing authorities aiming to improve low-income housing availability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2013 Low Income Housing Tax Credit Proposal?

The 2013 Low Income Housing Tax Credit Proposal refers to a set of guidelines established by the Internal Revenue Service (IRS) for allocating tax credits to encourage investment in affordable housing for low-income individuals and families.

Who is required to file 2013 Low Income Housing Tax Credit Proposal?

Entities that develop, own, or operate low-income rental housing and wish to claim the Low Income Housing Tax Credit must file the 2013 proposal, including developers and project owners.

How to fill out 2013 Low Income Housing Tax Credit Proposal?

To fill out the 2013 Low Income Housing Tax Credit Proposal, applicants need to complete the necessary IRS forms, ensuring all required information regarding the project, such as financial details, tenant income levels, and compliance with low-income housing requirements, is accurately provided.

What is the purpose of 2013 Low Income Housing Tax Credit Proposal?

The purpose of the 2013 Low Income Housing Tax Credit Proposal is to promote affordable housing development and help reduce the deficit of affordable rental housing in the United States by providing tax incentives to developers.

What information must be reported on 2013 Low Income Housing Tax Credit Proposal?

Information that must be reported includes project details, the number of low-income units, tenant income levels, rental rates, and compliance with housing regulations as well as any other information required by the IRS regarding the tax credit eligibility.

Fill out your 2013 low income housing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Low Income Housing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.