Get the free Oklahoma Agricultural Producer Credit

Show details

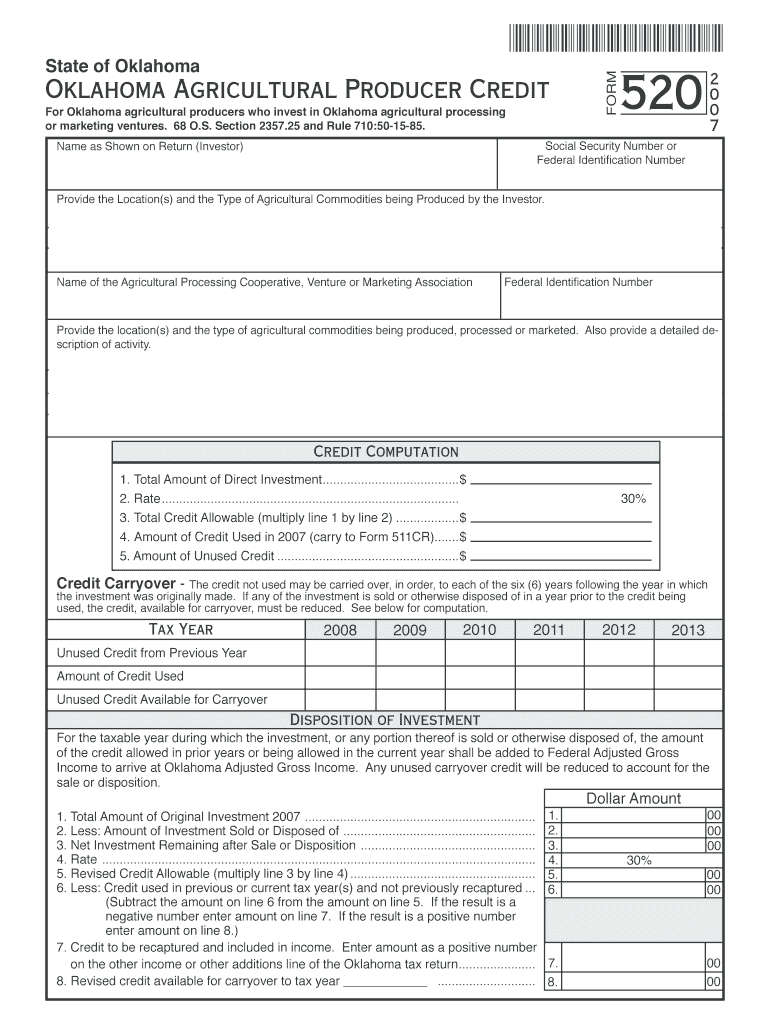

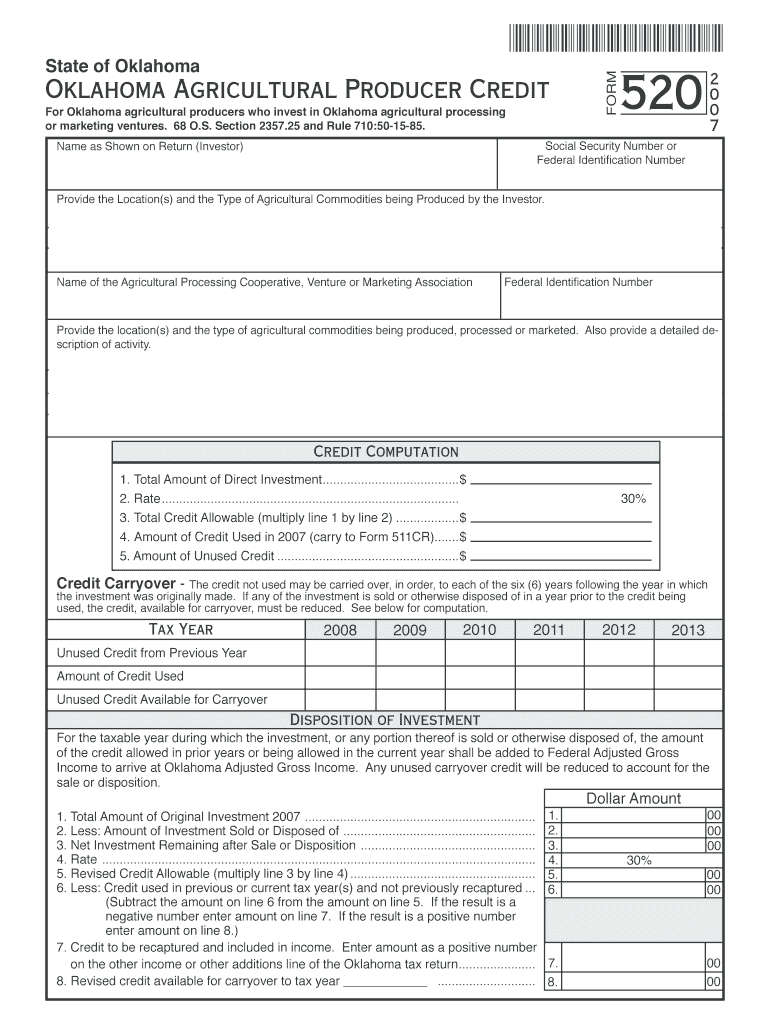

This form is for Oklahoma agricultural producers who make investments in agricultural processing or marketing ventures in Oklahoma, detailing credit computations, unused credits, and definitions related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma agricultural producer credit

Edit your oklahoma agricultural producer credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma agricultural producer credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma agricultural producer credit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oklahoma agricultural producer credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma agricultural producer credit

How to fill out Oklahoma Agricultural Producer Credit

01

Gather all necessary documents such as proof of agricultural production, income statements, and any existing debt information.

02

Obtain the Oklahoma Agricultural Producer Credit application form from the Oklahoma state website or local agricultural department.

03

Fill out the application form completely, ensuring all personal and business information is accurate.

04

Provide detailed information about the agricultural operation, including the type of production, size of operation, and financial history.

05

Calculate the credit amount based on eligible expenses and input this figure in the correct section of the application.

06

Review the completed application for any errors or missing information before submission.

07

Submit the application by mail or online as per the instructions provided on the form.

Who needs Oklahoma Agricultural Producer Credit?

01

Farmers and ranchers in Oklahoma who are in need of financial assistance for agricultural expenses.

02

Producers looking to invest in agricultural production or improve existing operations.

03

Those who require credit to manage cash flow or to cover operating costs.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an agricultural tax exemption in Oklahoma?

Apply for an agricultural exemption permit at OkTAP. Applicants should submit an IRS Schedule F, Form 4835, Forms 1065, 1120, 1120S or other document you believe demonstrates you are regularly engaged in farming/ranching for a profit.

Does Farm Credit pay income taxes?

Under the Farm Credit Act, Farm Credit Debt Securities and the interest thereon are exempt from state, local and municipal income taxes.

How many acres do you have to have to be considered a farm?

To qualify for agricultural assessment: Must have 7 acres or more of land in production for sale of crops, livestock or livestock products. The same farmer must farm the land for at least 2 years.

How many acres is considered a farm for tax purposes?

