Get the free OW-8-P-SUP-C

Show details

This form is used to calculate the annualized income installment for corporations and trusts in Oklahoma, including necessary calculations for taxable income and required tax installments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ow-8-p-sup-c

Edit your ow-8-p-sup-c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ow-8-p-sup-c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ow-8-p-sup-c online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ow-8-p-sup-c. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ow-8-p-sup-c

How to fill out OW-8-P-SUP-C

01

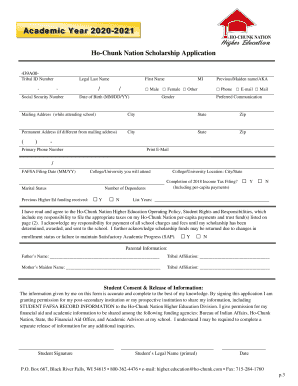

Begin by obtaining the OW-8-P-SUP-C form from the appropriate source.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide any relevant identification numbers, such as social security or tax identification numbers.

04

Complete sections that pertain to your specific situation or claims.

05

Review the form for accuracy and completeness before submission.

06

Submit the form to the designated agency or office as instructed.

Who needs OW-8-P-SUP-C?

01

Individuals or entities who need to claim specific benefits or provide information related to their tax filings.

02

Those who are required to report changes in their circumstances affecting their eligibility for benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is releve 8 in english?

This slip shows the total amount you paid for full-time post-secondary studies or occupational training, as well as any donations you made to your school. Note: The following fees and expenses are not included on the RL-8 slip: student association fees.

What is the underpayment of interest?

The IRS charges underpayment interest when you don't pay your tax, penalties, additions to tax or interest by the due date.

What is the sales tax interest in Oklahoma?

The report and tax will be delinquent if not paid on or before June 1 for max filers and September 15 for non-max filers. A 10% penalty and 1.25% interest per month is due on payments made after the due date.

What is the underpayment of estimated tax interest in Oklahoma?

The unpaid tax becomes delinquent and interest is charged at the rate of 1.25% per month from the date of the delinquency until paid. 2) 100% of the prior year tax liability. The underpayment of estimated tax Interest due on any quarterly due date is computed at a rate of 20% per annum for the period of underpayment.

What is the Oklahoma Tax Commission forgiveness program?

Oklahoma VCI/Tax Amnesty is available for a taxpayer that did not file the required Oklahoma tax return(s), underreported tax due on a previously filed tax return(s), or did not pay previously assessed taxes. The program applies to both Oklahoma residents and out-of-state taxpayers who owe Oklahoma taxes.

Why am I getting a letter from the Oklahoma tax commission?

They send you this because you didn't pay your taxes on time. They don't send you the bill for the penalties and interest until after you've paid the taxes because they don't know how much penalties and interest you will owe until you pay the tax balance and they stop accruing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OW-8-P-SUP-C?

OW-8-P-SUP-C is a specific form used for reporting certain tax information related to individuals or entities.

Who is required to file OW-8-P-SUP-C?

Individuals or entities that meet specific criteria regarding income, residency, or type of transactions are required to file OW-8-P-SUP-C.

How to fill out OW-8-P-SUP-C?

To fill out OW-8-P-SUP-C, follow the instructions provided on the form, ensuring to provide accurate information such as personal details, income types, and any applicable deductions.

What is the purpose of OW-8-P-SUP-C?

The purpose of OW-8-P-SUP-C is to collect detailed tax information that aids in the assessment of tax liabilities and ensures compliance with tax regulations.

What information must be reported on OW-8-P-SUP-C?

Information that must be reported on OW-8-P-SUP-C includes personal identification details, income amounts, and any relevant deductions or credits.

Fill out your ow-8-p-sup-c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ow-8-P-Sup-C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.