Get the free Oklahoma Net Operating Loss

Show details

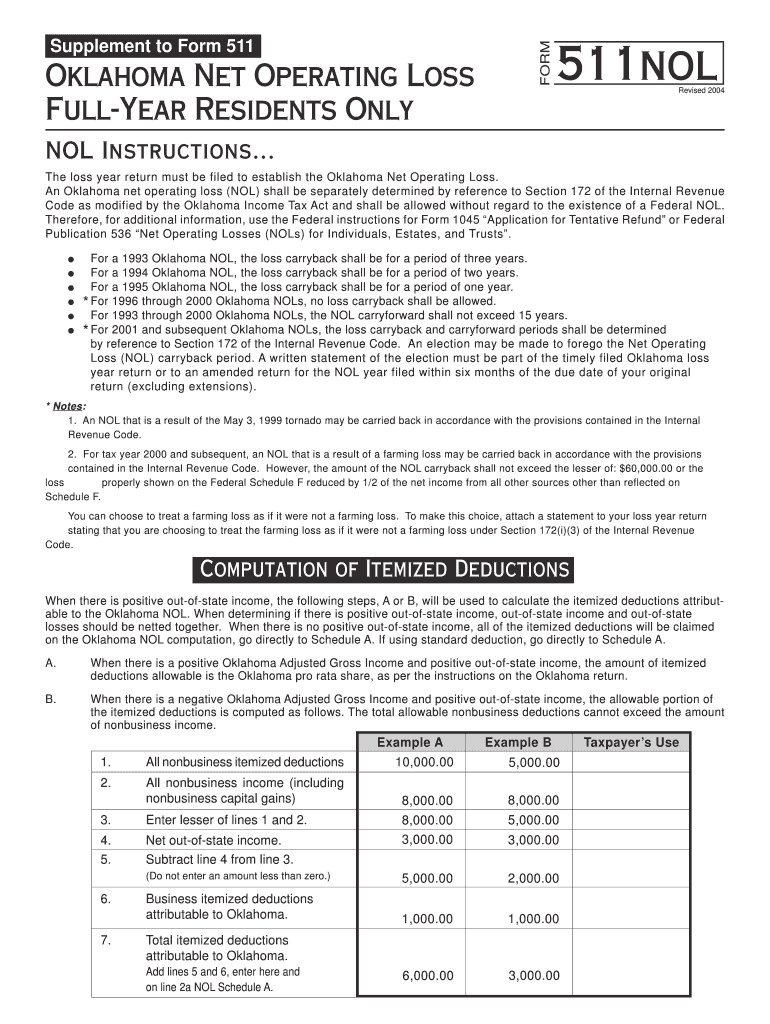

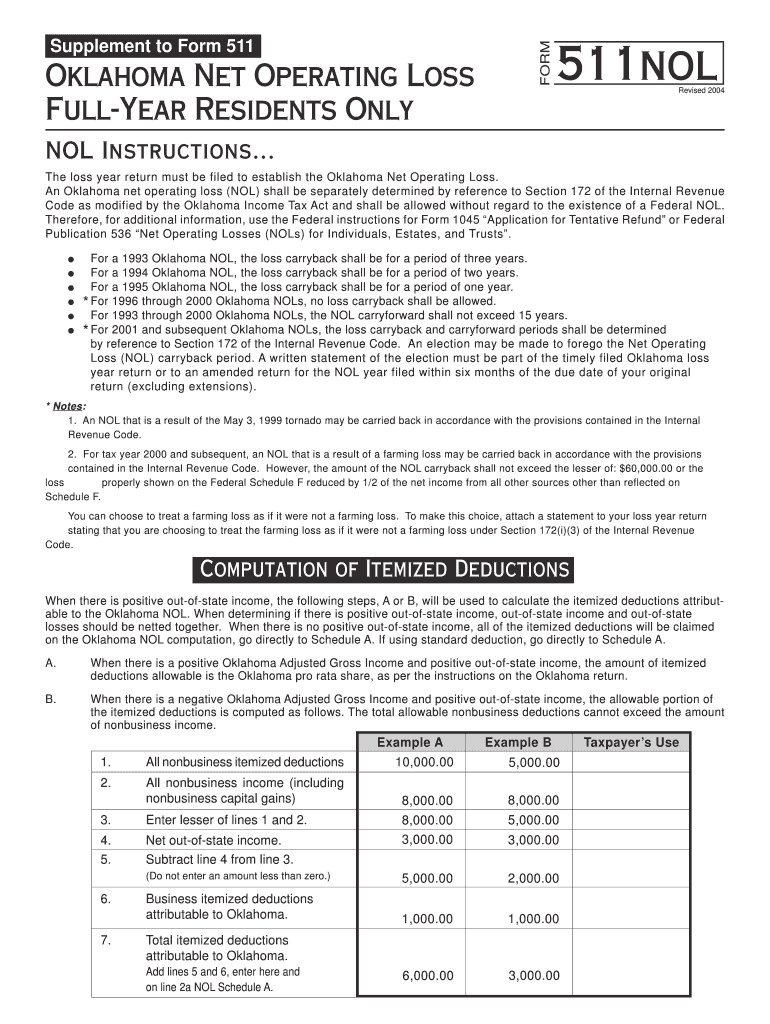

This document provides instructions and forms for full-year residents of Oklahoma to establish and calculate their net operating loss (NOL) as per Oklahoma tax regulations, referencing federal guidelines