Another question that frequently comes up in this discussion is “how big does my farm have to be to be considered a farm?” Since property taxes are handled at the local level rather than the federal level, the answer will vary from state to state. Generally speaking, there is no minimum acreage for farm tax exemption.

How does the Oklahoma tax credit work?

The Oklahoma credit is the greater of 20% of the credit for child care expenses or 5% of the child tax credit. A credit equal to 5% of the earned income credit allowed on your federal return.

How do I claim my farm on my taxes?

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-SS, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Check with your state and local governments for more information.

How to qualify for a farm tax credit?

Your farm or ranch may qualify for the R&D tax credit if you participate in any of the following activities: Soil health practice adoption, including planting cover crops. Using new or innovative inputs. Developing new feeding techniques or formulas for your livestock. Iterating on new harvest techniques and tools.

How do I get farm tax credit?

Your farm or ranch may qualify for the R&D tax credit if you make farm technology or operational updates like using new or experimental soil or fertilizer, developing new pesticides to protect crops, planting cover crops, or developing new or improved harvest techniques.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oklahoma Agricultural Producer Credit?

Oklahoma Agricultural Producer Credit is a tax credit available to qualifying agricultural producers in Oklahoma, aimed at providing financial support for farming operations and encouraging agricultural investment.

Who is required to file Oklahoma Agricultural Producer Credit?

Agricultural producers who meet specific eligibility criteria and have incurred qualifying expenses related to their farming operations are required to file for the Oklahoma Agricultural Producer Credit.

How to fill out Oklahoma Agricultural Producer Credit?

To fill out the Oklahoma Agricultural Producer Credit, individuals must complete the designated tax form, provide necessary documentation of agricultural activities, and submit it along with their income tax return.

What is the purpose of Oklahoma Agricultural Producer Credit?

The purpose of the Oklahoma Agricultural Producer Credit is to support and promote agricultural production in the state by alleviating some of the tax burdens faced by farmers and encouraging reinvestment in agricultural operations.

What information must be reported on Oklahoma Agricultural Producer Credit?

Information that must be reported on the Oklahoma Agricultural Producer Credit includes details about qualifying agricultural activities, expenses incurred, and any other documentation that supports the eligibility for claiming the credit.

Fill out your oklahoma agricultural producer credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Agricultural Producer Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.