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma net operating loss

Edit your oklahoma net operating loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma net operating loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma net operating loss online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oklahoma net operating loss. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma net operating loss

How to fill out Oklahoma Net Operating Loss

01

Gather your financial records for the relevant tax year.

02

Calculate your total income and total deductions to determine your net operating loss (NOL).

03

Complete the Oklahoma Net Operating Loss Worksheet using the calculated NOL.

04

Fill out the appropriate sections of your Oklahoma tax return, including Form 511 if applicable.

05

Transfer the NOL amount to the designated area on the tax return.

06

Submit your completed tax return along with the NOL documentation to the Oklahoma Tax Commission.

Who needs Oklahoma Net Operating Loss?

01

Businesses that have incurred losses and wish to offset future taxable income.

02

Corporations that want to claim a refund or carry forward their net operating loss.

03

Taxpayers who are eligible to utilize the carryback option if applicable.

Fill

form

: Try Risk Free

People Also Ask about

What is the 80% NOL rule?

As amended by the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, NOL deductions may only offset up to 80% of taxable income. The legislation also repealed NOL carrybacks but allows indefinite carryforwards. In 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, P.L.

Do states follow federal NOL rules?

In fact, states vary when it comes to whether the NOL deduction is limited to a certain amount of taxable net income for the tax year, as well as with the time allowances for NOL carryover periods. Currently, some states have suspended the NOL deduction or do not allow the deduction at all.

Does Oklahoma allow out of state telehealth?

Services that are provided must be within the scope of the practitioner's license or certification. If the provider is outside of Oklahoma, the provider must comply with all laws and regulations of the provider's location, including health care and telehealth requirements.

What is the NOL limit in Oklahoma?

However, the amount of the NOL carryback shall not exceed the lesser of $60,000 or the loss properly shown on the Federal Schedule F reduced by 1/2 of the net income from all other sources other than reflected on Schedule F. The “Oklahoma NOL from Oklahoma sources” is computed using 511-NR-NOL Schedule A Oklahoma.

What is the Oklahoma NOL limitation?

However, the amount of the NOL carryback shall not exceed the lesser of $60,000 or the loss properly shown on the Federal Schedule F reduced by 1/2 of the net income from all other sources other than reflected on Schedule F.

Does Oklahoma allow nil?

Senate Passes Landmark NIL Legislation to Protect Oklahoma Student Athletes. OKLAHOMA CITY – The Oklahoma Senate has approved Senate Bill 490, authored by Senator Todd Gollihare, marking a significant step in modernizing the state's collegiate athletics landscape.

What is my net operating loss?

An NOL occurs when a company's allowable tax deductions exceed its taxable income within a specific period. This happens for various reasons, such as during a company's startup phase, when expenses often outpace revenue, or in cyclical industries where profits fluctuate significantly from year to year.

Does Oklahoma allow NOL?

Net Operating Loss (NOL) carryback period. A written statement of the election must be part of the timely filed Oklahoma loss year return or to an amended return for the NOL year filed within six months of the due date of your original return (excluding extensions). 172.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oklahoma Net Operating Loss?

Oklahoma Net Operating Loss refers to the financial situation where a taxpayer's allowable deductions exceed their gross income, resulting in a negative taxable income. This loss can be carried forward to offset future taxable income.

Who is required to file Oklahoma Net Operating Loss?

Taxpayers, including individuals, corporations, and partnerships, who have experienced a net operating loss in Oklahoma and wish to utilize this loss for tax relief purposes are required to file.

How to fill out Oklahoma Net Operating Loss?

To fill out the Oklahoma Net Operating Loss form, taxpayers should complete the required sections detailing their income, deductions, and calculations of the net operating loss as per the state's tax guidelines.

What is the purpose of Oklahoma Net Operating Loss?

The purpose of Oklahoma Net Operating Loss is to provide tax relief to businesses and individuals by allowing them to carry forward losses to future tax years, thus reducing their taxable income and overall tax liability.

What information must be reported on Oklahoma Net Operating Loss?

Taxpayers must report information such as total income, allowable deductions, the amount of the net operating loss, and details on how the loss will be utilized in future tax filings.

Fill out your oklahoma net operating loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Net Operating Loss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.